The 2TF refers to strategies that operate on the basis of standard forex indicators. The tasks of the strategy are to accurately determine the current trend, and then, taking it into account, identify the optimal point for opening positions. Trading using this strategy can be made on two intervals H4 and D1, separate and independent from each other. The strategy was created for the EURUSD and GPBUSD currency pairs, but keep in mind that the trading conditions will be slightly different.

Strategy indicators

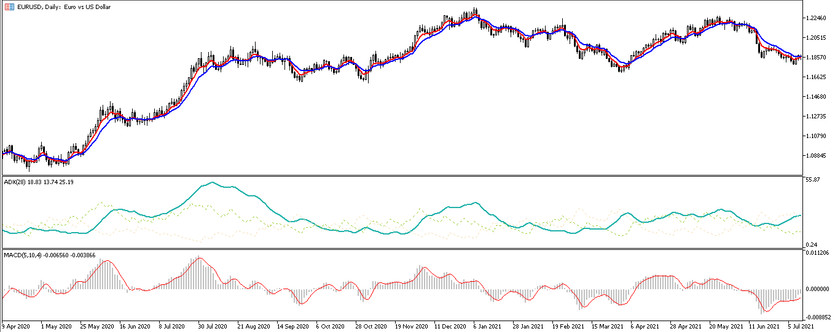

The 2TF strategy was created on the basis of four forex indicators, the parameters of which should be correctly adjusted to the EURUSD and GPBUSD currency pairs. The timeframe has practically no effect on changing the parameters of the indicators.

- -EMA (5) - fast exponential moving average, the period of which is 5.

- -EMA (10) - slow exponential moving average, the value of which should be set to 10.

- -ADX trend strength indicator with a period of 28.

- -MACD-technical oscillator with parameters 5,10 and 4.

Trading with the strategy

The main signal for making trades using the 2TF strategy will be the intersection of two exponential moving averages, and only after they cross in a certain direction, the signals of other indicators should be considered. The conditions for making trades for the EURUSD and GPBUSD pairs will be almost the same. Some conditions will differ when choosing a timeframe.

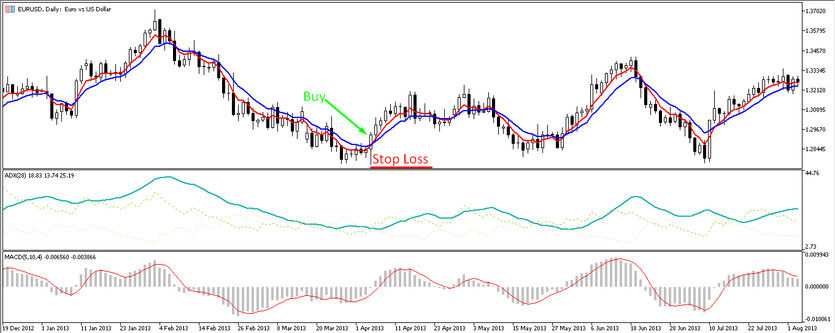

Conditions for Buy trades:

- - EMA (5) crosses EMA (10) from the bottom up and is above it.

- -The main line of the ADX indicator is moving upwards. At the same time, its signal line +D is above the -D line.

- - The histogram of the MACD indicator is above the zero level.

After receiving these conditions on the current candle, it should be opened a long position, which should be closed after the reverse intersection of the exponential moving averages. When trading on the H4 timeframe, a stop loss order is placed in the amount of 10 points from the slow moving average, while its minimum size is 35. Take profit on this interval for the EURUSD pair is 60 points, and for GPBUSD - 70 points. When choosing the D1 interval, stop loss should be set at the minimum of the signal candle. Take profit on the daily interval for the EURUSD pair is 200 points, and for the pair GPBUSD-250.

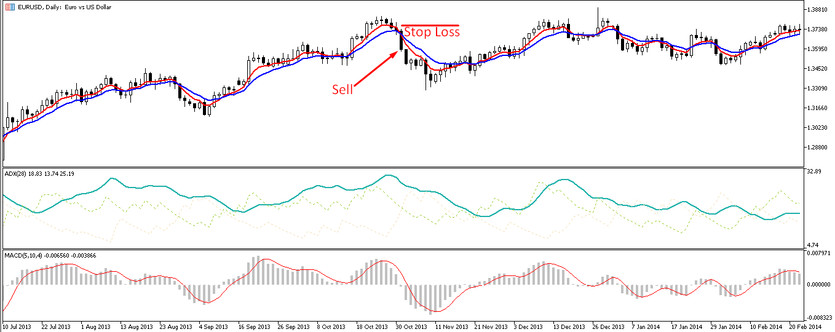

Conditions for Sell trades:

- -The slow exponential moving average crosses the fast one downwards and is above it.

- -The ADX line is characterized by downward movement, while its -D line is higher than the +D line.

- -MACD indicator is below zero.

If these conditions match, a short position is opened on the current candle, which should be closed after the EMA (5) is above the EMA (10). When choosing the H4 timeframe, the stop loss should be set slightly above the EMA (10), that is, in the amount of 35 points, and the take profit on this interval with the EURUSD pair is 60 points, and with the GPBUSD pair - 70 points. When trading on D1, it is set at the maximum of the signal candle. Take profit with EURUSD is 200 pips, and with GPBUSD it is 250.

Conclusion

The 2TF trading strategy shows excellent results in practice. The strategy cannot be used with other currency pairs, except for EURUSD and GPBUSD and H4 and D1 timeframes, as it is profitable only with the use of these instruments. Its correct use will allows making effective trades.