Persistence and trading strategy. The alpha and omega that determine whether a trader will eventually stand at the top or somewhere at the bottom.

When it comes to persistence, there is no extra help with it, as it is always in the hands of each individual. It good trading strategies, there are many of them on the market, like the one right here!

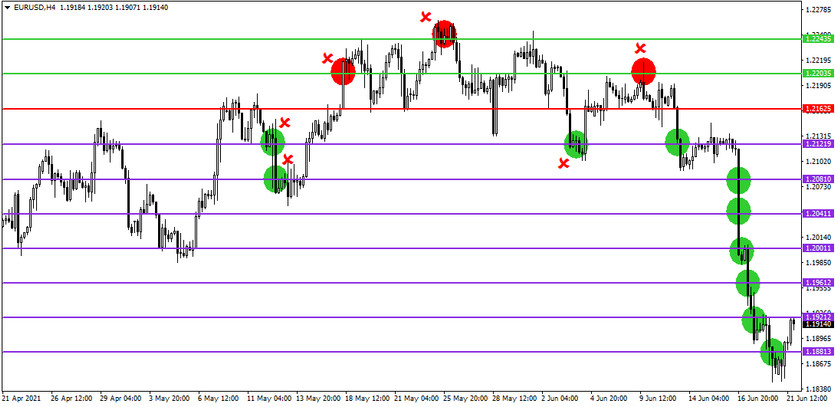

Strategy entry rules (example)

Entering long positions

- Hitting one of the levels above the grid

Entering short positions

- hitting one of the levels below the grid

How to trade with the strategy

The basis of the strategy is a starting line (red - chosen by each person at his/her discretion) and grid levels, which are located at regular intervals above and below the starting line (the size of the intervals is again chosen by each person at his/her discretion). Everything starts when the price hits the starting line and then you just have to wait until the market hits one of the first grid lines (line below= short entry, line above= long entry). The next levels are entered in this analogy and the moment the predetermined profit is reached, then all positions are closed and the whole strategy is restarted.

A little explanation:

Since the strategy tries to follow the essence of trend movements, as the market moves in the direction of the trend, further new entries are made in its direction, which in turn reduces the time needed to reach the set profit.

With this strategy it is possible to achieve a long-term success rate in the range of 40-60%, which due to multiple entries is usually fully sufficient to cover previous losses and at the same time to achieve the desired profits.