US Dollar Fundamental Outlook: Powell Shrugs Off Rising Treasury Yields, Giving Green Light to USD’s Rally

The greenback extended the rebound last week, particularly the move accelerated after a speech by Fed Chairman Jerome Powell in which he shrugged off the recent rise in Treasury yields. Dollar bears, and investors in general, were hoping that Powell will at least be concerned by it and hint at some easing response by the Fed. Powell’s disregard of rising bond interest rates instead triggered a surge in the USD versus all other major currencies and a slump in assets such as stocks and commodities.

The much better than expected NonFarm Payrolls and unemployment reports powered the USD rally to new local highs and will likely continue to support it into this week as well. In the meantime, the US Senate passed Biden’s $1.9 billion stimulus bill over the weekend. But the markets seem unimpressed so far as this was expected for many weeks before.

The CPI inflation reports are the focus on the USD calendar this week, where economists expect a notable uptick in the y/y rates. Still, this and other economic data is likely to take a backseat to the rise in Treasury yields and the dollar, which are the most important theme for markets at the moment. We were anticipating a USD rebound for some time, especially because of the extremely crowded short positioning. The unwind process of those short positions has only begun, which is another factor that should help fuel an extension of this dollar rally.

Euro Fundamental Outlook: ECB Starting to Feel the Pressures of the “EU’s Vaccine Lag,” EUR to Follow Suit too

The ECB meeting on Thursday is the focus for this week in the Fx market. Effectively, the ECB can “break” the euro by providing a catalyst for key technical levels in EURUSD to fall. While consensus expectations are for a neutral ECB at this meeting, there is a chance that they might prepare the markets for more easing later in the year. If that happens, EUR would likely plunge lower. On the other hand, if President Lagarde is unconcerned – much like her colleague Powell at the Fed - then we can expect a neutral and rather muted reaction in the markets.

The EUR calendar for this week features a range of other economic data, though none that can impact the markets in a great way. Forex traders are firmly focused on the narrative that the EU is “way behind” in the vaccine race compared to the US and the UK, and that dominating theme should continue to pressure the euro versus the dollar and pound sterling.

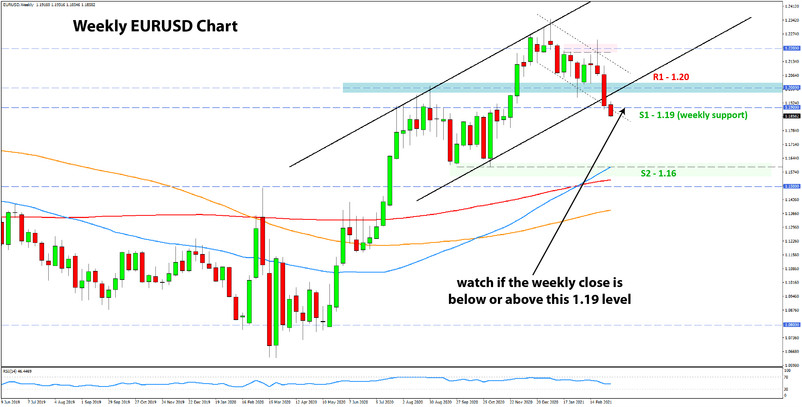

EURUSD Technical Outlook:

Having closed the past week almost at the 1.1900 level, EURUSD is testing the limits of the bulls already on the first day of the new trading week. We should keep in mind that the 1.19 level represents the lower end of the 1.20 support area that we previously described as pivotal for the uptrend. Tests below 1.19 are possible (and have already happened), but the weekly close on Friday will matter for what happens with EURUSD.

With that said, the pressures are building, nonetheless. If the bears prevail here and take EURUSD through 1.19, then the road toward the next major support area will be clear. That area is at the September/November 2020 lows in the 1.16 price zone. Given the proximity of the 1.15 psychological level (in which proximity the 200-week moving average stands), we can view this support zone as 1.15 – 1.16.

The nearest key resistance to the upside is the former support at the 1.20 level.

British Pound Fundamental Outlook: GBP Uptrend on Pause, but Far From Over Yet

Pound sterling has declined some 400 pips off the highs against the US dollar, but the consolidation hasn’t been that steep versus other currencies. EURGBP is trading near the February lows while GBPJPY and GBPCHF reached a new cycle high last Thursday. It seems GBP bulls are very much alive, and only the recent dollar strength has played a role in taking down the GBPUSD pair.

The GBP calendar has another relatively “quiet” week, with no major events or economic data scheduled. The focus will remain on the longer-term factors that underpinned the GBP rally. That is mainly the UK’s advantage from being a leader in the COVID vaccination race, which should eventually propel GBP higher again.

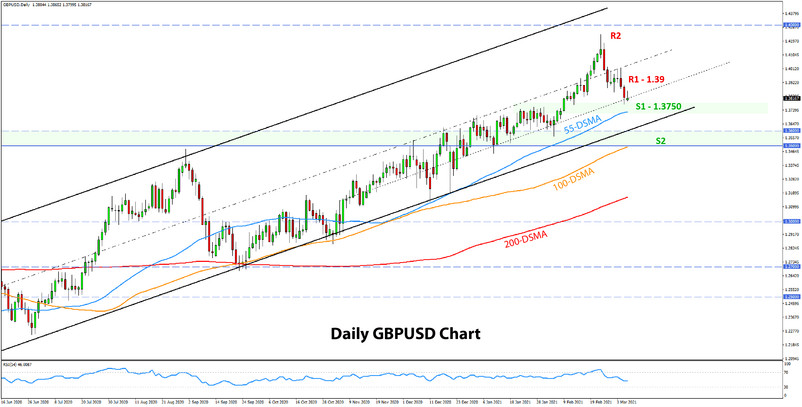

GBPUSD Technical Outlook:

GBPUSD stayed below 1.40 and extended the decline last week. The peak at 1.4240 resembles a blow-off top, which suggests we need to see some stabilization of the sell-off first before thinking about establishing new longs.

The pair has reached the 1.38 level and is currently near to the 1.3750 support we described in our previous weekly analysis posts. The 55-day moving average is also in this area of support. Some bounce can be expected here, though more convincing reversal signals will be needed to confirm a turn and resumption of the uptrend here.

Resistance to the upside is at the 1.39 and 1.40 levels.

Japanese Yen Fundamental Outlook: Safe-Haven JPY Remains One of the Weakest Major Currencies

The yen resumed its slide last week, together with other safe-haven currencies and assets. The decline was most evident against the surging US dollar, with the USDJPY pair finishing the week above the 108.00 level.

The factors driving the JPY lower are the same that we discussed in recent weeks. US Treasury yields continued to rise, but risk sentiment remains sanguine, with almost no decline in stock markets. Well-supported risk sentiment driven by vaccine efficacy and recovery optimism combined with increased USD attractiveness due to higher US bond yield is a bad cocktail for safe-haven assets. While the JPY weakness already seems stretched, it will hardly reverse before those underlying trends reverse.

USDJPY Technical Outlook:

The technical situation on USDJPY has turned from bullish to more bullish. Namely, the pair broke out of the ascending channel formation by accelerating higher. Such a development on the charts is usually a strong indication of a healthy trend.

The 110.00 area looks within reach now, where USDJPY is likely to encounter resistance. However, it’s hard to bet in this situation that the resistance will hold, let alone stop the uptrend. An Elliott wave count of the recent bullish legs suggests we are in wave 3 of an extended wave 3 with more bullish legs in store.

In either case, how USDJPY reacts with that 110.00 resistance will be important. If it breaks through, then the path to 112.00 or higher will be clear of obstacles. To the downside, the nearest support from current levels is 108.00. Stronger support remains at the old highs around 106.00.