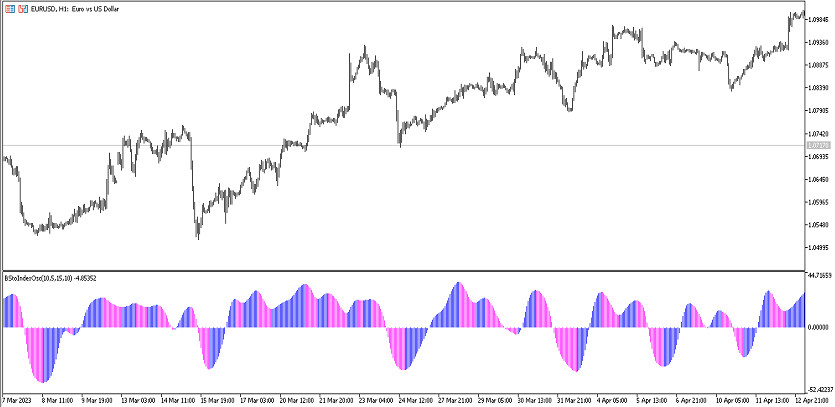

The Blau Stochastic Index indicator is a trading algorithm, the calculations of which are based on the functioning of several trading indicators. Its calculations are aimed at determining the current trend, namely its strength and direction, that is, trading using the indicator is a trend indicator. The indicator is presented in the lower window of the price chart in the form of a histogram that changes color and direction depending on the current trend. The current values of the indicator's histogram are considered the main ones in determining the market movement and opening a certain trade, respectively.

The Blau Stochastic Index indicator is suitable for trading on any timeframe, using any currency pairs.

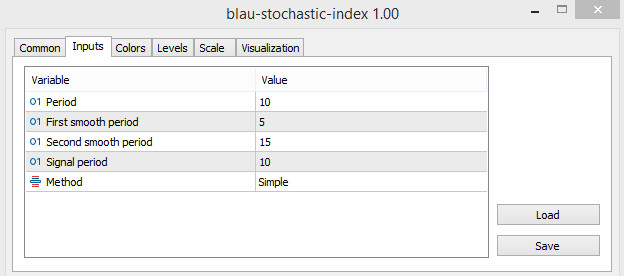

Input parameters

The Blau Stochastic Index indicator settings contain several sections. Thus, the Input Parameters section is used to change its technical work, the Colors section is used to change the visualization, and the Levels section is used to add signal levels to the indicator window.

-Period - value of the indicator calculation period. The default value is 10.

-First smooth period - the period of the first, main smoothing of the indicator values. The default value is 5.

-Second smooth period - period of the second smoothing of values. The default value is 15.

-Signal period - period of the signal line of the indicator. The default value is 10.

-Method - type of indicator value smoothing. By default, it has the Simple value.

Indicator signals

The way to use the Blau Stochastic Index indicator is very simple. To open a trade, it is needed to take into account the values of the indicator, which in turn are aimed at determining the direction and strength of the current market trend. If the indicator characterizes the presence of an upward trend, long positions are opened; if the trend is downward, short positions are opened. At the moment the current trend changes, in both cases, the trades are closed.

Signal for Buy trades:

-The histogram of the indicator is colored in color with the growth value and rises. In this case, the new column of the histogram is higher than the previous one.

Upon receipt of such conditions, a buy trade can be opened on the signal candle, due to the presence of an upward trend in the current market. It should be closed upon receipt of a return signal from the indicator. At this moment, a change in the current trend is possible, which in turn will allow considering the opening of new trades.

Signal for Sell trades:

-The indicator is colored with the fall value and its bars are directed downwards. In this case, the newly formed histogram bar is lower than the previous one.

A sell trade can be opened immediately upon receipt of such conditions on a signal candle. At this moment, the presence of a downward trend is determined in the market. If the trend direction changes, namely when opposite conditions are received, the trade should be closed.

Conclusion

The Blau Stochastic Index indicator is a trading algorithm whose calculations are aimed at trend trading. Despite its effectiveness, the indicator is very easy to use, but this does not negate the preliminary practice on a demo account.