The leash strategy is based on the functioning of complex Forex indicators that form an equally simple strategy. However, after acquiring the proper skills, the strategy will not only become simple and easy to use, but will also deliver good profits. The main difference between the strategy and other similar ones is the ability to trade, like during the trend, and during its absence. The Leash strategy is considered multi-currency, that is, it can be used with any currency pairs. The most optimal timeframe will be H1.

Strategy indicators

The Leash strategy includes 5 forex indicators, which, together with each other, create a universal and profitable strategy.

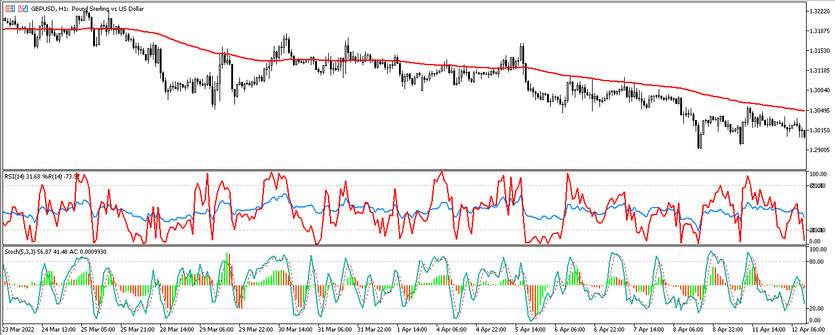

- -EMA (100) - exponential moving average, the period of which is set to 100.

- -RSI-indicator, the period of which is 14, and the levels are 20 and 80.

- -Williams Percent Range-indicator, which should be installed in the RSI indicator window. The period value is equal to 14.

- -Stochastic-indicator whose parameters remain unchanged.

- -Accelerator Oscillator - oscillator to be added to the Stochastic indicator window.

Trading with the Leash strategy

Despite the fact that making trades using the Leash strategy may initially seem difficult, the opposite will be proven over time. The main indicators of the strategy will be RSI and Williams Percent Range. After these indicators give a signal, opening positions is considered, and the rest indicators will only confirm or deny the received signals. However, it is still important to take into account the signals of all indicators included in this strategy, based on the signals of its main indicators.

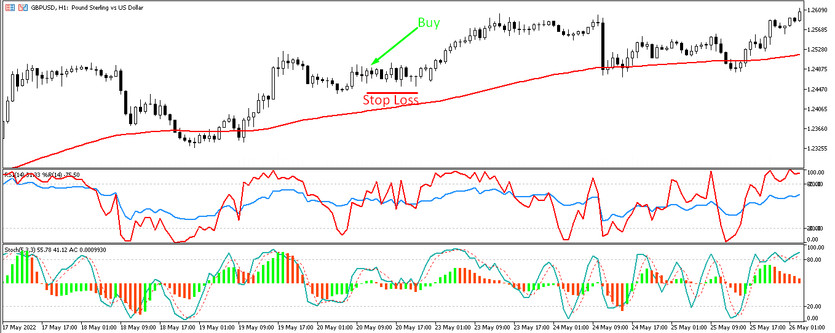

Conditions for Buy trades:

- -After the intersection of the lines of the RSI and Williams Percent Range indicators, the line of the second one began to be above the indicator line. It is very important that both indicators are not above the level of 80, that is, the overbought zone.

- -The candle must be above the exponential moving average, which is moving upwards.

- -The histogram of the Accelerator Oscillator indicator has a growth value and is directed upwards.

- -The lines of the Stochastic indicator intersect with each other, while the main line is above the signal line. It should be borne in mind that both lines are not higher than the level of 80.

After receiving all the above conditions on a certain candle, a long position can be opened. A protective stop loss order is set at 35 pips, and a take profit is 80 pips. The trade should be closed after the reverse intersection of the RSI and Williams Percent Range indicator lines.

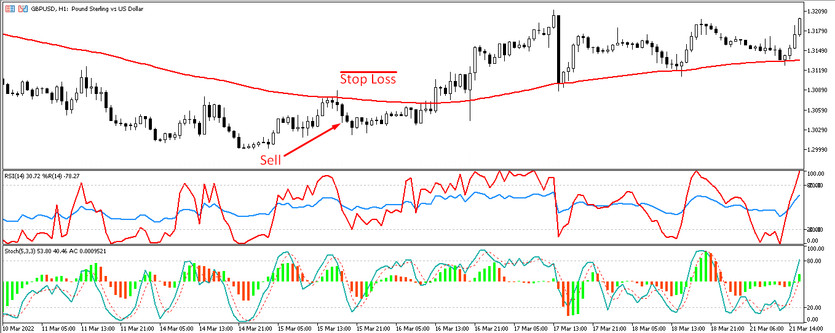

Conditions for Sell trades:

- -The lines of the RSI and Williams Percent Range indicators intersect so that the RSI indicator is above the Williams Percent Range line.

- -The candle is under the EMA indicator moving down.

- -Indicator Accelerator Oscillator has a falling value and is pointing down.

- - The signal line of the Stochastic indicator crosses the main one, being above it. At the same time, both lines are not lower than level 20.

After the above conditions are met, a short position can be opened on the current candle, which should be closed after the reverse intersection of the lines of the RSI and Williams Percent Range indicators. Stop loss is set at 35 points, and take profit should be set at 80 points.

Conclusion

The Leash strategy is very profitable and shows excellent results both during the determination of the market trend and during its absence. However, before trading on a real deposit, it should be practiced on a demo account.