US Dollar Fundamental Outlook: Democrats win Georgia for Control of Senate; USD Corrects Higher on “Buy the Rumor Sell the Fact”?

The USD strengthened in the second part of the past week as it previously reached a peak following the Democrats’ win in the Senate runoff election in the state of Georgia. The victory secured Senate control for the democrats, and the expected reaction was for a weaker USD. Several factors may have caused the USD rebound on Thursday and Friday, but the prime suspect is a “Buy the Rumor Sell the Fact” activity. A lot of bad news was already priced into USD, so some profit-taking surely is playing a role in this correction.

Perhaps justifiably, the markets shrugged off political mayhem in Washington, where Trump supporters broke into the Congress building. The situation was defused relatively quickly and Trump conceded that he would peacefully transfer power to Biden. There was no substantial risk-off reaction in stocks or other markets.

The NonFarm payrolls report was notably worse than the consensus forecasts, spurring the Friday risk-off reaction and probably helping the USD’s bounce. While stocks recovered, the greenback’s correction is extending into the current week, making a sentiment shift more likely. Traders are still extremely bearish, so if the dollar keeps advancing this week, some traders will liquidate their positions, which can fuel the upside correction further. While the USD long-term downtrend remains intact, currently, the correction has scope to extend on this basis.

The calendar for the week ahead features the CPI inflation report on Wednesday and the retail sales on Friday. Several Fed Presidents will also speak throughout the week, who may grab the main attention of traders. If Chair Powell and the other FOMC members aren’t as dovish as markets expect, more USD strength is likely to follow.

Euro Fundamental Outlook: EU Lagging the Vaccine Race; Uneventful EUR Calendar This Week

On the European continent, much less was going on last week compared to the US. Vaccinations have started, although the EU is currently behind the UK and the US in the pace of delivering the jabs. Other than this, traders remain mainly focused on the long-term picture for the euro, which should keep the currency supported on a broad basis. The stretched long-positioning and some technical factors, however, may compel a EUR corrective move lower, particularly vs the dollar.

The EUR calendar is scant of market-moving events and, aside from some 2nd tier economic data, only features the ECB Meeting Accounts (also known as ECB minutes) on Thursday. Given the extended positioning and the potential for a short-term sentiment shift, traders may decide to reconsider some views and scale back on positions.

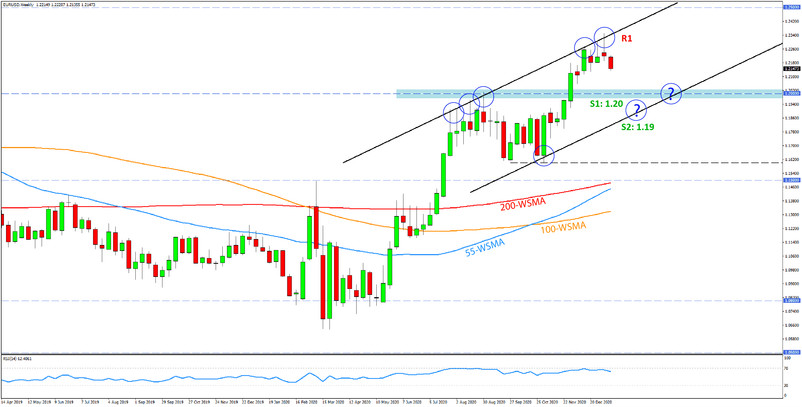

EURUSD Technical Outlook:

Much as we flagged in our Fx weekly analysis last week, EURUSD broke the support trendline and the floodgate for further downside correction was opened. While this downside correction may go all the way to 1.20, it won’t happen in a straight line. Rather, it’s much more likely that we’ll see some zig-zag swings to the downside on the weekly chart or even plain choppy consolidation.

On the chart below, we highlight a potential (possible but unconfirmed) slope of the EURUSD uptrend. As can be seen, the resistance trendline was confirmed with last week’s rejection. The projected parallel support trendline suggests 1.20 is easily within reach if this correction unfolds as expected.

Aside from the obvious 1.20 support, 1.19 is also likely to prove a big hurdle for sellers to break if EURUSD declines that far. To the upside, the 1.23 area and the 1.2340 high is now the confirmed resistance.

British Pound Fundamental Outlook: UK Leading in Vaccine Rollout but Surging Numbers of New Infections Keep GBP Pressured for Now

The UK was the first country to start coronavirus vaccinations and is now a leader in the race with the highest percentage of vaccinated population in the world thus far. Eventually, if everything goes well with the vaccination program, it should be a positive for GBP because the UK service economy will be able to open up completely before other nations.

However, infections with the new strain of COVID-19 are skyrocketing in the UK, and that seems to be a drag on GBP in the very near-term. The encouraging news is that officials are confident the vaccines are effective against this variant of the virus as well, so the overall GBP prospects remain positive once this outbreak is put under control.

On the GBP Forex calendar, the focus is on the UK’s GDP release this Friday, where traders will look for the scope of economic damage from the harsh lockdowns during late autumn. A better than expected GDP number may offer some support for GBP; however, the currency will likely need a bigger mix of positive factors to find its feet again and start climbing.

GBPUSD Technical Outlook:

GBPUSD had the first red week in a month and is also falling today. But looking at the weekly chart, there are reasons to remain optimistic.

Importantly, GBPUSD broke above the 1.33 – 1.35 resistance band. The price is now merely coming back to this range from the other side, which may end up being only a retest before continuing higher again. Another factor in favor of such a view is the rising trendline that is supporting GBPUSD higher since May of last year. The trendline stands around the 1.33 level, which makes it a critical support to hold. As long as 1.33 holds, this uptrend here remains intact.

To the upside, the 1.37 high is now modest resistance.

Japanese Yen Fundamental Outlook: JPY Not Budging Much While USDJPY Fixed in Sideways Mode

Nothing unusual is happening with the Japanese yen as domestic drivers of the exchange rate are almost non-existent. The BOJ is keeping yields fixed with the YCC policy, and no big monetary or fiscal policy changes are on the horizon over the near or long term.

The yen, thus, continues to track movements in US yields and the US dollar, with the USDJPY firmly fixated in tight ranges. Nonetheless, JPY will still oscillate against its other peers, and shifts in risk sentiment will continue to be a primary driver for the Japanese currency.

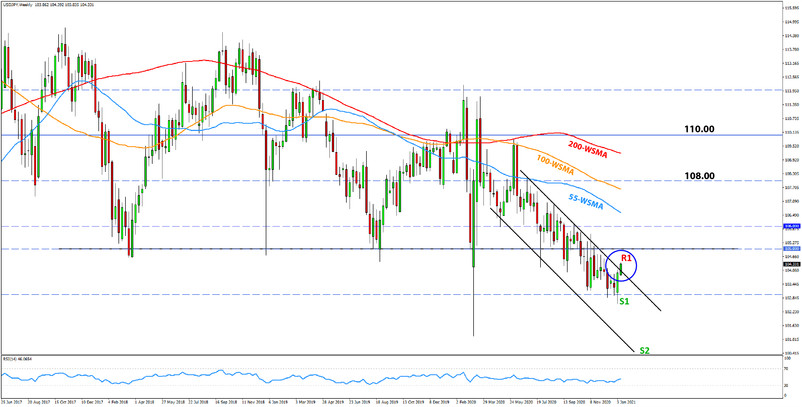

USDJPY Technical Outlook:

USDJPY recorded a “good-looking” bullish engulfing pattern with the close of the past weekly candle and is now making a breakout attempt on that falling resistance trendline that has kept the downtrend in place for seven months. Whether it breaks higher or the resistance holds is the key question for USDJPY traders right now.

While the resistance trendline stands closer to the 104.00 – 104.50 area, the 105.00 zone still seems like the key resistance that needs to be cracked to really open up the upside potential. Under a bullish scenario of a strong momentum close above 105.00, there will be no big resistance until the 108.00 area.

In a bearish scenario where the resistance holds, the 102.50 low is the nearest moderate support. The main focus in this case, however, would be on the 100.00 technical area.

Don't Miss: Yearly Forex Forecast Of EUR/USD, GBP/USD, USD/JPY (Fundamentals&Technicals) See it Here 100% FREE