US Dollar Fundamental Outlook: Modest USD Strength Within a Broader Consolidation?

The dollar ended the past week stronger, albeit the recent rally looks more like consolidation than a trend. For instance, the USD advanced higher Monday to Thursday last week, but it was cut short on Friday.

It is easy to blame last Friday’s reversal on the Nonfarm payrolls report, however, we would argue against that narrative. Instead, the Friday rejection smells more like an overdue reaction to dollar strength that came within the context of an overtly bearish dollar market. After all, NFP job gains disappointed only marginally, and the unemployment rate surprised positively by 0.4%. You can’t argue that is so bad for the dollar. The recent moves in USD and, i.e. the EURUSD pair, therefore, suggest we have probably entered a consolidation phase that can last for weeks or months. That consolidation, though, is likely to play out with a moderately bullish USD (stronger dollar) tone. Let’s see if we are proven right.

This week’s highlights on the USD calendar are the CPI inflation data and Fed Chairman Powell’s speech on Wednesday. No big surprises are expected around those two events, but they can certainly induce some volatility in USD pairs, especially if the release time coincides with some important technical levels on the charts. Overall, the USD should trade with a modest bullish tone this week too, but nothing more than that.

Euro Fundamental Outlook: EUR to Be an Underperformer as EU Lags the Vaccine Race?

As we have been warning for several weeks already, the extreme bullish EUR sentiment was ripe for a correction if some long euro positions were to be liquidated. That has indeed transpired to a degree last week, helping the downside correction in EURUSD too.

Perhaps the fact that the EU is clearly lagging behind other developed countries in the vaccine race has triggered the recent EUR weakness. However, despite the shift in sentiment from extremely bullish to neutral, we have to remember that we are coming here from what was a robust EURUSD and also a general EUR uptrend. Those EUR bulls will not give up easily, and perhaps this argument was most evident in the strong bounce last Friday.

On the calendar this week, the focus is on the economic forecasts released by the European Commission on Thursday. Traders will watch if EU economists will cut their growth projections for this quarter due to the winter lockdowns. This could prove another headwind for the euro if they do so. Eurozone industrial production reports will also be released this week.

On balance, the euro fundamentals are currently much less favorable than they were last year. The slower rollout of vaccines will likely delay the recovery in the Eurozone compared to other countries. In turn, the means that the ECB will have to stay dovish for longer, putting a lid on the euro for the time being.

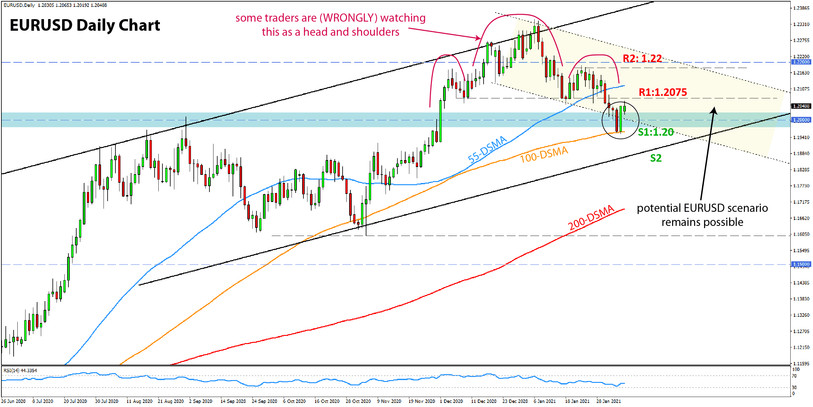

EURUSD Technical Outlook:

EURUSD is so far following our base case scenario that we described in last week’s analysis, albeit not exactly (you can find that post here). While EURUSD rebounded at the 1.20 support zone as we expected, it firstly fell all the way down to 1.1950 before rebounding above 1.2050.

Still, as you probably know, technical S/R zones are not exact levels, and this type of price action is not surprising, especially at such a sensitive area on the chart. So, with the rebound now confirmed, it seems EURUSD will follow our base case scenario and gradually move higher from here. However, expect strong resistance to kick in at 1.22, which should hold off the advance.

It’s worth mentioning that initial resistance lies close to current levels, at around 1.2075. Some analysts would regard this as the neckline of a successful head and shoulders pattern. However, we would like to note that this pattern, while closely resembling a head and shoulders, doesn’t meet the classical definition of this pattern. Nonetheless, it could still work, and the projection of its “head” is some 280 down from the breakout point, which puts the target at the 1.18 zone. For this scenario to remain a possibility, the 1.2075 resistance mentioned above needs to hold.

British Pound Fundamental Outlook: BOE Dismisses Negative Rates, GBP Soars

GBP was an outperformer last week as the Bank of England made it clear they don’t intend to use negative interest rates in the near future. GBP/USD surged by 100 pips on the announcement, while EURGBP fell by 60 pips. Adding the successful vaccination program into the mix, it seems that the stars are aligning increasingly in favor of the British pound.

As of Monday, February 8, over 12 million people in the UK had received the first shot of a COVID vaccine. By February 15, that number is expected to stand at 16 million or around 25% of the total UK population. At this pace, the UK is well on its way to declare victory over the pandemic by mid-spring. That means the economy could fully reopen as early as April, which is probably much sooner than any other developed country. This is likely to prove a huge advantage for the pound sterling in the following weeks and months as the UK economy will practically have the upper hand over its peers.

Perhaps the fast vaccine rollout gave the Bank of England the confidence to dismiss negative rates at their meeting last week. Whatever the reason, it was a risk that has been removed from the GBP outlook and a clearly bullish development for the currency. With Brexit done with a deal, the threat of negative rates almost gone, and an economy set to rebound strongly because of a fast vaccine rollout, there is little that stands in the way of more GBP strength at this stage. The currency should continue to benefit on a broad basis, including against EUR and USD.

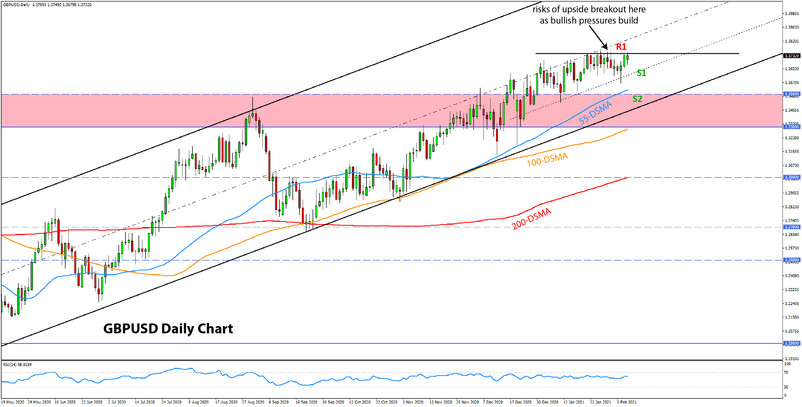

GBPUSD Technical Outlook:

GBPUSD continues to follow the trend of recording higher highs and higher lows on the daily and weekly charts. Taking all into consideration, it seems the technicals support what the fundamentals are saying.

With the big 1.33-1.35 resistance zone being broken and then retested several times from above, it seems the road to higher levels for cable is getting clearer. The only hurdle is the moderate resistance at the late January highs around 1.3750. The risks seem to be tilting toward an upside acceleration from here, particularly after the strong bounce last Thursday.

To the downside, support at the 1.36 zone should hold to keep the uptrend firmly intact. Lower, the more important support remains at the 1.35 zone.

Japanese Yen Fundamental Outlook: JPY Remains Weak as USD/JPY Holds Above 105.00

The JPY played along in Friday’s dollar sell-off, but it remained a laggard in general terms when compared to the ten major currencies in Fx. As we discussed in our past editions of the weekly analysis, without a specific domestic factor to support it and in a broad global risk-on environment, JYP is likely to be an underperformer.

In the meantime, US yields continued to advance last week, as another factor that is known to drag USDJPY higher. The pair will remain a key barometer for overall JPY performance, with the 105.00 level remaining the pivotal make or break point. If USDJPY continues to climb higher, it will likely be a sign of general JPY weakness, especially if the USD resumes its downtrend.

USDJPY Technical Outlook:

USDJPY is getting more interesting now that it is trading above 105.00. Still, it didn’t take long for the pair to hit a roadblock and start coming down. The strong rally last week stalled at the 200-day moving average (red line) and is falling further today.

The first support on the way down is expected to be at the obvious 105.00 level. If that fails, a cluster of recent highs stands in the 104.30 – 104.50 zone.

To the upside, resistance has been confirmed at the 105.50 zone around the 200 DMA. Higher, the 106.00 zone may also act as resistance as there are several previous highs there.