Trades on pullback trading strategy provides the opportunity to trade using the EURUSD and GPBUSD pairs on time intervals from M5 or slightly higher. The strategy is designed to identify market entry points through the general functioning of classic forex indicators, which are considered very effective.

Trading with the Trades on pullback strategy is performed only on small timeframes, any trade can be made in a short period of time, while it will bring a fairly good profit.

Strategy indicators

The Trades on pullback strategy includes four standard indicators, thanks to the combination of which favorable trading conditions are created. In order to fully understand the signals of the strategy, before using it in practice, it is recommended to study each indicator included in its composition.

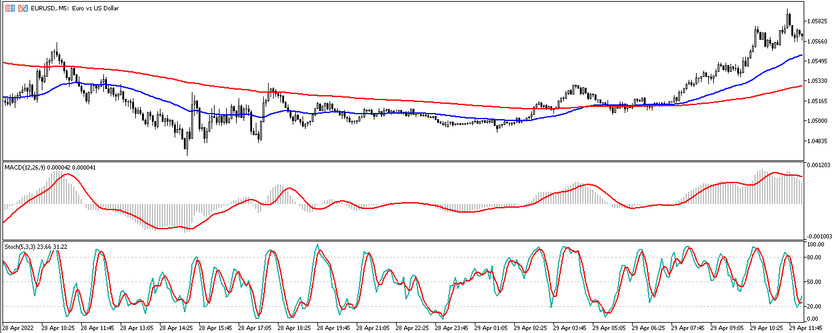

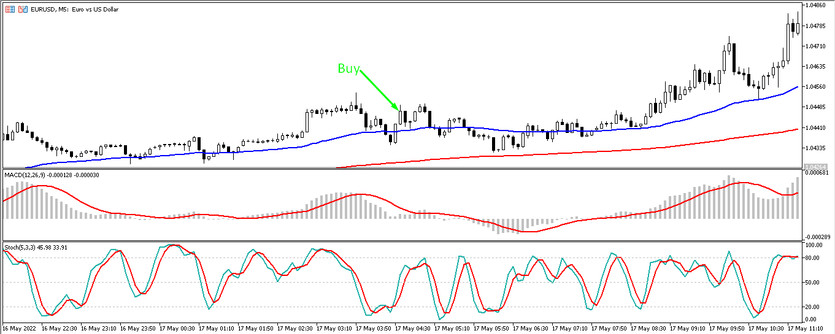

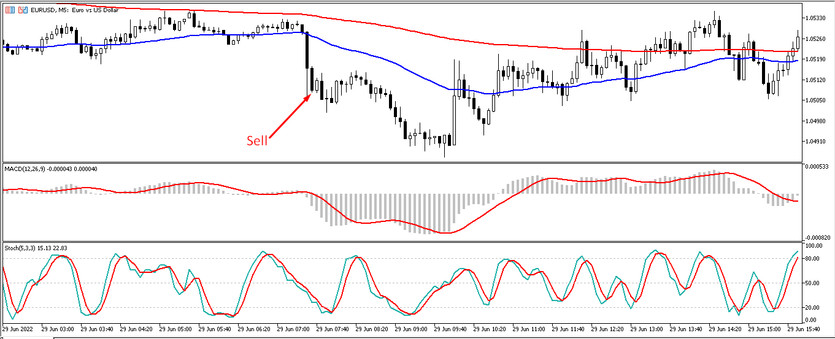

- -EMA (50) - fast exponential moving average, the period of which is 50.

- -EMA (200) - slow exponential moving average with a period of 200.

- - MACD-indicator of technical analysis, made in the form of a histogram, the values of which remain unchanged, that is, equal to 12.26 and 9.

- -Stochastic-indicator of the relative price range, the values of which also remain unchanged.

Trading on pullbacks with the strategy

It is very easy to make any trades using the Trades on pullback strategy, due to the fact that it includes indicators that are often used in trading due to their effectiveness, so even a beginner can handle trading with this strategy. The main thing is to take into account all the trading conditions and be able to control the current price chart.

Conditions for Buy trades:

- - Exponential moving averages crossed so that the fast one turned out to be higher than the slow one. It is important that they do not intertwine, but move in parallel.

- -MACD histogram rose above the zero level.

- - The lines of the Stochastic indicator cross the level 50 and move up, while not reaching the level 80. At the same time, the main line of the indicator is above the signal line.

Upon receipt of such conditions, a long position can be opened on a certain candle. The trade should be closed with reverse signals from the indicators.

Conditions for Sell trades:

- - EMA (200) crosses EMA (50) and is above it. After such a crossing, the moving averages should move in parallel.

- -MACD indicator is below zero.

- - Stochastic crosses level 50 from top to bottom, while being above the oversold zone, that is, level 20.

Upon receipt of the above conditions, a short position can be opened on a certain candle, which should be closed after the opposite conditions appear.

Conclusion

With the correct use of the Trades on pullback strategy, it can be achieved good results, that is, make a profit from any trades. It is important to remember that the strategy is not suitable for all currency pairs and timeframes.To fully master the strategy, it is needed to study the indicators included in it, and practice on a demo account.