US Dollar Fundamental Outlook: Strong NFP Gains Can Lift USD Further

The USD consolidated during the past week following the spike higher induced by the Fed’s hawkish surprise at the June 16 meeting. The change in the underlying USD trend dynamics from bearish to bullish seems to remain in place, however.

The Fed has taken note of rising inflation and the speedy recovery and has signaled a willingness to raise rates. Traders will seek confirmation of this narrative from the Nonfarm payrolls report this Friday. A strong NFP will do a great favor to dollar bulls as it’s likely the only thing that can power the next bullish leg. On the other hand, if jobs data disappoints, the result may not be a reversal for the USD, but more likely a sideways, range-bound action. That said, the risks tilt to the upside for Friday’s reports (consensus forecast expect 700K NFP), which, if proven correct, should be moderately bullish for the dollar. A beat of estimates (e.g., around the 1 million mark or above) should prove strongly bullish for the dollar.

This week’s busy US calendar will also see the release of consumer confidence data (Tuesday), Chicago PMI (Wednesday), and the ISM manufacturing PMI (Thursday).

Euro Fundamental Outlook: EUR Stays Neutral as Main Action Takes Place in Other Currencies

While many are optimistic about the prospects for the EU’s economy, the speed of the recovery is lagging the United States, with a lower outlook for both inflation and GDP. Moreover, the spiking inflation in the US has also recently made the Fed turn hawkish. At the same time, with inflation barely rising above 2.0% driven by temporary base effects, the ECB is in no rush to withdraw stimulus. This dynamic should keep the ECB on the more dovish side compared to the Fed, which should continue to pressure the EURUSD pair to the downside during the summer.

However, on a broad scale versus other currencies, the euro can remain generally neutral and even strengthen moderately, especially if risk appetite fully reverses and turns into risk aversion. This means the euro can continue to do well against the “risk-on” currencies (AUD, NZD, AND CAD) while struggling versus the safe-havens (USD, JPY).

The highlight on the EUR economic calendar this week is the flash (preliminary) CPI inflation release, which should show (as said above) y/y prices increased by 1.9%, while the core CPI reading is expected to show a modest 0.9% increase.

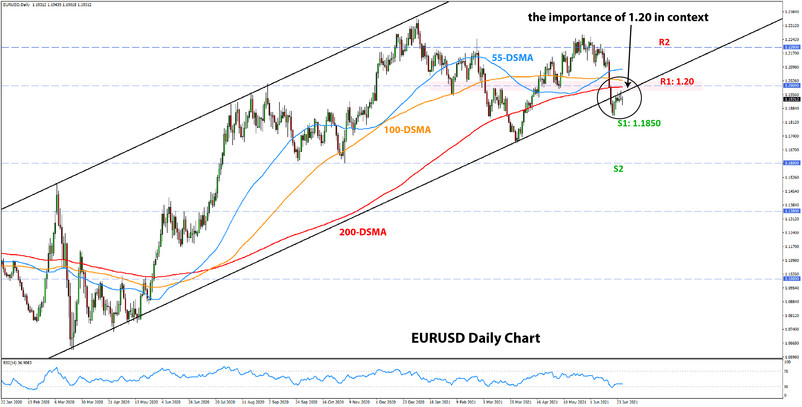

EURUSD Technical Analysis:

EURUSD retraced moderately last week following the big decline the week before. However, the trend remains bearish as long as EURUSD stays below the big 1.20 resistance zone. The convergence of past lows with the 100-day and 200-day moving averages makes the 1.20 zone a particularly robust resistance.

While the pair has hit a moderate support zone around 1.1850, the bearish trend change that occurred with the break below 1.20 remains in force and suggests that the 1.1850 low will probably be taken out. In such a bearish scenario, EURUSD can fall toward 1.17 and 1.16, which is where the next support zone is located.

British Pound Fundamental Outlook: Dovish BOE Knocks GBP Lower

The Bank of England delivered a moderate dovish surprise last week (or rather, not as hawkish as GBP bulls hoped), sending the pound lower across the board. The overcrowded long GBP positioning suggests the corrections in GBP pairs can extend further with GBPUSD, GBPJPY, EURGBP likely to give the biggest moves.

The rising number of new Covid infections with the more contagious delta variant continues to pose a risk to a smooth reopening. However, the markets are currently not worried much as the vaccines seem effective in preventing Covid disease from the new variant. Prime Minister Boris Johnson has said the Government would very likely proceed with the plan to fully reopen the economy on July 19 (original plan was pushed back from June 21). Still, the number of new cases continues to rise rapidly, and the risk is if the death toll starts rising, it could prompt the Government to reverse its plans for reopening again. This would be am ore negative (bearish) GBP scenario.

The relatively quiet GBP calendar this week suggests the pound may remain range-bound or be driven more by international factors rather than domestic ones.

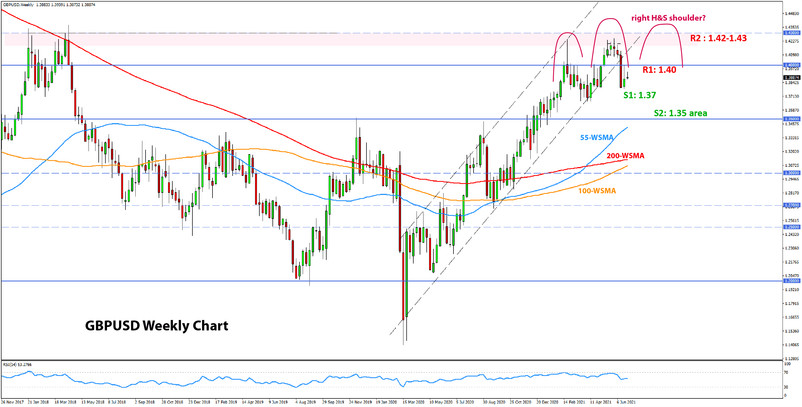

GBPUSD Technical Analysis:

The weekly technical have deteriorated significantly for GBPUSD as well. The big 300 pips bearish candle broke the 1.40 support as well as the 15-month old rising channel that defined much of the GBPUSD uptrend since the March 2020 lows.

Traders’ focus is clearly on the downside now, with the nearest support seen at 1.37 and the more significant support at the 1.35 area (see chart). The size of the big red candle suggests continuation is very likely, at least toward the 1.37 – 1.3650 lows.

There is also potential for GBPUSD to form a head and shoulders pattern, though it’s still early as the right shoulder hasn’t even started to take shape. For a H&S to be possible, the 1.3670 low from April must not be exceeded.

To the upside, the first key weekly resistance is at 1.40. The next one is at the highs around 1.43.

Japanese Yen Fundamental Outlook: JPY Gives Back Gains as Stocks Recover Post-Fed Losses

The range-bound nature of JPY pairs returned last week as the Japanese currency reversed almost all of its gains from the week before. In the meantime, the USDJPY pair remains stuck and driven more by technicals rather than fundamentals (see next section) as US Treasury yields are capped in ranges also.

It is difficult to find a fundamental theme that is driving JPY pairs other than that of persistent risk appetite. In line with this, stocks also reversed the declines induced by the hawkish Fed, which shows investors are still unfazed by the recent change at the Fed, despite the “pricey” valuations of equity markets.

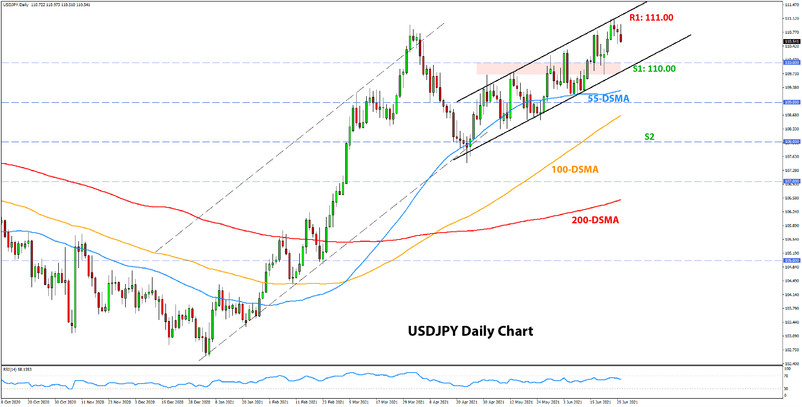

USDJPY Technical Analysis:

The technical picture on USDJPY remains largely unchanged as the pair continues to trade between the two trendlines of the ascending channel formation. As we suggested here in our previous analysis, USDJPY found resistance around the 111.00 level last week.

This could be the start of a double top formation, or USDJPY may simply continue to trade inside of the channel. A daily close above 111.00 would indicate that a double top would not be on the cards. On the other hand, a drop from here and then a bearish break of the channel would confirm a double top pattern. Under such a bearish scenario, 108.00 would be the target zone and also the main support zone lower.

Near-term, the key support zone to be broken (also concurring with the channels support line) is 110.00.