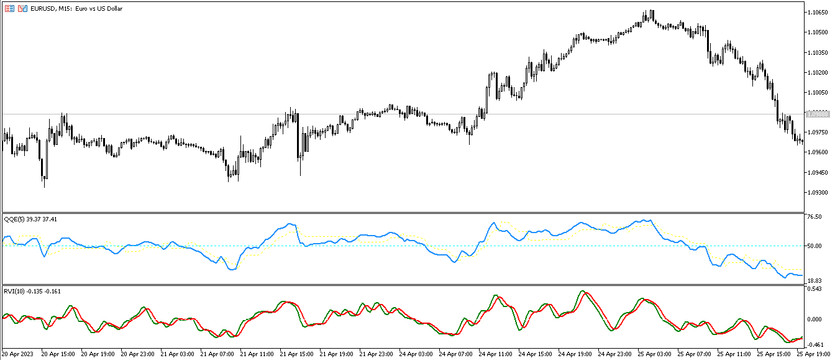

The QQE RVI strategy is a trading algorithm based on the functioning of calculations and the general interaction of two forex indicators, each of which is very accurate and proven profitable trading. The indicators in the strategy work on confirming each other's signals, so when trading it is important to consider the signals and values of both indicators. According to their concept, the indicators included in the strategy are very similar, so the divergence in signals is extremely rare. Therefore, a certain signal of one of the indicators is most often confirmed by a signal of another, which in turn allows determining the current direction of the market movement and open a certain trade.

The QQE RVI strategy is best used on the M15 timeframe and high volatility pairs to get the most out of a trade.

Strategy indicators

The QQE RVI strategy includes only two indicators, which are included in its name. Both indicators work very efficiently, which in turn increases the profitability of trading. Indicator values are set in the strategy, while their parameters can change when a specific timeframe or currency pair is selected.

- QQE is an indicator of processing current market values using the calculations of the standard RSI indicator. Its smoothing is set to 5, and the signal level is 50.

- RVI is an indicator for determining the strength of the current market. Its period is set to 10 with a signal level of 0

Trading with the QQE RVI strategy

The QQE RVI strategy is very easy to use, thanks to the trading indicator included in it, which in turn are easy to use. To open a certain trade, it is needed to take into account the values of both indicators. Since the concept of indicators is similar, their signals are generated almost simultaneously, but if one of the indicators is late with a signal, the trade should not be opened temporarily. At the same time, if the indicators determine an upward trend, long positions are opened, if the trend is downward, short positions are opened. When the trend changes, the trade is closed.

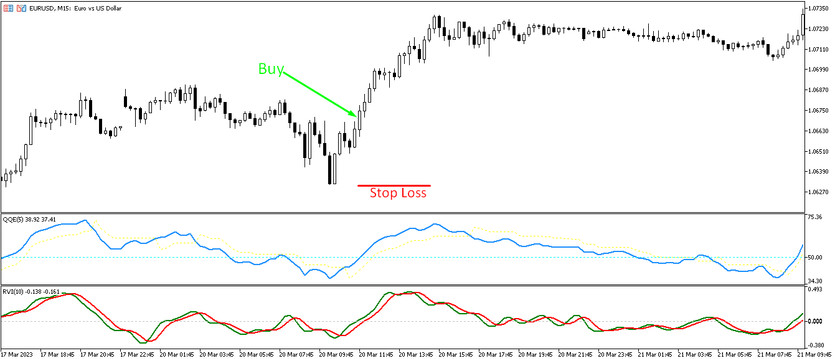

Conditions for Buy trades:

- QQE lines move up and rise above level 50, while the main line is above the signal line.

- RVI lines are moving up and after crossing the fast line is above the slow one.

Upon receipt of a full combination of conditions from indicators, a buy trade may be opened, due to the presence of a strong uptrend in the current market. A stop loss order is placed at the recent extreme point. It should be closed the trade when the trend changes, namely when the opposite conditions from at least one of the indicators are received. At this point, it should be considered opening new trades.

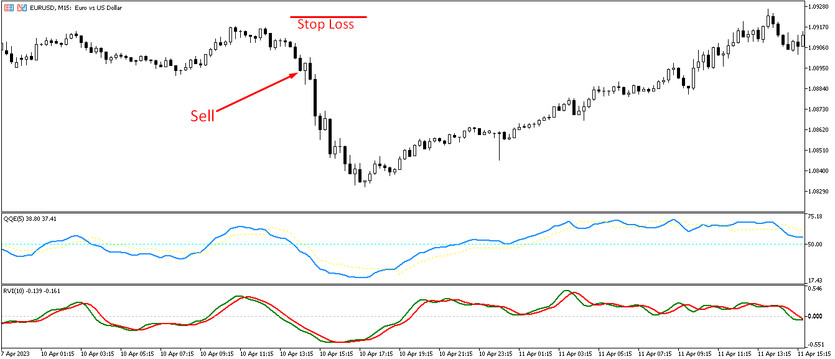

Conditions for Sell trades:

- The QQE indicator moves from top to bottom, falling below the signal level. Its lines intersect so that the signal line is above the main one.

- RVI lines fall below level 0, while the slow line is higher than the fast one.

A sell trade, determined by the presence of a downtrend in the current market, can be opened immediately upon receipt of such conditions on a signal candle. Stop loss is set at the level of the recent local extremum. Upon receipt of reverse signals from one of the indicators, the trade should be closed. At this moment, a possible change in the current trend, which in turn will allow considering opening new trades.

Conclusion

The QQE RVI strategy is an algorithm whose signals are very accurate due to the presence of indicators in it, the effectiveness of which has been proven by time. In addition, the strategy is very easy to use and is suitable even for beginners, who, in turn, can use a demo account in advance to improve their trading skills and apply the strategy correctly.

You may also be interested The RSIOMA Solar Winds Universal Trading Strategy