US Dollar Fundamental Outlook: Another Hot CPI Print Fails to Fuel More USD Upside

The dollar was stronger last week, driven by support from economic releases, particularly the hot CPI inflation print and strong retail sales numbers. However, the initial reaction to the (again) hotter than forecasted CPI faded, and the dollar failed to extend the gains.

The mixed reaction to the inflation report reveals that the market still believes in the “inflation is only transitory” narrative. Otherwise, the dollar would have been much higher by now. Fed Chairman Powell also reiterated the “only transitory” view in his testimony before Congress last week.

The US calendar for the week ahead is very light and features no major tier 1 reports or events. This means that the dollar will be affected more by other factors such as risk appetite and technicals. Also, since everything in Forex trading is a relative game, developments in other currencies and countries can also affect where USD’s exchange rates are moving.

Euro Fundamental Outlook: Fx Traders Closely Watching the ECB This Week

The EUR remains on its broadly neutral trend versus currency peers, including the dollar, albeit EURUSD is in a moderately declining trend. However, there are first signs that the ongoing dynamics of a broadly neutral (range-bound) euro could change, perhaps as soon as this week.

Namely, the euro currency could be in for a busy trading week with the ECB meeting in focus this Thursday. The European central bank meets one week after their decision to alter the inflation target (the ECB would now welcome inflation overshoots above 2%, similarly to the Fed’s AIT regime). Naturally, traders will be closely watching the statement and press conference, especially as the change of the inflation target could mean the ECB is about to become a more dovish central bank than in the past (aiming for higher inflation means that monetary policy will need to stay stimulative for longer).

The action on the EUR calendar this week doesn’t end with the ECB. On Friday, the Eurozone will report the flash manufacturing and services PMI surveys. These will give the latest reading into how the European economic recovery is going.

One prominently bearish scenario for the euro this week would be a very dovish ECB coupled with disappointments in the PMI reports. Such an outcome would likely be enough to break the recent “neutral” trends on some EUR pairs.

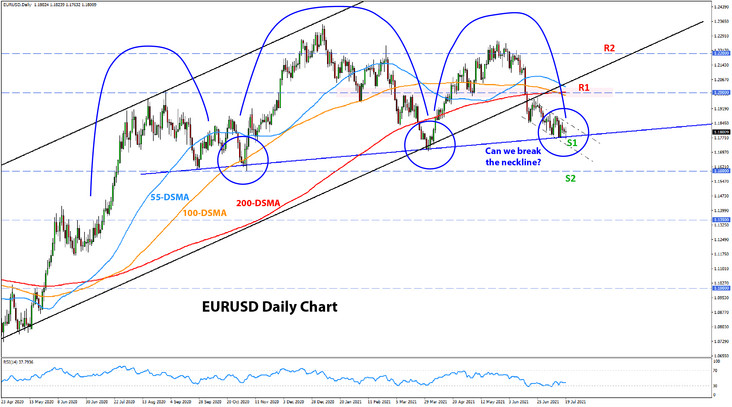

EURUSD Technical Analysis:

EURUSD bears continued to press on the lows and finally managed to close a weekly candle below the 1.1850 level. Still, further downside movement is not a given here because the pair is at support, stretching as a zone around the 1.1750 level. This is a tough support to crack and will likely need some fundamental factor or news release as a catalyst to break it. In fact, EURUSD is already bouncing here today.

Under a bearish scenario of a sustained break below the 1.1750 support zone, the potential head and shoulders pattern will get triggered. It would have a downside target of around 680 pips (measured by the height of the head), which points to the 1.11 – 1.12 area on EURUSD. Still, this would likely be a scenario for the long term. For the foreseeable future, EURUSD is more likely to experience notable buying pressures in the 1.16 and 1.15 support zones, even under the above bearish scenario.

To the upside, 1.1850 should act as the nearest resistance zone. This is based on it being a support level previously and also on the resistance line that has kept the moderate downtrend in place since the local highs from June 22-25. A bullish breakout of this small downtrend formation can open up a bigger upside potential, likely toward 1.20. This 1.20 area is the most important resistance for EURUSD traders in the current context and needs to hold to keep the bearish dynamics intact.

British Pound Fundamental Outlook: “Freedom Day” from Covid Restrictions in the UK but GBP Fails to Move Up

The pound was mixed last week, receiving a boost from stronger inflationary pressures as seen in the CPI and wage growth (Average Earnings Index) reports last week, both of which beat estimates. Adding to the bullish fire and related to the accelerating inflation was BOE’s member Saunders comment saying that it could become appropriate fairly soon to withdraw some of the current monetary stimulus.

Still, despite the above bullish dynamics, GBP failed to move higher against the dollar and euro. Firstly, a lot of the “good news” for GBP is already largely priced into markets. Secondly, the labour market reports were not unanimously strong, with the unemployment rate increased. Third, the EU-UK trade frictions are not completely over yet, and the two sides continue to negotiate for solutions.

In the meantime, the delta variant continues to spread rapidly in the UK, and experts are projecting that 100K new daily infections will become a reality in just a few weeks. Still, officials are not worried as hospitalizations and death rates remain low. As of today (July 19), the UK service economy is fully reopened as in pre-Covid times.

On the UK calendar this week, only the retail sales report on Friday will be of interest to traders, though little impact can be expected on the larger GBP trends from this report.

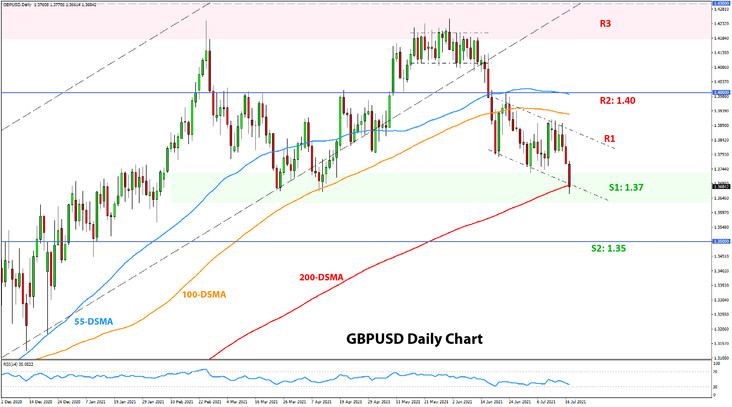

GBPUSD Technical Analysis:

GBPUSD is testing the important 1.37 support zone on the opening day of the new week. Like EURUSD, GBPUSD also has formed a downtrend defined by a channel formation (see chart) starting around June 22-25. Moreover, several technical factors concur in the 1.37 area, such as the 200-day moving average (red line) with the past lows from March and April, making 1.37 a particularly solid support area.

If the support here holds, then the first resistance higher is seen at 1.38, with a stronger one at 1.39 and the most important at 1.40. On the other hand, if the 1.37 support is broken, the probabilities for a deeper sell-off will increase significantly. The 1.35 area is the next support lower and would most likely be reached under this scenario.

Japanese Yen Fundamental Outlook: The Week Starts on a Risk-Off Tone & JPY Is Moving Higher

After ending the past week in the negative, equities are extending the sell-off into the new week, and the spillovers are already felt in the Fx market. The Japanese yen is the top performer of the day, also coming as an extension to a move from a few weeks ago.

The JPY broke its recent trend and strengthened over the past two weeks, driven by the correction in equity markets as well as a further decline in US Treasury yields. At the beginning of this week, these trends are only continuing, hence the JPY’s appreciation.

Domestically, the Bank of Japan meeting on Friday didn’t impact JPY crosses much, though they made some important announcements about their policy, especially in regards to climate change. But, as has usually been the case in the recent few years, domestic factors are not driving JPY exchange rates and instead, it is risk appetite and US Treasury yields that matter the most.

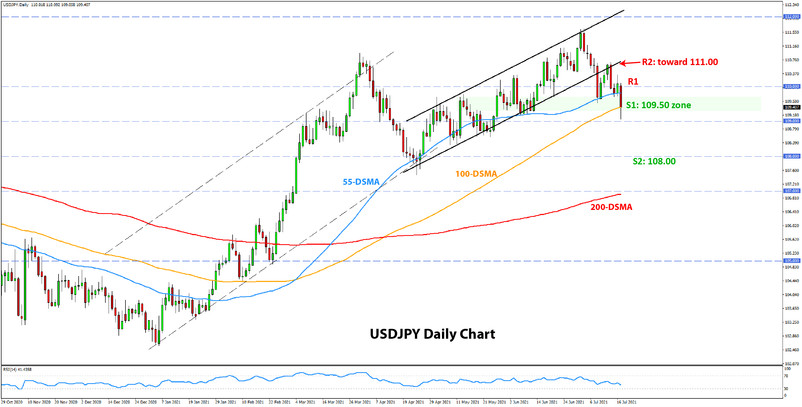

USDJPY Technical Analysis:

USDJPY is extending the sell-off that started two weeks ago and is firmly moving below 110.00 in today’s Monday session. The daily chart now looks clearly bearish after that breakdown of the ascending channel, and 109.50 seems like the last hurdle before a deeper decline toward 108.00.

The confluence of the 55-day (blue) and 100-day (orange) moving averages with the prior lows here around 109.50 form the key support. The 109.00 round number level could also provide some support, but other than the psychological element, there aren’t many technical factors to provide support there. In this bearish scenario, 108.00 is the clear target area lower and the next important support.

To the upside from current levels, 110.00 would be the nearest minor resistance. Above it, the more important support is located at that broken line of the channel, currently standing around 110.80 and rising toward 111.00.