Introduction to Iridium

Iridium is an esteemed worldwide mobile satellite communications business, offering services such as voice, data, and messaging to industries and government institutions all across the globe. Utilizing a powerful network of 66 low-Earth orbit satellites, Iridium ensures robust global coverage.

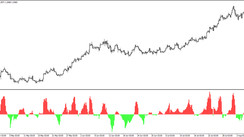

Routinely traded on the Nasdaq stock exchange, Iridium stock can be found under the ticker symbol "IRDM". While the value of these stocks has seen some decline in the past years, recent months have shown signs of a positive uptick.

Contemporary Challenges for Iridium

At present, Iridium faces a slew of tough challenges. These encompass:

- Intensifying competition from fellow satellite communications providers, including the likes of Inmarsat and Globalstar.

- The escalating expenses associated with the launch and maintenance of satellites.

- The necessity to channel investments into novel technologies in order to outpace competitors.

Nonetheless, despite these hurdles, Iridium remains a profitable entity with a healthy balance sheet. Moreover, the company is strategically situated to reap the benefits of the burgeoning demand for satellite communications facilities within maritime, aviation, and government sectors.

Predicting Iridium's Future

The trajectory of Iridium's future is unclear but several elements could potentially push its stock value higher over time. These comprise:

- The persistent expansion of the international satellite communications market.

- The creation of innovative technologies that could render satellite communications more cost-effective and widely available.

- The imperative need for dependable and secure communications in isolated locations.

Trading Strategies for Iridium

A range of strategies can be employed to trade Iridium stock. Some popular ones include:

- Long-term investment: An approach that focuses on purchasing Iridium stock and preserving it for an extended period, irrespective of short-term price instability.

- Swing trading: This method centers around acquiring Iridium stock when it is deemed undervalued and offloading it when its price is inflated.

- Day trading: A tactic that involves buying and selling Iridium stock within a single trading day to capitalize on swift price movements.

Evaluating Profitability and Risk

Investing in Iridium stock could potentially yield significant profits, but it is indisputably a high-risk proposition. Market volatility, global economic fluctuations, political unrest, and natural disasters can all impact the stock price. Prospective investors ought to evaluate the associated risks thoroughly and steer clear of investing funds they are not prepared to forfeit.

Analysts' Perspective

Various industry experts have proffered their opinions on Iridium stock's future. Some suggest that the stock is currently undervalued, and predict considerable long-term growth, while others caution against it, pointing out the inherent risks.

Conclusion

In essence, the decision to invest or refrain from investing in Iridium stock ultimately lies in the hands of individual investors. A thorough examination of one's personal finances and risk appetite should precede any investment decision.