Exploring the Volatility Smile: An Intriguing Concept

In the fascinating universe of financial theories and concepts, the volatility smile is one that stands out. This phrase refers to a distinctive pattern that arises when studying the realm of options trading. When we consider a series of options that have the same expiration date, the geographical pattern of their implied volatilities, plotted against the respective strike prices, forms an intriguing configuration. This configuration resembles a line that arches upwards at both ends, hence the evocative name, "smile."

Intriguingly, the presence of this smile-like curve contradicts the conventional logic presented by the esteemed Black-Scholes option theory. This pivotal theory in the field of financial mathematics assumes a flat volatility curve, making the emergence of the volatility smile a significant departure from established theoretical expectations.

Historically, the first notable manifestation of this interesting volatility smile was observed in the turbulent aftermath of the 1987 stock market crash - an event that left a lasting impact on the world of finance.

The Puzzle of Option Pricing: A Complex Conundrum

When it comes to pricing dynamics, options pose a greater challenge than their counterparts - stocks and commodities. The manifestation of the volatility smile is a testament to this complexity. To appreciate the unique character of an option's value, it's crucial to understand the triad of factors that shape it:

- The correlation between the strike price and the underlying asset: This involves assessing how the strike price stacks up against the value of the underlying asset. Is it higher, lower, or on par?

- The ticking clock – the time left until expiration: The time remaining for the option to mature or expire plays a significant role in determining its value.

- The expected ups and downs – the predicted volatility of the underlying asset: During the lifespan of the option, the anticipated fluctuations in the underlying asset's value significantly influence the option's value.

The bedrock of most option valuation models is the concept of implied volatility. This notion assumes a consistent level of volatility across all options of the same asset that share the same expiration date.

The Existence of Volatility Smiles: Several Hypotheses

Several hypotheses have been proposed to account for the existence of volatility smiles. The simplest, and perhaps most straightforward explanation, centers on the element of demand. According to this theory, options that are either in-the-money (ITM) or out-of-the-money (OTM) witness greater demand than those that are at-the-money (ATM).

Some financial pundits suggest that the advent of more refined options models has prompted OTM options to be priced higher. This pricing adjustment is designed to compensate for the risk associated with dramatic market crashes or unpredictable, rare events known as 'black swan' occurrences. This development presents a significant challenge to investment strategies that heavily lean on the implied volatility suggested by the Black-Scholes model, especially when assessing the value of downside puts that are significantly out-of-the-money.

Unraveling the Nature of a Volatility Smile

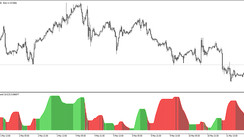

A volatility smile takes shape when you chart the strike price and implied volatility of a group of options that are tied to the same underlying asset and share the same expiration date. The resulting graph, bearing a striking resemblance to a smile, has hence earned its unique moniker.

A noteworthy feature of this volatility smile is the rise in implied volatility when the underlying asset of an option is either deep ITM or far OTM, in comparison to being ATM. It's important to remember, however, that this volatility smile phenomenon doesn't apply universally across all options, adding yet another layer of complexity to this intriguing subject.

Deciphering the Volatility Smile: What Does it Tell You?

The volatility smile delivers a unique insight into the dynamic world of option trading. It vividly illustrates how implied volatility shifts as the underlying asset swings more ITM or OTM. The deeper an option is in either territory (ITM or OTM), the higher its implied volatility soars. Conversely, options that are ATM or near-the-money typically exhibit the lowest levels of implied volatility.

Clash of Theories: The Real World Vs. The Black-Scholes Model

In the highly controlled environment of theoretical models like the Black-Scholes, the implied volatility curve maintains a flat appearance when juxtaposed against an array of strike prices. Based on this model, one would expect a uniform implied volatility for all options that share the same underlying asset and expiration date, irrespective of their strike price. However, the volatile and unpredictable sphere of real-world finance often defies these expectations, leading to intriguing discrepancies.

Volatility Smile in Action: Practical Implications

The practical value of the volatility smile becomes evident when comparing various options with the same underlying asset and expiration date but different strike prices. When you chart the implied volatility for each of these differing strike prices, the resulting pattern often takes the form of a U-shape — a pattern that, while not always perfectly symmetrical, certainly echoes the essence of a smile.

Distinguishing Between a Volatility Smile and a Volatility Skew

While near-term equity options and foreign exchange (forex) options are generally more inclined to align with the volatility smile, index options and long-term equity options often display a stronger correlation with the volatility skew. This term refers to a phenomenon where there is a higher implied volatility for options that are either ITM or OTM.

Beware of the Caveats: Limitations of the Volatility Smile

Despite its practical utility in options trading, the volatility smile does have its limitations. Firstly, it's crucial to verify whether the option in question truly conforms to a volatility smile. Secondly, other market factors such as supply and demand dynamics can distort the clean U-shape of the volatility smile. Lastly, it's essential to remember that while the volatility smile serves as a valuable guide for assessing higher or lower implied volatility, it should not be the sole factor relied upon when making options trading decisions.