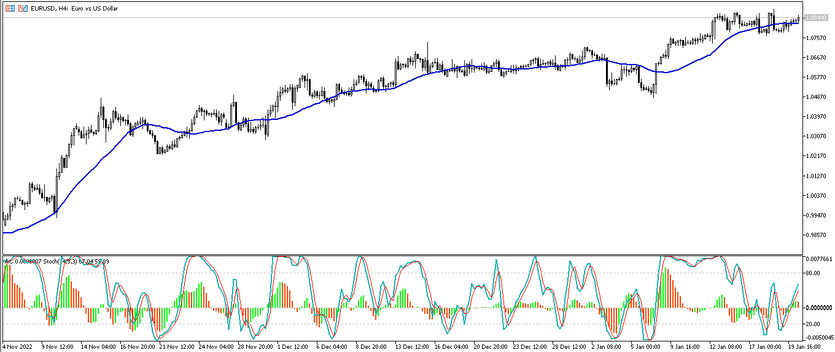

The Stochastic AC MA trading strategy is a combination based on the interaction of three standard Forex indicators, the effectiveness of which has already been proven by time. The strategy was created for trend trading, that is, any trade using Stochastic AC MA is opened at the moment when all three indicators included in the strategy will confirm the current trend on a certain candle. At the same time, trades cannot be opened if at least one of the indicators does not confirm the current trend, since it should be waited for the full combination of conditions. This indicates that the trading algorithm of the strategy is based on confirmation of each other's indicator signals.

The Stochastic AC MA strategy is suitable for any timeframe currency betting, while it is recommended to use the H4 time frame.

Strategy indicators

The Stochastic AC MA strategy consists of three indicators included in the standard forex set. They interact perfectly with each other, and therefore their combination is very successful. The values of the strategy indicators should change taking into account the selected timeframe and currency pair.

- Accelerator Oscillator - a trend oscillator that determines the strength of the current trend.

- Stochastic Oscillator - indicator of the technical analysis of the market. It should be installed in the indicator window. Its parameters are 14,3,3, the price is Close/Close, and the method of smoothing the moving average is Simple.

- SMA - simple moving average with a period of 30.

Trading with the Stochastic AC MA strategy

In order to open a certain trade using the Stochastic AC MA strategy, it is necessary to determine the current trend by taking into account the signals of all three indicators. Namely, the price location relative to the moving average, the color and location of the Accelerator Oscillator histogram relative to level 0, as well as the intersection of the Stochastic Oscillator and their location relative to the histogram. And on the candle, on which the uptrend is confirmed, long positions are opened, if the trend is down, short positions. Close any trade opened using the strategy should be after at least one of the indicators gives a reverse signal.

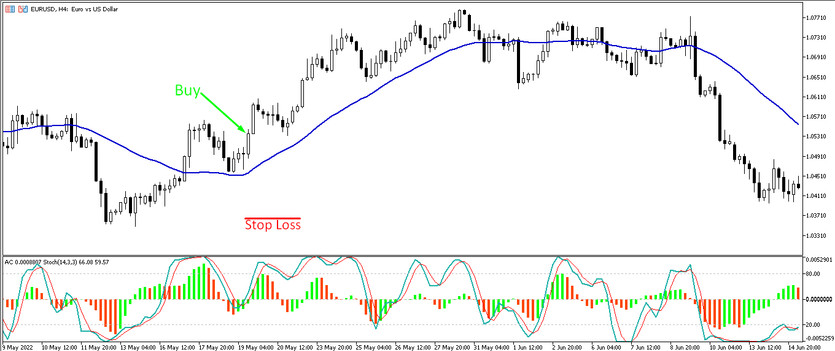

Conditions for Buy trades:

- Accelerator Oscillator, turning into a color with an increase value, rises above level 0.

- Stochastic Oscillator lines are crossed so that the main one is higher than the signal one, while both lines are above the 0 level of the histogram.

- The current price is above the SMA line.

Upon receipt of the full combination of indicator conditions, a buy trade may be opened, due to an uptrend in the market. Stop loss should be set at the point of a recent local minimum. Close such a trade and prepare to open new ones after at least one indicator of the strategy gives a reverse signal, which will confirm a possible change in the current trend.

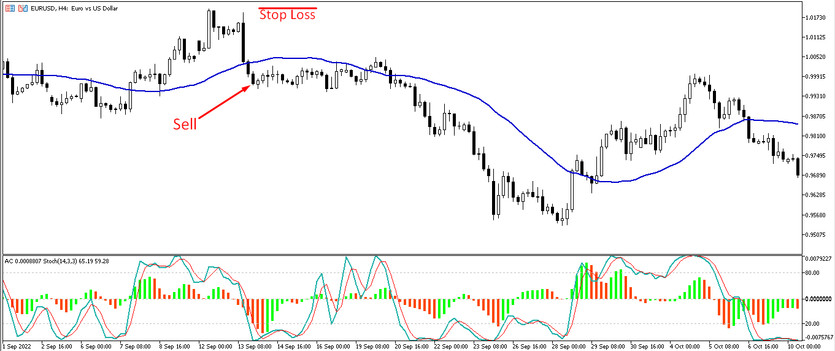

Conditions for Sell trades:

- The Accelerator Oscillator histogram has a color with a falling value and is under level 0.

- Stochastic Oscillator lines intersect so that the signal line is higher than the main one. Both lines are below the 0 level of the Accelerator Oscillator histogram.

- The current candle must be below the moving average.

Upon receipt of such conditions from the indicators, a sell trade may be opened, due to the presence of a downtrend in the market. Stop loss order should be placed at the point of a recent local maximum. At this moment, it should be prepared for the opening of new trades due to a change in the current trend.

Conclusion

The Stochastic AC MA strategy is a very well-composed combination of effective Forex indicators. It works on confirmation of signals, and therefore, of course, the received signal is very accurate. In order to be able to use the strategy correctly, preliminary practice on a demo account and a separate study of the concept of the indicators included in it is recommended.

You may also be interested The Inside RVI Universal Trend trading strategy