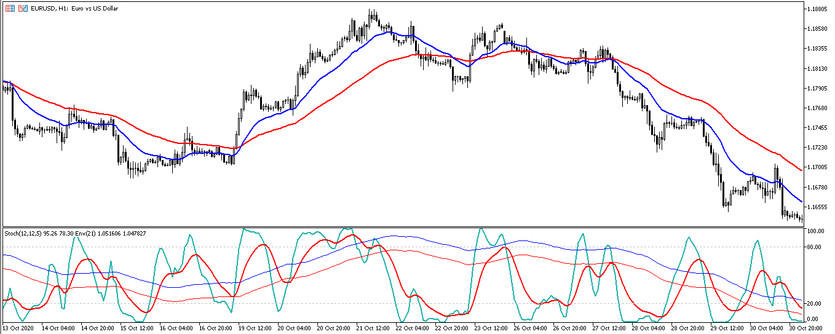

The Stochastic Envelopes strategy is an algorithm based on two indicators and an oscillator, which is used as an effective trading assistant. The strategy includes standard forex indicators that are quite profitable, which has been proven by time. Stochastic Envelopes can be used on any timeframe and with any currency pairs, as their choice will not affect the functioning of the strategy, which makes it universal.

Strategy indicators

The indicators included in the strategy create simple trading conditions in any direction, using any timeframe and currency pair, while the strategy will remain as effective and profitable due to the combination of two indicators and an oscillator.

- -EMA (21) - fast exponential moving average, the period of which is equal to the value of 21.

- -EMA (60) - slow exponential moving average, with a period value of 60.

- -Stochastic Oscillator - a standard oscillator that determines position opening points and overbought and oversold zones in a strategy. Its values remain unchanged.

- -Envelopes-acts as an additional indicator, which is applied on top of the Stochastic Oscillator indicator. Its settings also remain unchanged.

Trading with the Stochastic Envelopes strategy

When making certain trades using the Stochastic Envelopes strategy, it should be carefully considered the values of each indicator, starting with the signal indicator of this strategy - EMA. Since there are two EMA lines, it is logical that the signal will be their intersection, which will indicate the beginning of the current trend. Next, it will be set the value of the Stochastic Oscillator lines, which will be in the zone from levels 20 to 80, periodically crossing them, as well as the lines of the Envelopes indicator. And only after receiving certain conditions on the current candle, a trade can be opened.

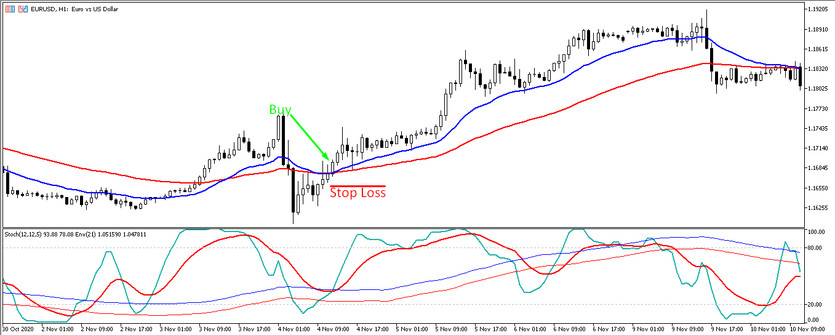

Conditions for Buy trades:

- -EMA lines cross each other, moving upwards, while EMA (21) is higher than EMA (60).

- - The lines of the Stochastic Oscillator indicator, crossing the level 20, move upwards, not reaching the level 80. At the same time, its main line is above the signal line.

- -Envelopes lines move so that Stochastic Oscillator crosses them from bottom to top.

After the formation of all the above conditions on a certain candle, a long position is opened, that is, a buy trade. It should be closed when the exponential moving averages cross in the opposite direction, or the Stochastic Oscillator lines cross their level of 80. Stop loss is set at the previous low of the candle close.

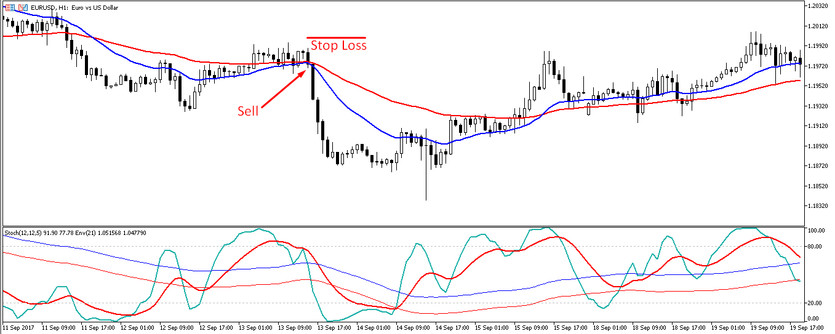

Conditions for Sell trades:

- -Two exponential moving averages intersect so that the slow one is above the fast line.

- -After crossing the overbought zone, the Stochastic Oscillator lines move down, but do not reach the oversold level. The signal line of the indicator is above the main one.

- -Stochastic Oscillator lines cross Envelopes lines from top to bottom.

After receiving these conditions, a short position is opened on the current candle. It should be closed after a change in the direction of exponential moving averages or when the Stochastic Oscillator lines cross the oversold zone, that is, level 20. Stop loss should be set at the point of the previous local maximum.

Conclusion

The Stochastic Envelopes strategy is very powerful and profitable, due to the use of time-tested basic indicators in it. Due to its versatility, the strategy is suitable for both long-term trading and short-term trading. Regardless of the choice of timeframe, the strategy retains its skills. To get more profit from any trade using this strategy, practice on a demo account is recommended.