US Dollar Fundamental Outlook: USD Reverts to Downtrend; Attention Centered on Georgia Runoff Elections

The Santa USD rally is over, and the currency is hitting fresh cycle lows on the first trading day of the new year. The bearish dynamics remain firmly in place for the dollar, namely a broad risk-on environment supported by vaccine and stimulus optimism.

The key event that traders will watch this week is the Georgia runoff election for the remaining two Senate seats. It is a crucial vote because the Democrats can potentially gain control of the Senate if they win the two seats. Such an outcome should keep the USD bear trend firmly in place. On the other hand, a Republican win may spur a dollar rebound on a negative risk-off reaction. This draws on the assumption that Joe Biden will have a harder time to deliver bigger fiscal stimulus with a Republican-controlled Senate.

The other closely-watched event this week will be the Non-Farm payrolls report on Friday. This has been a historically very important event in the Fx market but has taken a back seat since the corona crisis started. Barring large surprises in the actual data from the forecasts, we can expect minimal impact on the USD from the event.

Euro Fundamental Outlook: A Quiet First Week for the Common Currency

The euro currency is kicking off 2021 on a strong footing. It is up today versus all its peers among the 8 major currencies. The rate of spreading of COVID-19 is down in the Euro area significantly from the November peaks. In this sense, the Eurozone is once again leading the race against the United States in fighting the pandemic, which sets the stage for the European economy to outperform in 2021.

Furthermore, vaccinations should help to support risk appetite further, which should help the euro to appreciate versus the US dollar and other safe-haven currencies in the following months. The EUR calendar for this week is relatively light and only features the PMI services and manufacturing reports (less impactful final release). Therefore, the broader trend dynamics should continue to be the main driver of EUR price action this week.

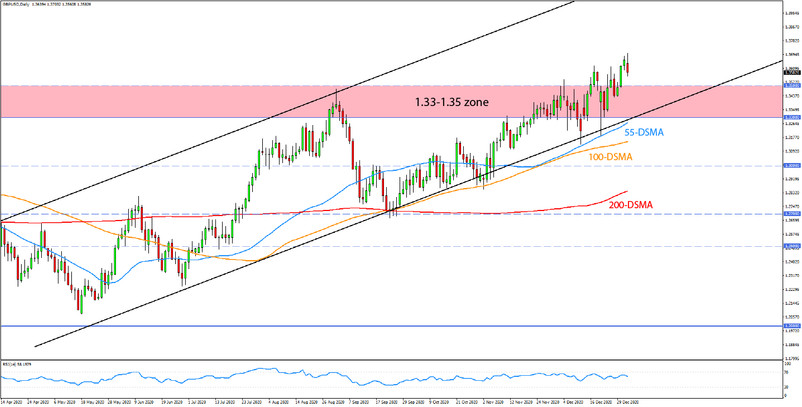

EURUSD Technical Outlook:

EURUSD closed in the red on December 31, but tested the 2.5 year highs again today. While the uptrend remains intact, there are some warning signs that a correction may be coming soon.

For instance, the pair didn’t break sustainably above the previous high from December 17. Also, the tall red candle on December 31 was a strong bearish engulfing candle pattern from a technical point of view. Moreover, the RSI is showing bearish divergence between the last two highs.

The rising trendline that hasn’t been broken yet is the last pillar that supports EURUSD higher (see chart). A bearish break of this trendline would likely trigger a deeper correction, with 1.20 being the probable target to the downside. On the other hand, if EURUSD can sustainably break above the most recent highs, then it will clear another hurdle on the way toward 1.25.

British Pound Fundamental Outlook: Cliff Edge Brexit Avoided; EU-UK Trade Deal Spurs GBP Rally

Pound sterling is celebrating the last-minute Brexit deal that saved the EU and UK from an automatic January 1 tariff hike. However, as was widely expected, the deal is only modest, and so is GBP’s rally following the announcement two weeks ago.

Nonetheless, the positive mood from the deal should support some further gains in GBP over the near-term, versus the euro and especially against the US dollar. This means GBPUSD can still appreciate to 1.38 or higher, and EURGBP can decline toward 0.88.

The uneventful GBP calendar this week features no market-moving data.

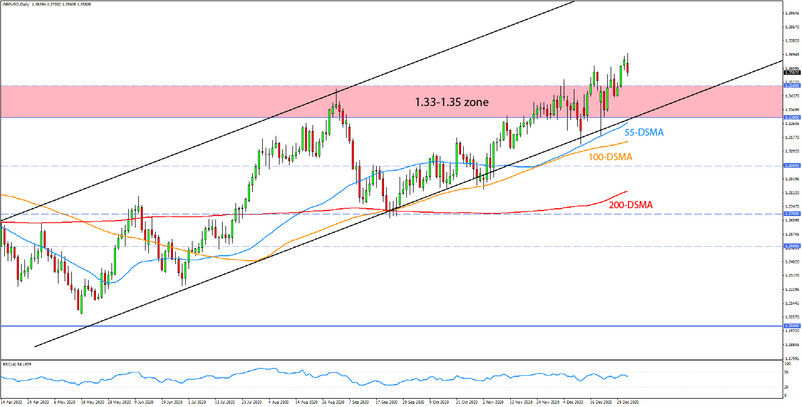

GBPUSD Technical Outlook:

GBPUSD is moving above the crucial resistance in the 1.35 area. The key question now is whether cable can sustain levels above 1.35.

The ride up hasn’t been all smooth, as the chart below shows. Previous attempts at the resistance, or even breakouts were reversed lower. However, the last few attempts to go back below this 1.35 technical zone were rejected. Judging by the price action, the last push higher seems to be of a more solid nature. This suggests further gains are possible for GBPUSD and there is no resistance higher until the 1.38-1.40 area.

Japanese Yen Fundamental Outlook:

The yen remains neutral in broad terms and still largely tracks the movements of the US dollar. USDJPY is moving gradually lower, though, reflecting a stronger JPY vs the weak USD.

These dynamics are likely to stay in place for the time being. Namely, JPY should remain a laggard versus risky currencies as long as risk appetite remains supported.

Another aspect that traders are watching is the 100.00 level, which seems like a pivotal level for the Bank of Japan. Rumor is that the BOJ may be uncomfortable to see USDJPY move below this level, so traders will be closely watching if the price comes near this level.

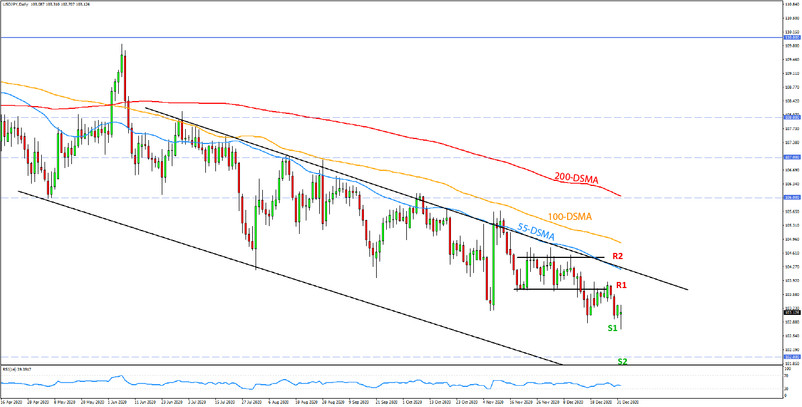

USDJPY Technical Outlook:

USDJPY continues to play with the 103.00 level but can’t sustain prices below it. While this may be an indication that a bounce is coming, at the same time, USDJPY is trading firmly inside the downward channel that was established following the onset of the corona crisis last spring..

The overall downtrend, therefore, is intact. However, the gradual action is not giving too many tradable opportunities in this environment. Aiming to sell into rallies at important technical zones may prove as a profitable strategy in this situation.