US Dollar Fundamental Outlook: Busy Calendar Should Confirm USD Bullish Momentum

The new week kicks off quietly but will get busier from Wednesday onward. The main focus will be on Friday’s jobs data, including Nonfarm Payrolls and the unemployment rate, and on the IMS manufacturing PMI survey, which will be out on Thursday.

The general expectations are for both the jobs and IMS data to come out very positive, confirming the US economy’s strong momentum. The unemployment rate is forecasted to have declined further to around 6%, with robust NFP job creation of over 600k. Many economists expect even higher numbers, so positive surprises for the NFP number seem probable on Friday.

All of this suggests that the USD bullish momentum has more legs and is likely to take the currency further higher. The US economy is once again in a much better shape than its peers thanks to the speedy vaccination program and the massive stimulus from Congress and the Fed. Much like during 2018 and 2019, US assets look the most attractive, which means capital will flow to the US from other parts of the world. This should keep the US dollar supported and possibly take it to a new cycle high this week.

Euro Fundamental Outlook: EU’s Vaccine Strategy Is a Disaster; EURUSD Likely to Fall Even Lower

In Europe, Fx traders will closely watch the preliminary (flash) CPI inflation reports which will be published on Tuesday for individual EU countries and on Wednesday for the whole Eurozone. Expectations are for prices to edge up to 1.3% for the headline CPI and 1.1% for the core CPI release. However, the risks are clearly tilted to the downside given the renewed lockdowns that EU countries are imposing due to a new surge in COVID-19 cases.

The failure of the EU leadership to secure enough vaccine doses as early as the UK and the US has put the region under new restrictions. While COVID infections are surging across Europe in a third wave, the US and the UK are seeing new monthly lows of infections. At this point, it’s crystal clear that the EU economy will lag significantly behind its peers who had a “smarter” vaccine strategy. This divergence should keep the EUR currency under pressure over the medium-term and at least as long as vaccinations don’t speed up and allow the economy to reopen.

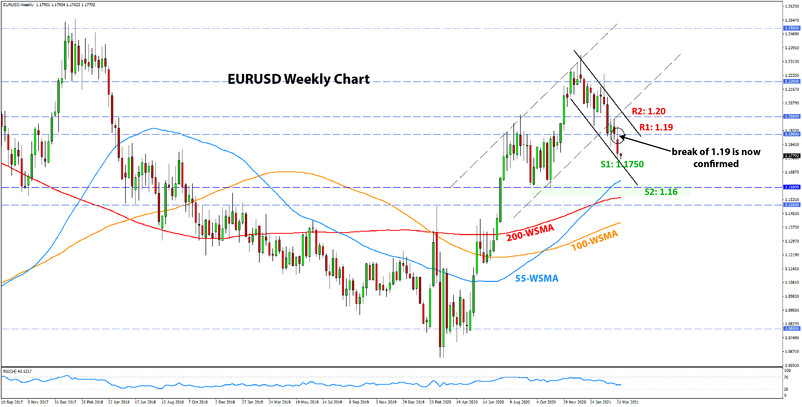

EURUSD Technical Outlook:

This week we are turning to the weekly EURUSD chart, where we can clearly see the definite break below the 1.19 level last week. From this perspective, the 1.16 support level is on the cards for EURUSD, if not highly likely.

The only (moderate) obstacle that may inhibit an immediate downside continuation is the 1.1750 zone, where the support trendline of the downward channel stands (see chart below). However, this is not a strong support zone, so it wouldn’t be surprising if the bears simply take EURUSD down through it.

On the other hand, if the downward channel stays intact as it is, the projections suggest that EURUSD would reach the 1.16 area in late April at the earliest or mid-summer at the latest.

The present levels of the resistance trendline currently stand at 1.20. Hence the trendline, concurs with the important resistance in this price zone.

British Pound Fundamental Outlook: GBP Stays Well-Supported on Vaccine Lead

Pound sterling was the second best-performing currency of the majors last week, trailing only behind the US dollar. We are probably all well-aware of the reasons for GBP’s resilience, as we’ve discussed them many times this year in our weekly analysis posts and Fx newsletter.

The main factor that supports the pound is the speedy delivery of vaccines in the UK, which was recently ramped up further. As of this week, the UK has over 57% of its adult population jabbed with at least one dose of a COVID vaccine. It is a significant milestone which means the country is reaching an important point in the fight against the pandemic. Easing of lockdown measures in the UK is already starting this week, which means that businesses will soon start to feel the benefits of the successful vaccination campaign.

The GBP calendar is light for this week and features only the final q/q GDP report. That means that GBP will be left to be mostly driven by risk sentiment and developments elsewhere, with the UK vaccine advantage providing a solid underpinning for GBP to stay resilient.

GBPUSD Technical Outlook:

The 1.3750 – 1.3800 in cable indeed held last week, and the pair is now trading near the 1.38 handle. The bulls are not out of the woods here yet. A new resistance trendline has formed on the GBPUSD daily timeframe, as shown below, essentially putting the pair stuck between support and resistance.

It’s worth noting that the support trendline is from the longer-term bullish channel that goes back to this time last year (March/April 2020). Therefore, it carries more significance in theory than the newly formed resistance trendline. However, the 1-year old uptrend is already quite mature at this stage, so it’s possible that the time has come for it to break.

The key insight will come if the resistance trendline is tested and the price reaction there. It stands near the 1.3900 level, so it will be critical for the bears to keep the price below this level. A strong move above 1.39 will re-establish control for the bulls, and the probabilities will increase for GBPUSD to potentially move above 1.40 again.

Japanese Yen Fundamental Outlook: JPY Remains the Underperformer in the Current Global Environment

The Japanese yen remains an underdog in the current environment of strong economic rebound and rising bond yields in the US. USDJPY, in particular, reached a 1-year high last week and is edging closer to the 110.00 level. Other than the positive global outlook and a dovish BOJ keeping interest rates negative, there are no distinct drivers of the yen. The fundamental factors remain bearish for JPY for as long as equity prices remain supported and risk appetite dominates.

Technical levels and pivotal support/resistance zones also tend to play a significant role in how JPY trades in recent times. The USDJPY technical situation, which often impacts other JPY pairs as well, is covered in the next section below.

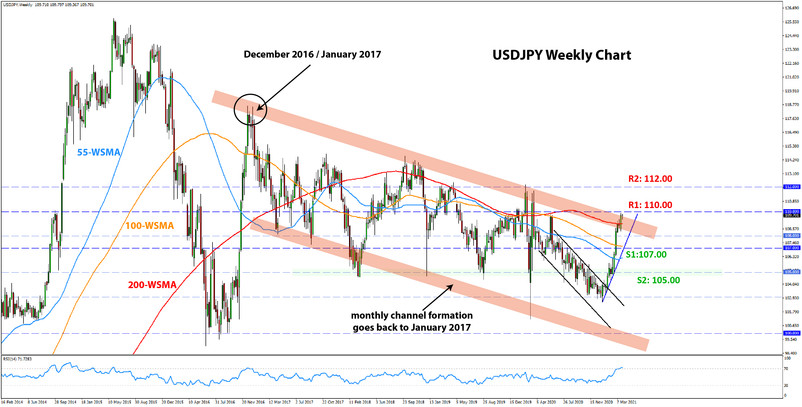

USDJPY Technical Outlook:

The 110.00 area is likely to act as a significant resistance in USDJPY. Not only was it an important psychological level for many years in the past, but 110.00 now coincides with the resistance from the 4+ years old downward channel in USDJPY.

The channel line represents monthly resistance, so it could take some time and fluctuations around it, even if it’s destined to turn the price down. While the 110.00 level looks likely to be reached as per the lower timeframes, it doesn’t mean this major resistance area will break. In fact, watch out for levels as high as 112.00 before declaring any bullish breakout final.

To the downside, the initial support is at the 107.00 area, followed by the 105.00 psychological zone.