Volume is the basis without which trading does not exist. Why? Simply because when the volume is zero, then no one buys or sells anything, as simple as that.

However, the loss of volume does not mean that volume has completely disappeared from the market, but only that it has been reduced, which on the one hand can bury some trading opportunities, so to speak, but on the other hand, can create other very interesting opportunities, and that is, after all, what traders are after.

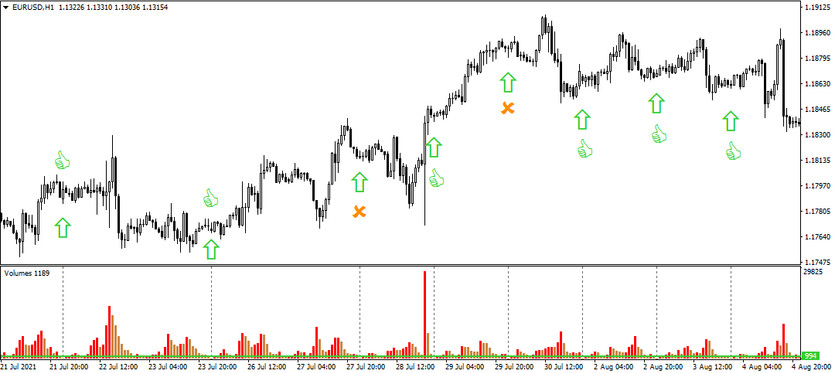

Strategy entry rules (example)

Entering long positions

- volume falls below a certain "extreme" value

How to trade with the strategy

Since this strategy uses the volume indicator "Volumes", it is therefore necessary to insert this indicator into the chart first of all. As far as the actual setup is concerned, the advantage of Volumes is that it is not an algorithmic indicator, but it is only a cumulative tick tool, which takes all the worry out of setting it up (the setup is fully automatic).

So, once the trader has the indicator embedded in the chart, then comes the most important and also the most difficult part of today's strategy, and that is defining a volume level (based on past volumes), which will represent a potential extra low volume level (setting the value is an individual matter and therefore this requires some practice), where if it is breached, it will subsequently lead to entering a long trading position (see chart below - the green level of 994).

Finally, there is the placement of limit orders (SL, P), in which traders usually follow the so-called ratio rules to maintain proper money-management (2:1, 3:1, etc.).

Despite the fact that the loss of volume usually does not allow obtain a high percentage appreciation from a single position, it is a strategy whose long-term success rate exceeds 70%, which allows more skilled traders even with small capital to achieve above-average and stable appreciation in a relatively short period of time.