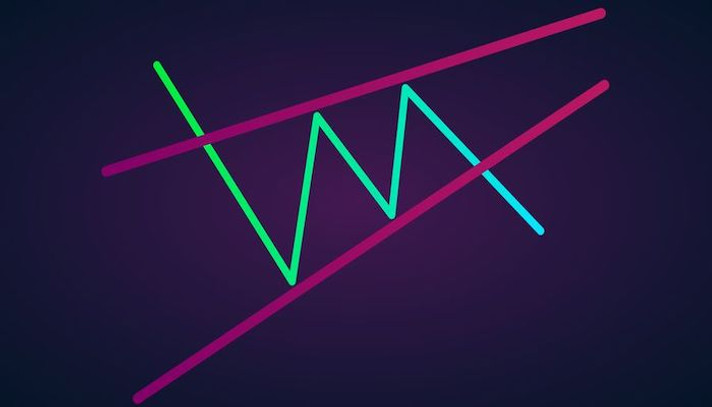

There are countless trading strategies in trading today, with some working better in pro-trend situations, while others give great results when the market moves sideways and oscillates regularly.

Today, however, we have one of the more unique strategies, which can be said to defacto fall under neither of the aforementioned types, as it not infrequently ever straddles the line between them, as it usually occurs when a new sentiment is forming in the market.

Strategy entry rules

Entering long positions

1) price passes through the upper clamping line

2) the candle closes relatively "further" from the upper line

Entry into short positions

1) price passes through the bottom line

2) the candle closes relatively "further" from the lower line

How to trade with the strategy

First and foremost, it is important to be able to create two converging trend lines in a trend (see chart above), but they need to fall/rise relatively slowly (this requires getting a feel for them) and not quickly. If a trader can already do this, then the next step is to wait for a situation where the market breaks one of the lines (see orange ellipse above). Of course, a single breakout does not constitute a quality entry signal, but in addition, the breakout candle still needs to close relatively farther away from the line it is holding (above this was met). In contrast, the red ellipse below shows just a case where, although the line was broken, the market was unable to climb to a safe distance and therefore the entry was not realized here after all.

Conversely, as can be seen below, the breakout candle here eventually closed relatively close enough to the line, and therefore it was better to wait for a more distant close of a subsequent candle, after which an entry could be made immediately. Since this strategy is one of the more advanced ones, it also requires a certain professionalism and a sense of quality assessment of the situation, such as the breakthrough mentioned here, waiting and then entering.

Today's strategy is certainly not one of those that are full of trading opportunities, but if a trader learns to use it correctly, then even an average of a few trades per month can bring a very interesting appreciation with a success rate of around 75%.