Despite the fact that many Forex traders choose intraday trading systems because of the increased opportunities in shorter time frames brought on by market volatility, a weekly trading plan for the currency can offer greater flexibility and stability. A weekly candlestick offers comprehensive market data. Weekly Forex trading techniques focus on keeping position sizes small and avoiding taking on too much risk.

The most popular price action trading patterns, such as engulfing candles, haramis, and hammers, can be employed by traders for this approach.

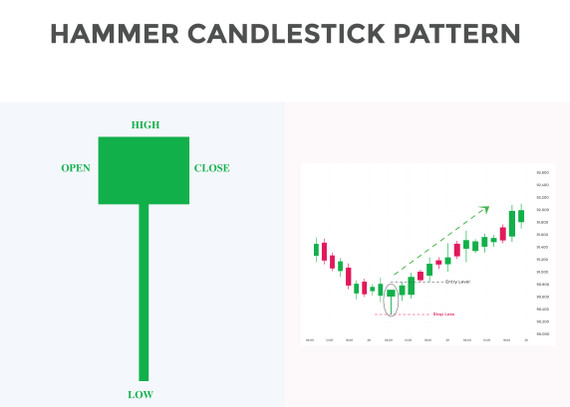

The hammer pattern, which resembles the illustration below, is one of the most widely employed in forex trading.

The reverse hammer or also a shooting star, which is the antithesis of the hammer, resembles the illustration below:

The chart below displays the NZDUSD's weekly price movement as well as illustrations of the aforementioned patterns.

The success of the Weekly Forex Trading Strategy depends on the current market situation. Like many other strategies, this strategy hasn't been proven to be successful every time; it's only a starting point for your own ideas and it requires practice.