The YinYang strategy is widely used in determining trend or reversal signals. Thanks to its correct use, excellent results can be easily achieved. The YinYang strategy can be used for any currency pairs on intervals from M5 to H4.

Indicators for the Yin Yang strategy

- -Envelopes. This indicator is used with a period value of 21 and a deviation of 0.18.

- -Parabolic SAR. Used in increments of 0.02 and a maximum of 0.7.

- -Awesome Oscillator. This indicator is used with default settings.

Trading with the Yin Yang system

Making trades using the Yin Yang system is very simple, but do not forget that any trade is opened after the previous one is moved to breakeven. And no trades are made in the last 1.5 hours of the trading day. There are two options to make a buy trade using this system. The first option is used only once a day, when the first signal is received from the beginning of the day.

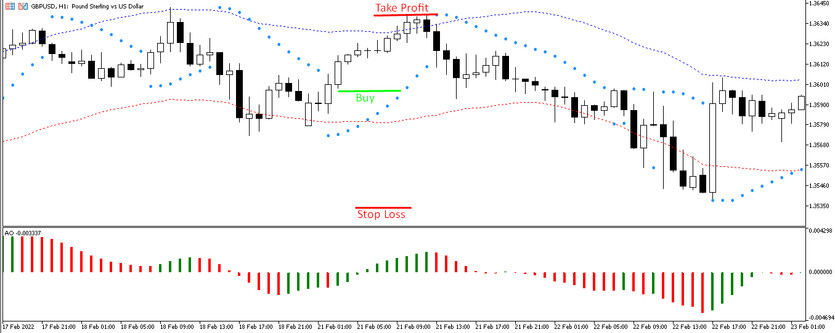

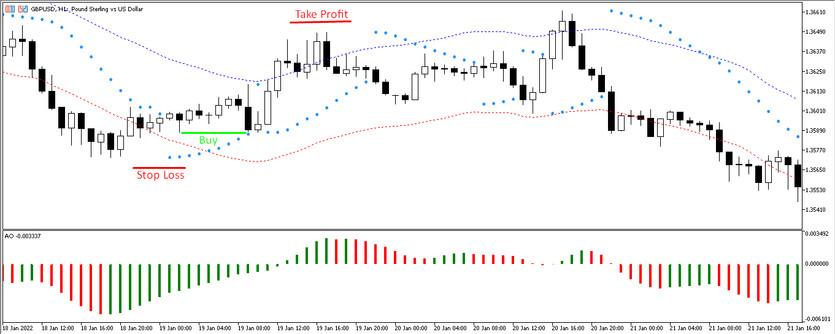

The price is above the lower line of the Envelopes indicator, but below its upper line, while the Parabolic SAR indicator is below the price, and the Awesome Oscillator indicator is above level 0 with lines with a value up, and lines with a value up are also located in front of them. At the close of the current candle a buy trade is made.

When considering the second option, the price is also between the two lines of the Envelopes indicator, the Parabolic SAR indicator is located below the price. The Awesome Oscillator indicator is above level 0 with lines with a value up, but there may be lines with a value down in front of them.

The stop loss order in both cases is placed below the Parabolic SAR indicator, while it is not less than 15 points, but not more than 30 points. If the stop loss size is more than 30 points, then the trade is transferred to breakeven. Take profit several times greater than the stop loss order. When a reverse signal is received in the negative zone, the trade is closed at the market price.

When making sell trades using the Yin Yang system, one should not forget that any trade is opened after the previous one goes to breakeven. And no trades are made in the last 1.5 hours of the trading day. There are two options to make a sell trades using this system. The first option is used only once a day, when the first signal is received from the beginning of the day.

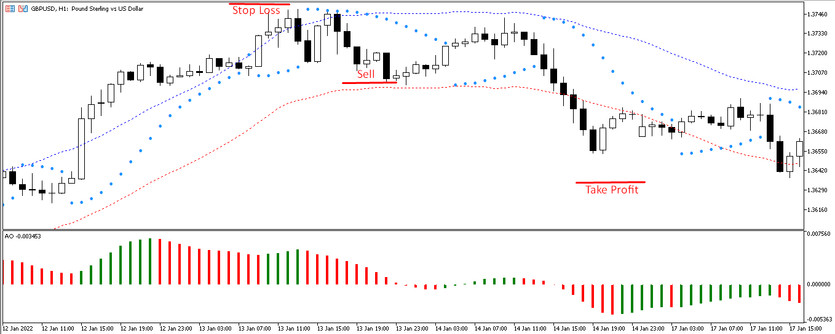

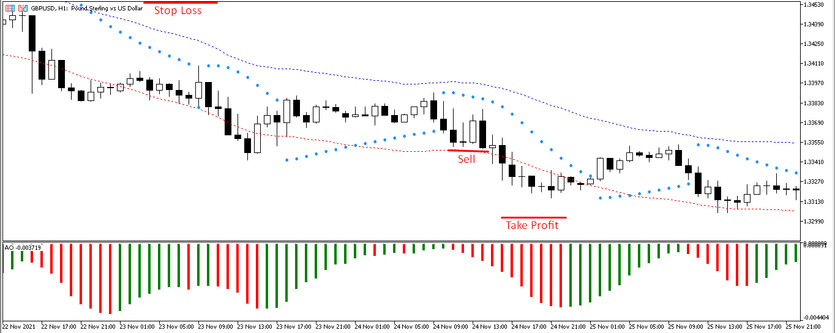

The price is between the lines of the Envelopes indicator. The Parabolic SAR indicator is above the price. The Awesome Oscillator is above level 0 with down lines and down lines in front of them as well. At the close of the current candle, a sell trade is made.

When considering the second option, the price is also between the two lines of the Envelopes indicator, the Parabolic SAR indicator is below the price. The Awesome Oscillator indicator is above level 0 with lines with a value down, but there may be lines with a value up in front of them. At the close of the current candle, a sell trade is made.

The stop-loss order in both cases is placed above the Parabolic SAR indicator, while it is not less than 15 points, but not more than 30 points. If the stop-loss size is more than 30 points, then the trade is transferred to breakeven. Take profit less than the stop loss order. When a reverse signal is received in the negative zone, the trade is closed at the market price.

Conclusion

Thanks to the combination of three indicators: Envelopes, Parabolic SAR and Awesome Oscillator, an excellent forex strategy was formed. Its use is not difficult and you can make a trade very profitably.