The MAMB Trend is a trading algorithm that operates on the basis of performing calculations of three effective indicators. The strategy is based on confirming each other's indicator signals, this allows making a certain signal more accurate, and thereby increase the profitability of the trade. Trading made exclusively during a certain market movement, and therefore, before opening any trade, for starters, the current trend is determined by the interaction of indicators, and only then, a position is opened in its direction.

The MAMB Trend strategy was developed for the GPBUSD currency pair, as it is not so effective with other currency pairs, while the timeframe is also limited, and only the H1 interval can be selected.

Strategy indicators

Only three indicators are included in the MAMB Trend strategy, while two of them are included in the standard forex set, which makes this strategy much easier to use. For best results, it is recommended to change some input parameters in their settings.

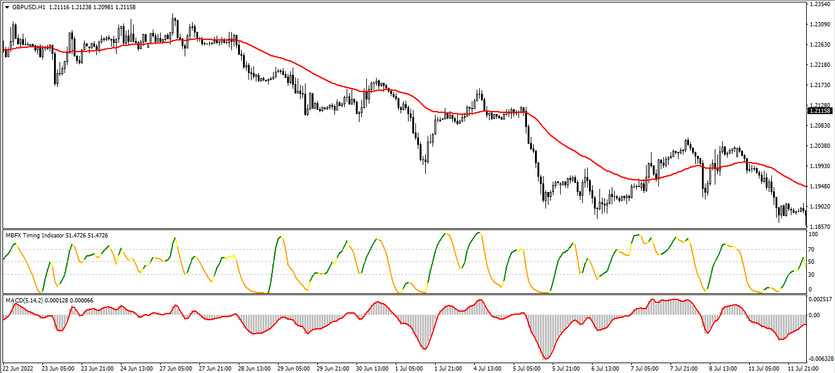

- Smoothed Moving Average (SMA) - a smoothed moving average with a period of 24.

- MACD - indicator of the technical analysis of the market, the parameters of which are set to 5.14 and 2.

- MBFX Timing is an indicator for analyzing the current market trend and whether it is oversold or overbought. Its parameters are set to 7 and 0.0 with signal levels of 30,50 and 70, that is, they remain set by default.

Trading with the MAMB Trend strategy

The scheme for applying the MAMB Trend strategy in practice is very simple. To open a certain position in the direction with the current trend, it is only needed to correctly determine the combination of conditions drawn up by the indicators. These conditions include the main ones, namely the location of the price relative to the moving average and the location of the MBFX Timing line relative to its levels, and additional ones, namely the direction of the MACD histogram. Thus, if the main conditions appear on a certain candlestick, then, taking into account the additional one, a trade can be opened due to a certain trend.

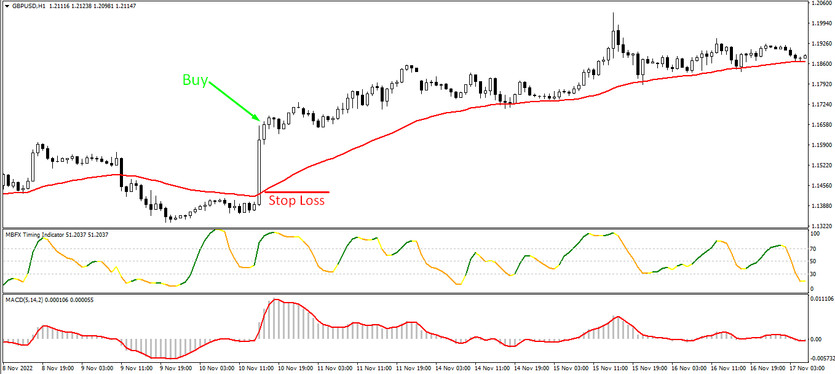

Conditions for Buy trades:

- The current price must be above the SMA.

- MBFX Timing must have a color with a growth value and be above level 50.

- The MACD indicator should be above the 0 level.

Upon receipt of such a combination of conditions, a long position can be opened on the signal candle due to the presence of an uptrend in the market. Sop loss is set at 30 points, or below the moving average. Close the trade should be after at least one of the indicators gives a reverse signal. This will signal about a possible reversal of the current movement, which will allow opening new positions during a new trend.

Conditions for Sell trades:

- Signal candle should be below the moving average.

- The MBFX Timing indicator line, colored with the falling value, should fall below level 50.

- The histogram of the MACD indicator should be directed downward, below level 0.

After receiving a complete combination of conditions that characterize a downtrend in the market, a short position can be opened on the signal candle. Stop loss should be set slightly above the moving average, while it is important that it be at least 30 points. Such a position should be closed immediately after receiving at least one return signal from one of the indicators. At this moment, one should prepare for the opening of new trades due to a change in the current trend.

Conclusion

The MAMB Trend strategy is a very logical and efficient trading assistant that allows making trades during a certain market movement. Its use is not difficult, and therefore this strategy is suitable for traders of different levels of preparedness, that is, even beginners, who, in turn, can strengthen their trading skills by first using the strategy on a demo account.

You may also be interested The Rollback Scalping Trading Strategy for EURUSD and GBPUSD