US Dollar Fundamental Outlook: Expecting Volatile Trading with Focus on Fed Meeting, Q4 GDP, and Biden’s $1.9 Trillion Stimulus Plan

An eventful USD calendar almost guarantees a busy trading week in the Fx market. Wednesday’s Fed meeting will be front and center, although no big announcements or policy changes are expected. Traders will still closely watch the Fed’s communication, especially the press conference with Chairman Powell, for clues on the future course of policy. The pace of QE purchases will remain unchanged, but some FOMC members in recent weeks talked about possible paths to tapering, so perhaps Powell can offer more clarity on that. It is this part of the presser that can induce the most volatility in markets and the one that we need to watch closely.

Of note is also the still stretched USD short positioning. If these positions are squeezed out, the dollar can stage a solid rebound, most probably taking EURUSD below 1.20. That won’t happen without a decent catalyst, but maybe this week’s busy schedule can provide the very trigger to extend the USD rebound in what would be a “healthy” correction in this extremely shorted market.

On the economic data front, Thursday’s GDP release will receive the main attention. CB Consumer Confidence is out on Tuesday, while the PCE deflator price index and the Chicago PMI will be reported on Friday. The less stringent pandemic restrictions in the US than in Europe and some other countries have likely helped the US economy stay on a better footing. This is another factor that can lend support for the USD, especially also because the US is faster and more effective with vaccinations than, i.e., Europe and other countries.

Developments with Joe Biden’s $1.9 trillion USD stimulus plan will also be closely watched. If the Biden administration faces an uphill battle to pass the bill, risky assets may correct lower, which would be bullish for the dollar. Overall, there are many two-way risks this week. Positioning continues to favor a better risk-reward on tactical USD long positions than trying to chase the market lower here at oversold levels.

Euro Fundamental Outlook: Friday’s GDP Data in Focus as EUR Longs Look “Heavy”

The euro remained resilient last week as business sentiment indicators showed the economy likely didn’t contract in Q4 as deeply as initially feared. Furthermore, Italian political turmoils were somewhat mitigated as Prime Minister Conte survived the two confidence votes in the Italian Parliament. Helping to keep the euro stable, ECB’s President Lagarde also didn’t express any worry about the euro’s recent appreciation at the press conference last week.

Yet, despite all these relatively EUR positive factors last week, the currency is still almost 200 pips lower from the 1.2350 peak against the dollar. Perhaps the fact that the actual Q4 GDP data is not known yet (due on Friday) and that Italy’s Conte has to face another confidence vote this week are keeping EUR bulls at bay. Or, the EUR staying off the highs is a telling sign that the consolidation or correction probably has further to run here because what doesn’t go up on good news will probably go down on bad news.

How deep exactly was the economic contraction during Q4 will be shown in the GDP data that the Eurozone reports on Friday. The euro is at risk of a sell-off if the numbers miss the forecasts but could also rebound if the actual data is stronger than what the forecasts predict.

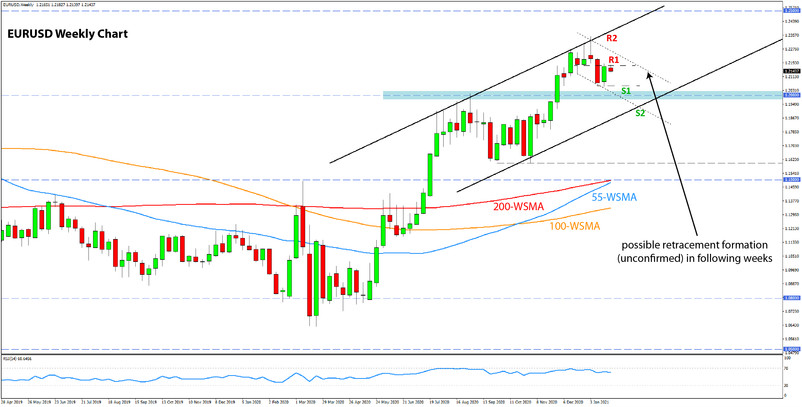

EURUSD Technical Outlook:

EURUSD closed the past week in the green, but the bullish candle stayed below the 1.22 level. Slightly higher, the 1.2250 level looks like the line in the sand between bullish and corrective (bearish) sentiment on the pair.

The whole area between 1.2200 and 1.2250 will likely act as a resistance zone. A close above it will signal that EURUSD may be ready to make an attack on new cycle highs. On the other hand, as long as the price stays below this 1.2200-1.2250 zone, EURUSD stays in corrective “mode.” That means another bearish leg with a lower low is a real possibility.

On the chart below, we have shown a potential scenario of how that could look like. Note the major 1.20 support area is highlighted in blue.

British Pound Fundamental Outlook: Some Mixed Factors Are Limiting GBP’s Potential

As we expected, the pound traded with a bullish sentiment last week, although it didn’t break any milestones to the upside. Instead, the currency reversed a large part of the gains after the big disappointment in the flash (preliminary) services PMI report, which came at 38.8 versus the 45.2 forecast.

GBP may take a pause now while traders reassess the outlook on the pandemic and the economy. Sterling strengthened notably in recent months due to the positive resolution on Brexit and is currently receiving some support from the UK’s fast vaccine rollout. However, the effects of the strict lockdowns imposed in December are taking a big toll on the economy. Hence, for the time being, the outlook on GBP is mixed, and that’s exactly how the currency may trade in the following days and weeks.

UK employment data will be released tomorrow, but other than that, the GBP Forex calendar is absent of market-moving events.

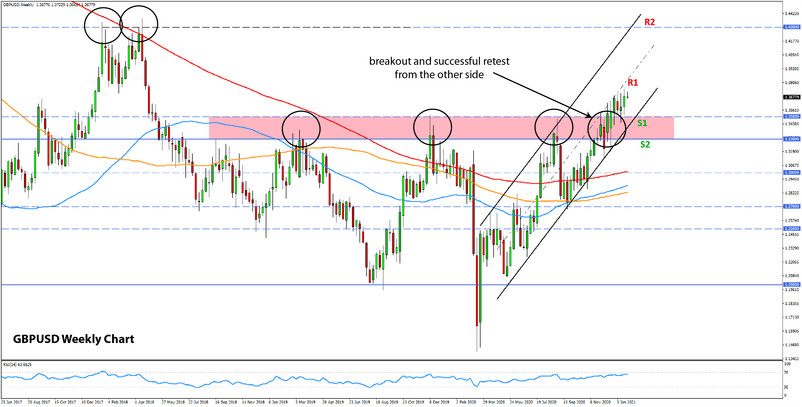

GBPUSD Technical Outlook:

GBPUSD continues to “dance” on the mid-channel trendline without breaking higher or correcting lower. The potential for a rally to the 1.40-1.42 area is there, but GBP bulls are struggling to push the pair above this rising mid-channel trendline.

Nonetheless, the technicals remain bullish here after that solid breakout above the 1.33-1.35 resistance zone. It is now acting as support, and GBPUSD should stay above it if this trend is going to progress higher. The several successful retests of this 1.33-1.35 technical zone suggest that, indeed, this support will hold.

Japanese Yen Fundamental Outlook: The Dollar Leads the Way, JPY Follows

There isn’t much to add to our comments from last week’s analysis post regarding the JPY’s outlook. USDJPY was again stuck in a very tight range for the whole week - this time only 75 pips - and closed exactly where it opened. Essentially, USDJPY is acting like the yen is pegged to the dollar, and it’s hard to say for how long this sideways range will persist.

Longer-term, the JPY should be an underperformer in the currency space in what is expected to be a year of a broad risk-on rally. That JPY trend will be more evident versus high-beta risk-sensitive currencies such as AUD, NZD, CAD, and emerging market currencies.

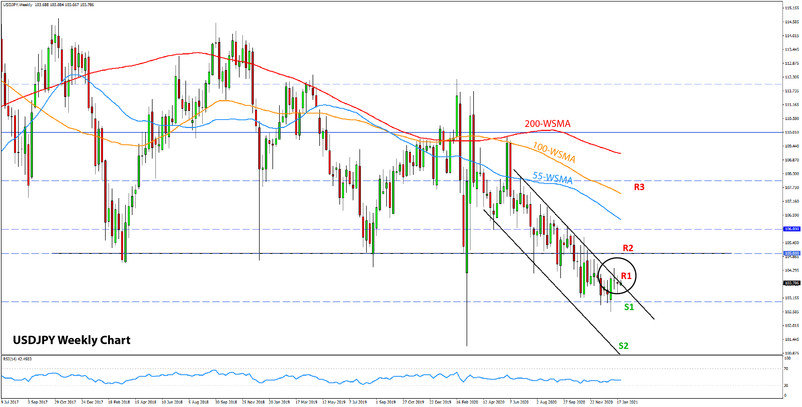

USDJPY Technical Outlook:

USDJPY continues to consolidate just below the resistance trendline of that 7-month downside channel (see chart below). The bullish candle that was recorded on the first trading week of the year keeps the tone slightly bullish, but the resistance is also strong. Hence, USDJPY remains stuck between the 103.00 lows support and the falling trendline’s resistance, which currently stands around 103.70.

We can suggest that a breakout in either direction may offer some larger follow-through moves, but USDJPY’s price action in recent years has been anything but usual. Breakouts didn’t often lead to large continuation moves. It won’t be a big surprise if that happens again.

Nonetheless, a bullish or bearish breakout will still set the tone for how USDJPY would trade. So, these technical zones are worth keeping an eye on.

Don't Miss:Yearly Forex Forecast Of EUR/USD, GBP/USD, USD/JPY (Fundamentals&Technicals) See it Here 100% FREE