At this time, there are many strategies, the purpose of which is to accurately determine the trend, and then the points of opening positions. One of these strategies is MASTO.

This strategy is based on classic forex indicators that are used in the strategy according to their basic application rules. Therefore, before using strategy, it is recommended to carefully study the indicators included in its composition. Trading using the MASTO strategy is made mainly on the H4 interval only with the EURUSD currency pair.

Strategy indicators

The composition of the MASTO strategy includes only two indicators with modified parameters. The combination of two classic forex indicators creates a wonderful strategy that shows excellent results when used correctly.

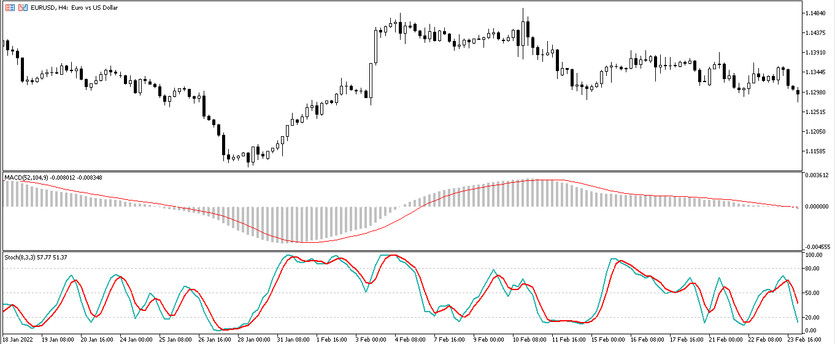

- -MACD-indicator for determining and correcting the trend. It is applied in the lower window of the price chart. The parameters should be changed to 52,104,9.

- -Stochastic Oscillator - an indicator for determining trade entry points. It is located in the lower window of the price chart. It has parameters 8,3,3. In addition, the indicator has levels 20 and 80, to which level 50 should be added.

Making trades using the strategy

If, before using the MASTO strategy, it is carefully studied the technique of the MACD and Stochastic Oscillator indicators, then using the strategy will not be the slightest difficulty. It should be borne in mind that the signals of the first and last candles of the week are ignored. Also, any trade should be closed upon receipt of a reverse signal or the absence of one of the conditions.

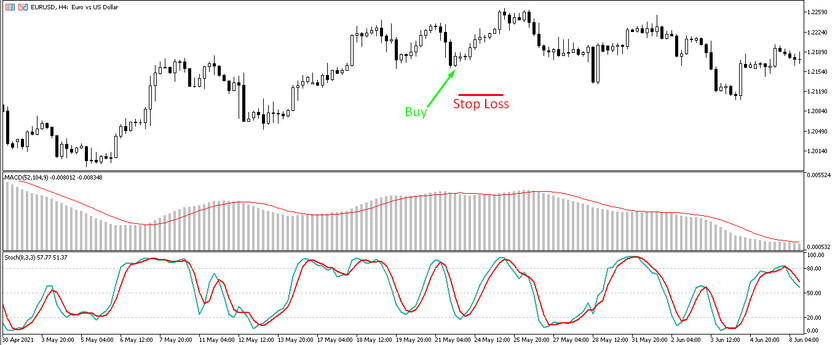

Conditions for Buy trades:

- -The histogram of the MACD indicator is directed upwards and above the zero level. This indicates the presence of an upward trend in the market.

- -The MACD indicator line is slightly above the indicator histogram, which means a corrective movement in relation to the uptrend.

- -The signal line of the Stochastic Oscillator indicator is below the main line, crossing it from top to bottom. At the same time, the indicator lines are below level 50.

If all of the above conditions are met, a buy trade is opened. Stop loss is set at 50 points, and take profit is twice the stop loss.

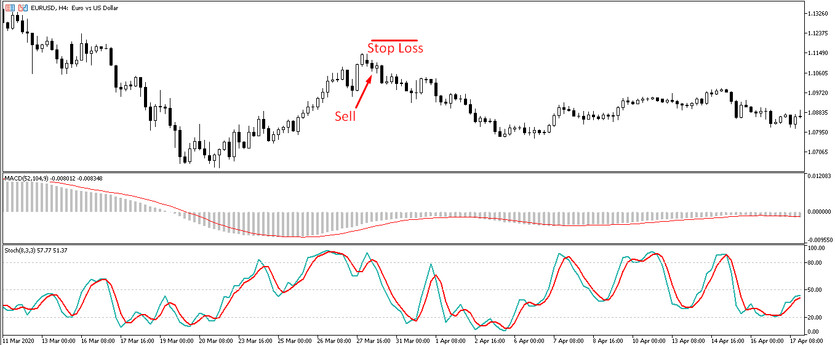

Conditions for Sell trades:

- -The MACD indicator is below the zero mark, which signals a downtrend in the market.

- - Moving indicator MACD just below the bars of the indicator. This characterizes the correction in relation to the downtrend.

- -The signal line of the Stochastic Oscillator indicator is above the main line. Both lines of the indicator are above the level of 50.

When all conditions are determined, a short position can be opened. The stop loss order is 50 points, and the take profit is 100 points.

Conclusion

MASTO is a convenient, simple, but at the same time effective strategy, the trades of which are most often profitable. The combination of two indicators creates a win-win strategy only if it is used correctly. Therefore, in addition to studying the indicators included in the strategy, it should be used a demo account before trading on a real deposit.