US Dollar Fundamental Outlook: All Attention on Thursday’s Pivotal CPI Inflation Print but Ranges Unlikely to Break

The Nonfarm payrolls report was another disappointment Friday. It showed that only 559K jobs were created during May, or around 100K less than the 650K consensus expectations. Adding the horrendous 800K miss from the previous May release (actual 266K vs. 1 million expected), the average for the past two months is 412K. The US labour market is still short of around 7-8 million jobs from pre-Covid times (February 2020). This is a much slower and much weaker recovery than what the Fed wants.

The weak Nonfarm Payrolls report means that it’s more likely for the Fed to remain comfortable with the current ultra-easy monetary policy of $120 billion QE purchases per month and at ease with their view that the recent inflation surge is only transitory. While it’s becoming evident that the market has reached a point where it wants to buy the dollar higher, the fundamentals just aren’t there. Should the NFP have been stronger, the USD would have surely been higher this week. But it remains stuck trading sideways instead. Due to the high uncertainty of the Fed’s decisions and actions next Wednesday, the dollar will likely remain range-bound in the period between now and then.

Traders’ attention this week will be fixated on the CPI inflation report, due on Thursday (June 10). Higher volatility around the release time is almost ensured, but not necessarily breakouts, not until the June 16 Fed meeting at least. That’s because it’s not so much important what Thursday’s CPI inflation shows (whether hotter or cooler), but rather how the Fed responds to it next week. This is why we expect the ranges in USD pairs to persist at least for the coming 7-8 trading days.

Euro Fundamental Outlook: ECB Meets but Don’t Expect Any Fireworks

The euro ended the past week somewhat lower and, as expected, continues to trade without much direction in broad terms. This sideways trend is likely to continue as the ongoing Fx fundamentals driven by the recovery from Covid restrictions are nearly fully reflected in exchange rates at this point.

The European central bank meets this Thursday (same time as the US CPI report, so careful trading EURUSD around this time), and traders will keep an eye for any changes to the PEPP quantitative easing program or forward guidance. Overall, no big changes are expected from the ECB as they (unlike the Fed) are not pressured by inflation or the labour market to adjust policy which means the meeting is likely to go down as a nonevent with little impact on the euro. It will be interesting to see also if they comment anything on the euro’s appreciation in April and May, though they won’t overtly talk it down.

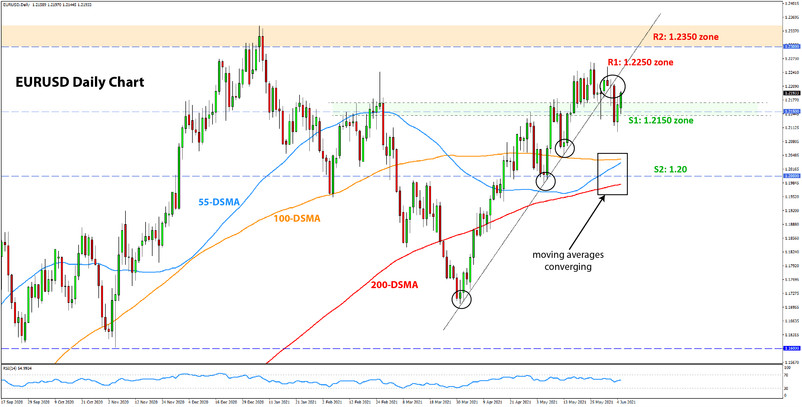

EURUSD Technical Analysis:

Our suspicion not to chase EURUSD higher last week was proven correct. EURUSD closed lower and formed a weekly bearish candlestick pattern. While this doesn’t mean that the price will immediately plunge lower, it does increase the chances that EURUSD has seen the highs for the cycle around 1.2266.

That said, we will look at the daily chart in this article for more details on the near-term outlook. For example, here we can see that EURUSD broke the rising trendline that propelled the bullish trend in April in May. This signaled the end of the bullish leg and could be an early sign that the trend may be over altogether.

While the April/May bull leg may be done, it doesn’t mean that EURUSD can’t have another go higher and perhaps retest the 1.2266 May highs or even the 1.2350 January highs. In fact, if it does that in the following days, it still wouldn’t cross above the broken trendline, which would act as a resistance trendline in this case (based on the support turning into resistance principle).

On the downside, 1.2150 is evolving into a key support zone. If the price breaks below, it’s likely to gather momentum and relatively quickly reach 1.20, which is the next critical support zone lower.

British Pound Fundamental Outlook: GBP Staying Resilient

The British pound is staying resilient as the Covid vaccines are effective against the Indian variant too, and its local spread should not deter the Government from allowing a full reopening of the economy on June 21. And while GBP is staying near its highs, it seems a breakout higher is not going to come that easily, and more fuel from the fundamentals will be needed.

A break to new multi-year highs in GBP can come from further strength in UK economic data and BOE”s communication to tighten monetary policy. The two, of course, are related and more evidence of strong economic performance will by itself amp up rumours that the BOE is preparing for further tightening. Nonetheless, until it happens, the pound may stay generally range-bound, albeit with a bullish bias. Since the bullish GBP sentiment hasn’t been broken, it alone could keep pushing sterling higher at a gradual pace.

Friday is the big day on this week’s GBP Fx calendar when GDP and industrial and manufacturing production data will be released.

GBPUSD Technical Analysis:

The bulls’ attempt to push cable to fresh highs faltered again last week, and the pair returned below the 1.42 handle, which has now toughen as a resistance. With the rejections of levels below 1.41 since mid-May, GBPUSD essentially finds itself stuck in a 100-pip range now between 1.41 and 1.42.

The main question in traders’ minds is which way GBPUSD breaks the range from here. If it breaks to the upside, it will still face significant (multi-decade) resistance in the wider price area of 1.42 – 1.46.

If, on the other hand, GBPUSD breaks below 1.41, then reaching 1.40 as well shouldn’t be a difficult task. There, at 1.40, it will encounter a strong support area, which shouldn’t give way easily either.

Japanese Yen Fundamental Outlook: JPY Not Moving Much

The yen regained some strength last week, largely owing to technical factors and the decline in US Treasury yields after the NFP miss Friday. Overall, the main narrative hasn’t changed here, and JPY is likely to remain stuck in ranges for the time being.

The JPY calendar this week gets busy on Tuesday when wage growth (average cash earnings), GDP, and current account data will be published. While, as usual, no material impact on JPY is likely from Japanese domestic releases, traders will keep a close eye on wage growth as a leading indicator of inflation, the primary target of the BOJ.

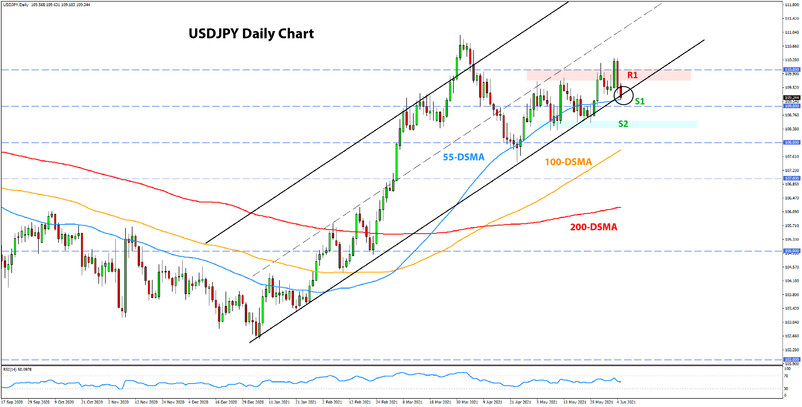

USDJPY Technical Analysis:

USDJPY last week made a second attempt to break its range to the upside, but with the price now again below 109.60, it seems that this was another failed attempt. If the decline continues toward 109.00, the pair will remain firmly stuck in its range between 108.40-108.60 as support and the more loosely defined 109.70-110.00 zone as resistance.

The gradual ascend of slightly higher high and higher lows, however, continues to suggest that the bulls have the upper hand to some extent. In this sense, USDJPY may continue to climb at a slow leisurely pace for a while longer. A stronger bullish scenario could come into being with a momentum close above 110.00, though that is looking less likely this week. On the other hand, a decisive close below the 108.50 lows would change this dynamic and turn the daily technicals bearish. Under this scenario, there will be potential for a move toward the 107.00 area.