Overbought and oversold markets are among the main factors that many traders use to decide whether to enter a trading position or wait quietly.

There are several ways to assess the oversold/oversold markets, but choosing the optimal one and the user-friendly one among these methods is usually not easy. Therefore, here we come up with a simple guide on how to assess the current market situation and at the same time not worry whether a mistake has been made somewhere "along the way".

Strategy entry rules (example)

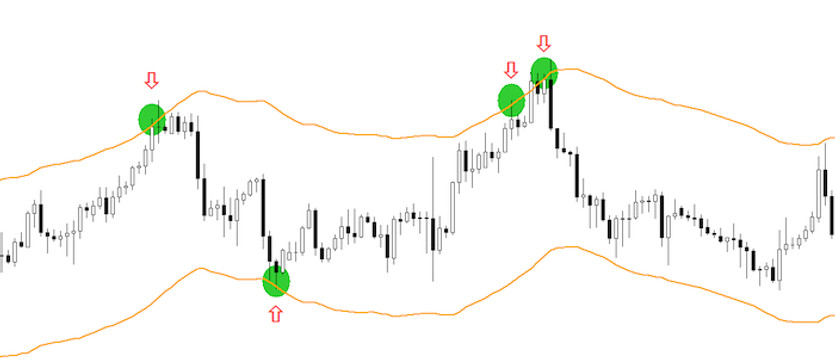

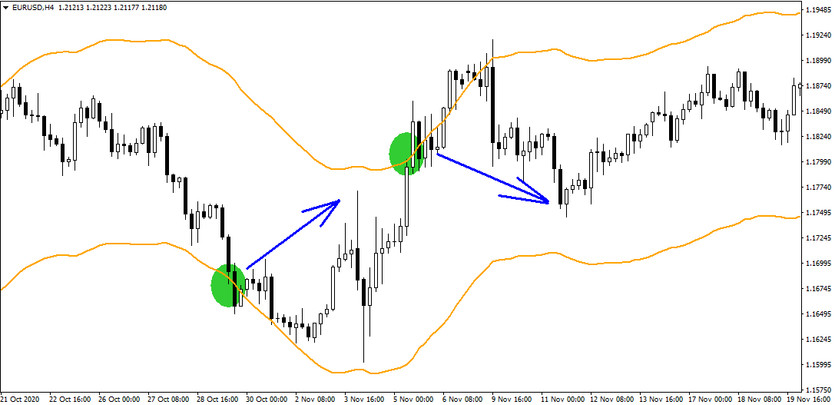

Entering long positions

- Hitting the lower "down" level (-1000)

Entering short positions

- hitting the upper "elevated" level (+1000)

How to trade with the strategy

Today's trading method is based on the development of a moving average (see the settings in the picture above); more precisely, it is two added levels (see the settings in the image above), based on which, on the H4 timeframe, entries into trading positions are made. By creating "widely" spaced levels, it can be assumed that the market is overbought/oversold at these levels and, therefore, if one of the levels is hit. A trade position entry is made in the opposite direction. As far as limit orders are concerned, it is up to each individual to decide at what distance and with what ratio they will eventually place their Stop-Losses and Take-Profits.

With today's business strategy, it is possible to achieve a success rate of 50 to 70%, which should be more than sufficient to achieve long-term sustainability using appropriate money management.