US Dollar Fundamental Outlook: USD Rebounds Despite Dovish Fed as No-One Can Argue Against the Facts

Much as we suspected, the dollar found a way to rebound last week even though Fed Chairman Powell did all he could to play down the improvements in the economy. While the initial reaction to the Fed meeting was USD bearish, it seems the markets don’t want to argue against the facts, and traders quickly realized that the Fed can’t get any more dovish than it currently is. Profit taking on bearish dollar bets last Friday snapped the 3-week falling USD trend, but could turn out to be the start of something much larger also. In this context, it’s worth mentioning that May is usually a bullish month for the dollar, with EURUSD ending lower in 8 out of the 10 last Mays (since 2010).

The focus this week is on Nonfarm Payrolls, where strong numbers should further embolden dollar bulls. Consensus forecasts expect a stellar 975K jobs for the NFP component and unemployment to decline to 5.7%, with the risks skewed for an upside surprise to these numbers. Fx traders may front-run the reports, so the USD could start gaining this week ahead of the releases on Friday. The other important economic reports this week are the ISM manufacturing and IMS services, which should also confirm the strength of the US economy.

Euro Fundamental Outlook: EUR Uptrend Takes a Pause

The euro traded lower versus most currencies last week and ended higher only against the Japanese yen. The developments in the most traded EURUSD pair are evidently affecting the action in other EUR pairs, which means the EUR may be in for a broader correction if EURUSD starts a new bearish leg here.

Eurozone data was also mostly positive last week, but it has already been largely priced in given the EUR’s rally in April. Furthermore, growth (GDP) and inflation in Europe still lag behind that in the US, as last week’s reports showed. All of this suggests the euro’s uptrend is likely to take a pause for the time being.

This week’s EUR calendar sees retail sales, German factory orders, and industrial production from several EU countries. ECB President Lagarde also has scheduled speeches on Wednesday and Friday.

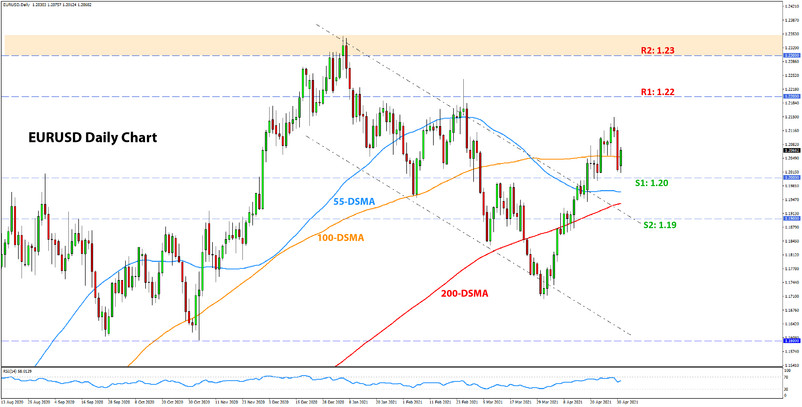

EURUSD Technical Analysis:

EURUSD rallied to 1.2150 last week but then sold off on Friday and closed the week at 1.2020. A sharp sell-off on the last day of April after such a stable rally during most of the month is sure to discourage some of the bulls.

The technicals, however, aren’t giving a clear directional signal. The price has broken above the channel trendline and above the pivotal 1.20 resistance zone, but then failed miserably to hold above 1.21. It seems this could easily turn into a sideways range, e.g., between 1.20 or 1.19 as support and 1.22 or 1.23 as resistance.

The 1.20 zone still remains important. A break below will put the bears back in charge, but the technicals will be leaned toward the bullish side as long as 1.20 holds.

British Pound Fundamental Outlook: BOE Meeting & Scotland’s Election Promise Higher GBP Volatility This Week

After an extended time of quiet action, things are set to finally get busier for the pound sterling this week. While the UK is on holiday today in observance of May Day, the action will get more interesting starting tomorrow. The big day is Thursday when both the Bank of England meeting and the Scottish Parliament election take place.

The BOE is not expected to make any changes to policy at this meeting, but they will release the monetary policy report, which contains their economic projections for GDP and inflation. These will receive the main attention from markets, and given the improvement in the economy, the odds seem to be in favor of a bullish GBP reaction to the BOE meeting.

However, while the BOE meeting is a cause for optimism on GBP, the Scottish election may not be. In fact, this event may be the very reason why GBP struggled to appreciate more during April, despite the strong recovery from Covid restrictions. Markets fear that pro-independence parties may gain in the election, which will be GBP negative.

On balance, picking GBP’s direction will likely be a tricky task this week, with the only ensured thing being higher volatility around Thursday’s events.

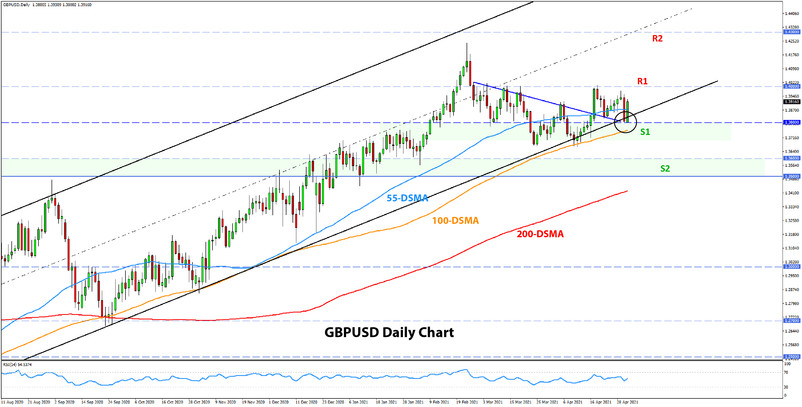

GBPUSD Technical Analysis:

Cable remains trapped between 1.38 and 1.40, though the bullish dynamics of the now 1 year+ uptrend also remain intact. That is, GBPUSD is still trading above the trendline that defined the long-term uptrend that is in force since April of last year. The trendline currently stands around the 1.38 level, which shows why this zone is so important as technical support. A downside break of this trendline would have big bearish implications for cable and will likely lead to an immediate decline toward the 1.35 area.

To the upside, 1.40 remains the nearest resistance. A break above it should lead to upside continuation toward the 1.42 area (February high).

Japanese Yen Fundamental Outlook: Not Much to Offer Support to JPY

USDJPY rebounded in tandem with US Treasury yields last week after selling-off for most of April. This made JPY the weakest currency of the majors last week, though it’s highly questionable whether the decline has legs or is driven mainly by technicals. The Japanese currency is not trading far from its longer-term averages and fair value, so it’s still hard to imagine large moves from a fundamental perspective.

Equity indices and risk sentiment remain well-supported, and this dynamic will continue to be a headwind for safe-havens like the yen. But if that changes, and it will suddenly when it does, it will be the safe-havens who will gain in value rapidly. In the meantime, expectations for a continuation of the rallies in Treasury yields and global equities are likely to keep the yen pressured.

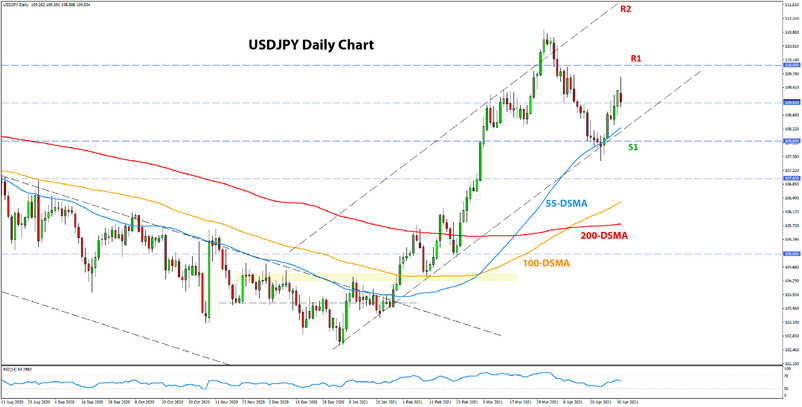

USDJPY Technical Analysis:

USDJPY staged an impressive rally in the final week of April, moving above 109.00, which arguably has big implications for the monthly chart (as we discussed in last week’s analysis).

But USDJPY is now falling again at the start of the new week. The pair rallied to the 61.8% Fibonacci retracement at 109.70 and reversed there. It is now trading just under 109.00 again.

While the rejection above 109.00 certainly looks negative on the charts, the USDJPY uptrend is not under immediate threat yet. The weekly chart shows us a tall bullish engulfing candle was formed with the last weekly candle, which should serve as a solid floor at 108.00. But to the upside, resistance at the 110.00 area is likely to be equally strong. Hence, it seems that a “wait and see” trading approach would be appropriate for the current situation on the USDJPY pair.