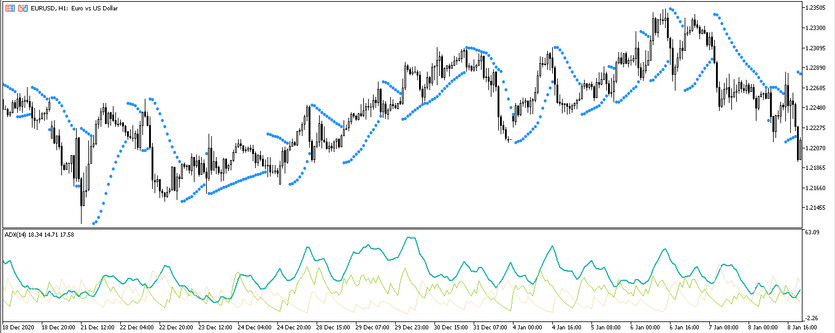

The Parabolic SAR ADX is a trading strategy based on the operation of only two standard forex indicators, which will be enough for effective trading. The indicators included in the strategy are trend indicators, and, accordingly, this strategy will be traded after the current market trend is determined. Due to its versatility, the strategy can be used on any timeframe and currency pair.

Strategy indicators

The Parabolic SAR ADX trading strategy includes two trend forex indicators, which can be understood from the name of the strategy. Due to the effectiveness of these two indicators, any trade made using this strategy should be successful.

- -ADX-a technical indicator that determines the current trend using the main and two signal lines -D and +D. The indicator settings remain unchanged.

- -Parabolic SAR -an indicator, which also determines the trend. Its settings also remain standard.

Trading with the strategy

Due to the fact that the Parabolic SAR ADX strategy includes only 2 forex indicators, trading will be made without much difficulty, especially if it is studied each of them separately, since they are used in the strategy for their standard purpose. After the ADX indicator determines the current trend, and the Parabolic SAR indicator confirms it, then a position can be opened in a certain direction.

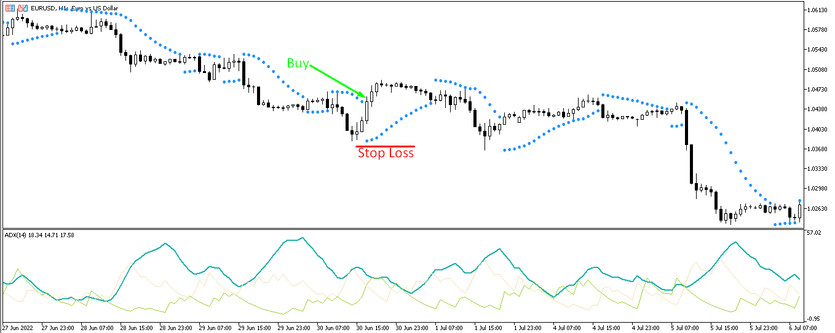

Conditions for Buy trades:

- -The ADX indicator must be above its 0 level. At the same time, its signal lines cross so that the +D line is above -D.

- -At the same time, the Parabolic SAR indicator is under the price at this moment.

After the appearance of such conditions on the candle after the signal, a long position is opened. Such trades should be closed after receiving the opposite conditions by the ADX indicator. A stop loss order should be placed at the point of a recent local extremum.

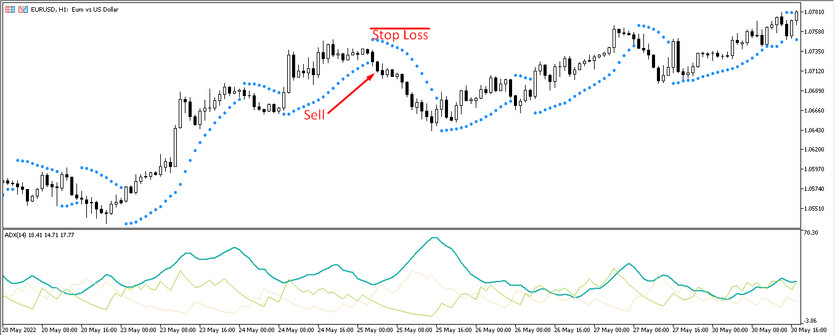

Conditions for Sell trades:

- -ADX lines are above level 0. At the same time, the -D signal line is above the -D line.

- -The Parabolic SAR dots are above the price.

After a combination of such conditions on a signal candle, a short position may be opened on the next one, which should be closed after the reverse intersection of the signal lines of the ADX indicator. A protective stop loss is set at the point of a recent local extremum.

Conclusion

The Parabolic SAR ADX strategy can be considered not only very easy to use, but also effective, due to the indicators included in its composition. Also, the choice of timeframe will not be difficult, since the strategy does not lose its effectiveness, both on small and on large intervals. However, even taking into account the fact that the strategy is very simple, it is recommended to practice on a demo account before using it on a real deposit.