Intraday trading is an exciting practice of buying and selling a variety of financial instruments within the course of a single trading day. This fast-paced world is occupied by day traders, who make use of technical analysis to decode short-term trends and market patterns. By opening and closing their positions swiftly, they intend to generate profit from these fluctuations.

The world of intraday trading is like walking on a double-edged sword. While it can bring hefty rewards, it can equally result in significant losses owing to market unpredictability. But what exactly is intraday trading, and how does it work?

Understanding the Mechanism of Intraday Trading

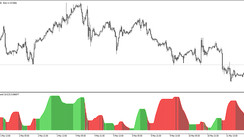

Intraday trading functions by capitalizing on the minute fluctuations in the price of financial instruments. These fluctuations are recognized and decoded using technical analysis, with the aid of a wide array of tools at their disposal.

These tools include Moving averages, Bollinger bands, Relative Strength Index (RSI), Stochastic Oscillator, and Fibonacci retracement levels. Coupled with trading strategies like scalping, day trading, and swing trading, these tools guide the trading decisions of intraday traders.

The Ever-growing Popularity of Intraday Trading

Intraday trading enjoys immense popularity primarily for its potential to yield high returns in a short span. Also contributing to its fame is its liquid nature. There are always willing buyers and sellers, facilitating easy trade execution. Additionally, intraday trading does not demand a particular location; as long as you have an internet connection, you can trade from anywhere.

Go-to Indicators for Intraday Traders

The choice of ideal indicators for intraday trading is subjective, varying as per individual preferences and trading styles. However, a fair share of popularity is enjoyed by Moving averages, Bollinger bands, Relative Strength Index (RSI), Stochastic oscillator, and Fibonacci retracement levels.

Ideal Financial Instruments for Intraday Trading

Assets with high liquidity and volatility are the prime choices for Intraday trading. These attributes ensure the availability of buyers and sellers and significant price movements during the trading day. Stocks, currencies, futures contracts, options, and commodities are some of the most popular choices for intraday traders.

The perception of intraday trading is not unanimous among traders. While some experts label it risky, reserved for experienced traders, others consider it a lucrative trading choice as long as one respects discipline and risk management principles.

If you contemplate venturing into intraday trading, it is essential to do comprehensive research and fully understand the associated risks, devise a concrete trading plan and adhere to it.

Successful Intraday Trading Practices

Before diving into actual trading with real money, use a demo account to practice your skills. Begin by investing a small amount and gradually enhance your investment with experience. Always use stop losses to confine your losses, and don't hesitate to cash in your profits when you're satisfied with your gains.

Wrapping Up

Intraday trading is a complex, risky, yet potentially lucrative trading avenue. Ensure you do adequate research, understand the associated risk, and have a robust trading plan in place. Although intraday trading can be profitable, it is never devoid of risks. If you are uncomfortable with the inherent risks, intraday trading may not be for you.