PinBar Patterns are very powerful trading indicators that can alert you to an immediate or impending change in the trend situation.

In Forex trading, however, there is no such thing as a PinBar, and therefore one should always be able to search for the valuable ones and then trade them. And just what PinBars to look for and also one possible way to trade them further can all be found in this unique article about a great PinBar strategy that deals with this very issue.

Strategy entry rules

Entering long positions

- Creating a long PinBar (the candle has a bottom wick at least twice as long as the body)

- PinBar size is above average (see strategy description below)

Entry into short positions

- creating a short PinBar (the candle has a top wick at least twice as long as the body)

- PinBar size is above average (see strategy description below)

Description of the strategy

It all starts on the H4 chart (see above), where you have to wait until the market forms either a long PinBar (long wick at the bottom) or a short PinBar (long wick at the top), but the condition is that the size of this PinBar is "very" above average, compared to the previous candles.

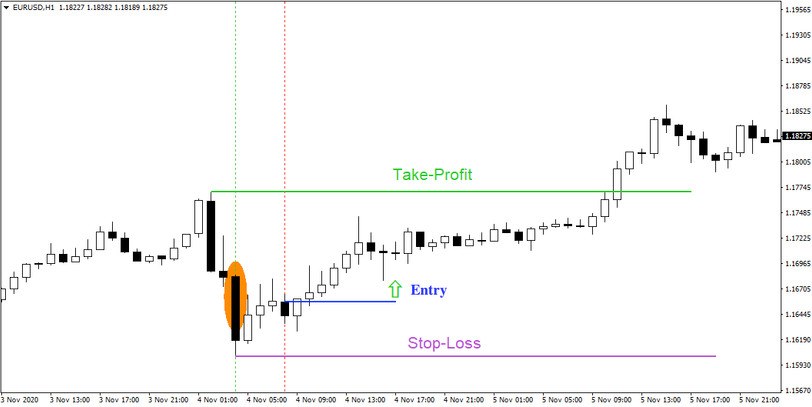

As soon as this situation occurs, the chart on H1 (see below) is switched at the same time, on which the entry into the trading position takes place (the PinBar on H4 must be closed -> the red vertical line marks the time of opening of the new candle after the PinBar on the H4 timeframe is closed ). Of course, one should not forget about the protective elements. Stop-Loss is placed at the minimum of the PinBar in today's strategy (see below - purple horizontal line) and in case of Take-Profit it is placed at one of the previous S/R levels.

The PinBar strategy described above allows to achieve an overall success rate exceeding 70%, which, given the possibility to use risk-management higher than 1:1, is certainly sufficient both for long-term sustainability and for achieving a very excellent final valuation.