Welcome to the world of financial trading, where the unpredictable market often seems like an impenetrable maze. Here's where the moving average bounce trading strategy steps in, acting as a reliable navigator, offering the following benefits:

- Overlooking Temporary Volatility: The strategy shifts focus from short-term price movements, capturing the broader stock trend instead.

- Capitalizing on Bounces: The system allows traders to make strategic trades around the 'bounces' or rebounds of a stock's price.

- Maximizing Profits: This strategy guides traders to potentially profitable opportunities.

Unraveling the Mechanism of Trading Bounces Off Moving Averages

Let's take a closer look at what lies at the heart of this robust trading system:

- Average Trend Line: The system calculates the rhythm of a stock's price, its highs and lows, to create a trend line that mirrors the average price movement.

- Bounce-Based Trading: This average line aids traders in initiating trades around 'bounces' when a stock rebounds against its average direction.

- Versatility: This approach is applicable for both long and short trades and can be replicated several times throughout the trading day, making it a versatile trading tool.

Continue to read on for a more detailed understanding of this strategy and how to apply it effectively in your trading decisions.

Exploring the Concept of Trading Bounces Off Moving Averages

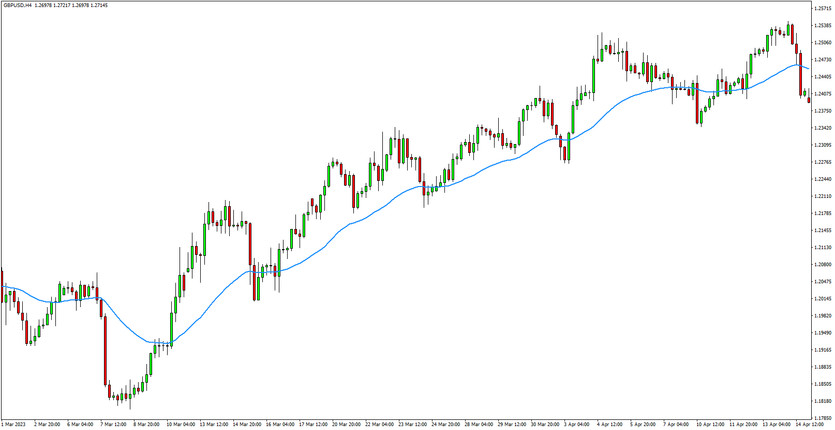

Stock prices tend to rise and fall during a trading session, but these movements typically stay within a certain range, thus generating an upward or downward trend. The moving average bounce trading strategy combines a short-term time frame with a single exponential moving average, with a focus on recent price activities. This dual setup aids traders in monitoring stock movements and aligning their trades with the bounces as they interact with the average trade line.

This strategy is applicable to both long and short trades, where the trader keeps an eye on particular indicators on a trading chart, then trades the stock as it veers away from, reverses, and eventually bounces off the moving average line.

In a long trade, the trader acquires a stock intending to sell it later at a higher price for a profit. On the flip side, in a short trade, the trader sells a stock at a specified price, planning to repurchase it at a lower price, thereby profiting from the price difference.

Diving deeper into the moving average bounce trading strategy reveals some interesting facets:

-

Following the Trend: During a trading session, stock prices tend to rise and fall but usually remain within a certain range, forming an upward or downward trend. The moving average bounce trading strategy effectively captures these trends.

-

The Short-term and the Exponential Average: This trading strategy combines a short-term time frame with a single exponential moving average. It puts more weight on recent price activities, providing traders with a detailed picture of market trends.

-

Bouncing Against the Average: This dual setup helps traders observe stock movements and time their trades around the 'bounces' as they interact with the average trade line.

-

Application Across Trade Types: Whether it's a long trade (where you buy a stock intending to sell it later at a higher price for a profit) or a short trade (where you sell a stock at a high price with the intention of buying it back at a lower price), this strategy can be applied effectively.

In the following sections, we'll take you through the operational mechanics of this strategy and offer insights into how you can implement it in your trading routine.

Operationalizing the Strategy of Trading Bounces Off Moving Averages

The moving average bounce strategy filters out short-term price volatility to reveal an investment's dominant trend and direction. The resulting smooth price line offers a visually pleasant view of the market scenario. When a strong price movement occurs, the line reverts back to the moving average before resuming its original direction. This bounce is what the moving average bounce trading strategy harnesses.

Typically, this strategy uses a one- to five-minute open, high, low, and close (OHLC) bar chart and a 34-bar exponential moving average of the typical price (high, low, and close, or "HLC"). These parameters can be adjusted to align with different market conditions. The default trading time coincides with the market's peak activity.

Implementing the Strategy of Trading Bounces Off Moving Averages

This strategy is versatile and can be applied as is, regardless of the markets you're trading in. Let's consider a long trade involving one contract, with a target of 10 ticks and a stop-loss of five ticks for illustration. The trader chooses the target and stop-loss based on their comfort level.

-

Open a Chart: Start by opening a one-minute OHLC bar chart for your market. This chart provides the necessary price information for the traded security, allowing you to visualize price movements.

-

Add an Exponential Moving Average: Incorporate a 34-bar exponential moving average of the HLC typical price into the chart. This moving average can provide insights into the underlying trend by smoothing out price fluctuations.

-

Wait for Price and Moving Average Divergence: Keep a close watch on the market and wait until the price drifts away from the moving average. This divergence signifies potential upcoming trading opportunities.

-

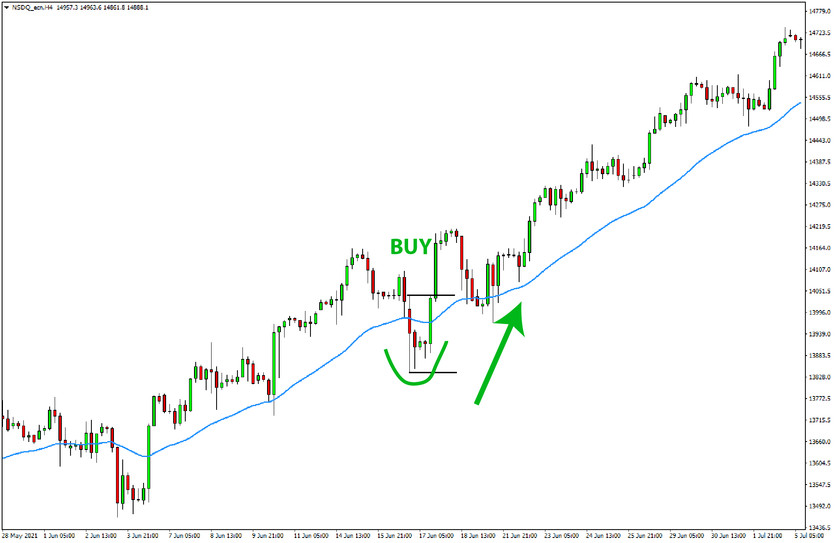

Wait for Price and Moving Average Convergence: Look for signs of the price reversing course and gravitating back toward the moving average. This convergence is a crucial event in the trading process, indicating that the price is likely to touch the moving average soon.

-

Wait for Price and Moving Average to Touch: Monitor until the price touches the moving average. This contact point is when the 'bounce' happens and is the ideal time to initiate your trade.

-

Enter Your Trade: Initiate your trade when the first price bar that fails to create a new low (or high) is broken. This signifies that the trend is likely to continue, and it's a good opportunity to make a trade.

-

Place Your Orders: Once your entry order is executed, ensure that your trading software has set your target and stop-loss orders. These orders help limit potential losses and lock in profits.

-

Wait for Your Trade to Exit: Hold on until the price hits your target or stop-loss, and one of these orders gets executed. The time it takes for your trade to reach your target or stop-loss can range from a few minutes to a couple of hours.

-

Repeat the Trade: Rinse and repeat the trade from step four as needed until you reach your daily profit target, or the market becomes less active. Persistence and repetition are key for this strategy to deliver optimal results.