The Sten strategy was formed by a combination of the work of common trading indicators. Its main goal is to identify the optimal entry point into any trade. The strategy is a trend one and, accordingly, the main profit will be revealed in the presence of a trend movement in the market. However, the strategy is able to profit even with a sideways movement. A trade with a trend will be made faster than with a sideways movement.

Since the strategy is trending, the currency pairs in it should also be trending, but it is still better to use only the EUR/USD pair. Any timeframe can be used, but in order to avoid delays and false signals, it should not be used a very large or very small timeframe. The optimal interval will be H.

Strategy indicators

The Sten strategy includes three basic Forex indicators. Each of them is effective and profitable, and together they form a win trading strategy.

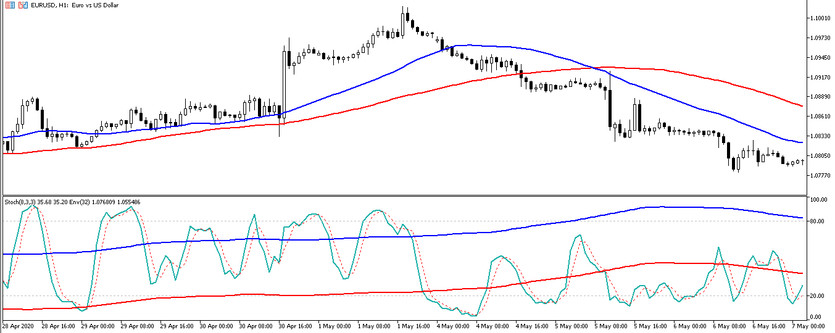

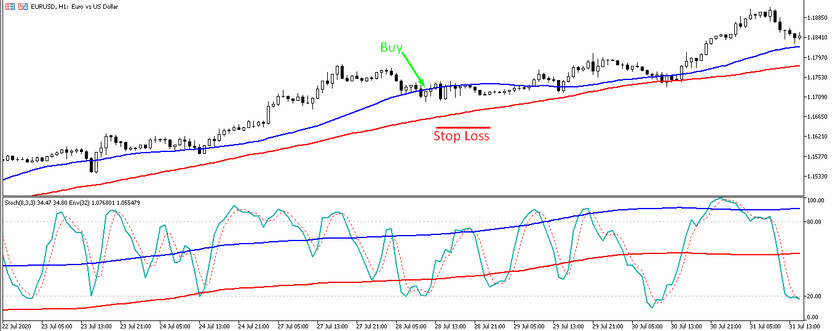

- -SMA(78) - slow moving average with a period of 78. The indicator is located directly on the price chart.

- -SMA(36) - fast moving average with a period of 36. The moving average is also located on the price chart.

- -Stochastic-indicator with parameters 8,3,3. It is located in the lower window of the price chart.

- -Envelopes-indicator with a period of 32 and a deviation of 42%. It is superimposed on the indicator and, of course, is also located in the lower window of the chart.

In the parameters of each indicator, it can be changed the color scheme and width.

Making trades using the strategy

At first glance, the use of the Sten strategy in practice may seem difficult, but this is far from being the case. If it will be taken into account all the trading rules for this strategy, as well as correctly determine the entry points to trades, then a profitable trade can be guaranteed. It is also worth taking into account what one trading interval, several trades can be made at once, despite the existing open positions.

Conditions for opening Buy trades

- -The price is above the slow moving average.

- -SMA(32) is above SMA(78) and crosses it from bottom to top.

- -The lines of the Stochastic indicator are above level 20 and cross the lower line of the Envelopes indicator.

The stop loss is set at 30 points and the take profit is twice the stop loss value.

A buy trade should be closed if at least one of the above conditions does not match.

Conditions for Sell trades

- -The price is below the SMA(78) indicator.

- -The fast moving average crosses the slow moving average from top to bottom, that is, the slow moving average is located above the fast moving average.

- -The Stochastic indicator falls below its level of 80, and its lines cross the upper line of the Envelopes indicator from top to bottom.

The stop loss order is 30 points and the take profit is 60 points.

The trade is closed if at least one of the above conditions does not match.

Conclusion

The Sten strategy is a very effective and easy to use strategy for the EURUSD currency pair, however, sometimes trades can be made using other currency pairs, but it should be borne in mind that this is a risky step. The strategy should be used for its intended purpose and all trading rules should be observed. And before trading on a real deposit, it is recommended to use a demo account.