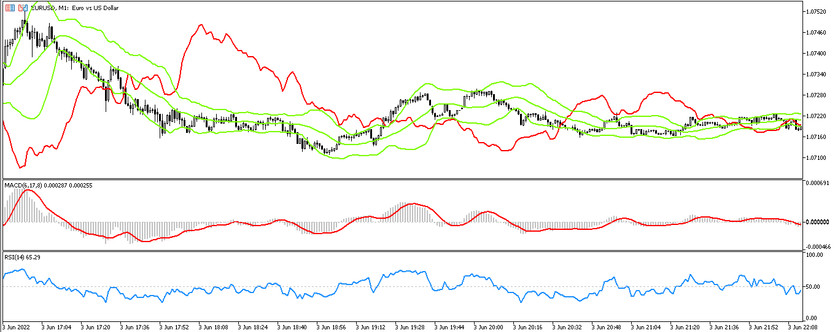

The ScalpM1 trading strategy is an algorithm based on four standard Forex indicators to identify market entry points. Trading with this strategy can only be made on small timeframes, the most optimal of which will be M1.

However, before trading on such small timeframes, it should be taken into account that the dynamics of market movements increases sharply, which means that the conditions for opening a position can be formed at any time, that is, the chart must be constantly monitored. In one trading day, several signals can be received at once to enter market, but it is not denied that most of them may turn out to be false. The choice of a currency pair does not affect the effectiveness of the strategy.

Strategy indicators

The ScalpM1 strategy, in addition to those given in the title, includes two more indicators that serve as filters for the two main ones in the strategy.

- Bollinger Bands is an indicator of the technical analysis of the market, it is used as the main one in the strategy. Its period should be set to 20, and the deviation to 3.

- EMA (3)-exponential moving average, which is also the main indicator in the strategy. Its period is 3.

- MACD - technical indicator that serves as an additional filter in the strategy. Its parameters are 6.17 and 8.

- RSI - indicator of the relative strength of the trend, which is also an additional one in the strategy. Its period is set to 14, while the level 50 should be added in the indicator settings.

Trading with the strategy

Despite the fact that the ScalpM1 strategy includes four indicators, it will be very simple to use it in practice, since all indicators are used in it for their standard purpose. Therefore, before trading on the strategy, it should be studied the nuances of all the indicators included in it composition, paying more attention to the main indicators of the strategy, namely Bollinger Bands and Moving Average.

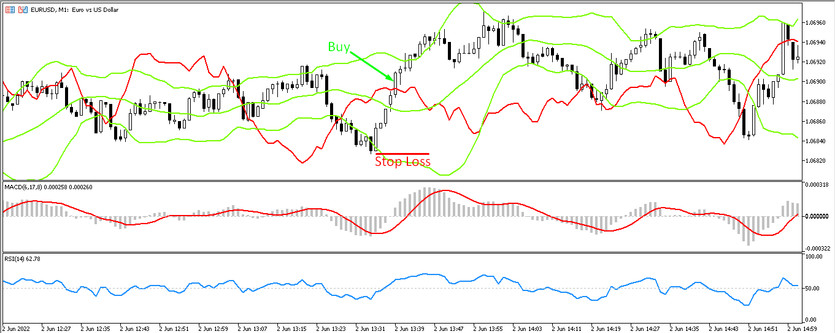

Conditions for Buy trades:

- The signal candle should close above the EMA indicator.

- At the same time, the EMA crosses the middle line of the Bollinger Bands indicator from bottom to top.

- The MACD indicator should cross or already be above zero.

- The RSI indicator should move up, crossing its level 50 from the bottom up.

After the formation of such conditions on a certain candle, a long position can be opened. It should be closed after the moving average crosses the middle line of the Bollinger Bands in the opposite direction. A stop loss order should be placed at the point of a recent local minimum.

Conditions for Sell trades:

- The candle must be below the exponential moving average.

- At this moment, the moving average itself should cross the middle line of the Bollinger Bands from top to bottom.

- MACD histogram should be below zero.

- The RSI line should cross its level 50 from top to bottom, that is, be below it.

Upon receipt of such conditions on a certain candle, a short position may be opened, which should be closed after the reverse intersection of the Bollinger Bands and EMA lines. Stop loss is set at the point of a recent local maximum.

Conclusion

The ScalpM1 is a very easy to use strategy that is profitable when used correctly. However, as in all short-term strategies, it should be taken into account the possibility of losing trades. To reduce the number of such trades, it should be considered that it should not be opened a position if the local minimum or maximum, that is, the stop loss point, is 10 points further than the expected entry point. For successful trading, at least 7 trades must be made per day, so it should be borne in mind that it is needed to track the chart throughout the day. Also reduce the number of losing trades preliminary practice on a demo account, which will help carefully study all the nuances of the strategy.