US Dollar Fundamental Outlook: NFP Miss Tilts the Odds Toward a Deferred Fed Tapering, USD to Remain Soft Near-Term

Friday’s disappointing NFP report sent the dollar lower across the board, with further USD weakness looking likely to persist. However, the losses may remain limited and small as one jobs report shouldn’t be a complete game-changer for the Fed when they meet on September 22. Remember, the Fed likes to look at 3-month averages for the NFP, and with the strong July and August reports, the average for the past three months is 742K, not far from the Fed’s desired pace of job gains.

Nonetheless, with this large NFP miss just two weeks before the FOMC meeting, the probabilities look much higher for a postponement of tapering plans. This is likely to be a bearish dynamic for the USD at least during the period between now and the September 22 meeting. Furthermore, the delta variant is clearly taking a toll on the US economy, and some FOMC members were skeptical about starting tapering even before the NFP miss. Hence, more Fed officials are likely to join the doves, which will tilt the balance toward an FOMC that prefers to remain patient for the time being before deciding to start withdrawing monetary stimulus via a QE tapering.

The new week kicks off quietly as the US is on holiday today. The light trading activity in Fx may extend into the remaining days too, as the US calendar features only non-impactful 2-tier data, with the main attention being on the JOLTS Job Openings and PPI reports.

Euro Fundamental Outlook: Busy EUR Week Centered Around ECB Meeting

The euro gained upside momentum in recent weeks as some hawks within the ECB were inspired by the acceleration in inflation in the latest CPI report. They talked about the need for reducing the pace of ECB’s PEPP QE purchases sooner rather than later. However, the inflation overshoot was only modest, and most economists still expect Eurozone inflation to come back down after base-effect transitory factors subside. Thus, the doves within the ECB shouldn’t have a hard time overcoming the hawks at the meeting on Thursday.

While the inflation overshoot certainly makes the ECB meeting more interesting, chances are President Lagarde and the majority of the ECB’s governing council will try their best to send a signal as dovish as possible. This means that recent EUR gains may fade soon, and post-ECB rallies are likely to be short-lived also.

Other than the ECB meeting, the EUR calendar features only the ZEW economic sentiment indicator among the more important reports. Overall, as said above, EUR’s upside should be limited, and depending on USD trends and other currencies, EUR may stay range-bound or start falling again in the coming weeks.

EURUSD Technical Analysis:

EURUSD hit the 1.19 resistance area on the NFP miss, stalled there, and after coming down somewhat, remains stuck now just above the 1.1850 level.

While some bullish signs are evident on the weekly chart here, the two weekly green candles haven’t completely reversed the head and shoulders pattern yet. Namely, EURUSD needs a firm weekly close above the neckline for the H&S pattern to be definitely canceled (neckline drawn based on weekly closes currently stands near the 1.19 level). Remember, the neckline is a trendline that’s rising, so if EURUSD consolidates for some time here, the neckline will move closer toward 1.20.

That said, the two weekly bull candles certainly challenge the bearish case based on the H&S pattern significantly at this point. If EURUSD doesn’t reverse lower soon, the chances will increase that the H&S pattern has failed.

To the downside, the initial support is at the 1.18 zone. The key weekly support, however, remains at the 1.16 area.

British Pound Fundamental Outlook: GBP Keeps Trading Quietly

GBP continues to quietly trade in ranges on the main Fx pairs as the summer lull draws to an end. The uneventful economic calendars over the past two weeks (and this one won’t be different) certainly helped to keep the pound contains during this time.

Perhaps GBP will be able to break some ranges soon? It’s unlikely that it will happen anytime soon. The British currency strengthened mostly during the first half of 2021, but the majority of the uptrend occurred during H2 2020. With a lot of the positive news regarding Brexit and the fast vaccination campaign in the UK already reflected in GBP’s price, the market is trying to determine what is next to come. Without a clear directional factor to push GBP higher or lower, the market has remained range-bound, which is also a normal phenomenon, especially after such a strong trend.

As said above, this week’s GBP calendar is far from super-busy, though Fx traders will keep an eye on the BOE’s monetary policy report hearings in Parliament.

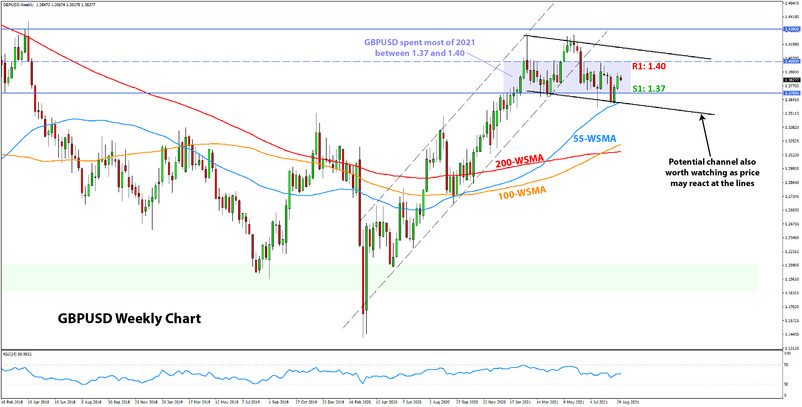

GBPUSD Technical Analysis:

GBPUSD remains stuck mainly between 1.40 and 1.37 over the last 10-12 weeks. There is no indication that a breakout is anywhere in sight, so the most likely scenario for the pair is for the range to hold for the foreseeable future.

The two levels noted – 1.40 and 1.37 – naturally are the key resistance and support zones in the current context. However, the rather irregular price action on the weekly chart during most of this year suggests that GBPUSD can rally to the 1.43 highs and still remain part of a trading range (this one larger, with 1.43 as the top end).

The key support areas below 1.37 are 1.36 and then 1.35. This could mean that potential downside moves could prove short-lived and may then even reverse quickly and sharply from these price zones.

Japanese Yen Fundamental Outlook: JPY Remains Stuck in Ranges as Japan’s Political Disturbances Emerge

The JPY continues to loosely track US yields as one of its main fundamental (intermarket) drivers, which is especially true for the USDJPY pair. But, this pair is stuck in a tight horizontal range of 150 pips for the past two months, meaning that JPY pairs are also largely correlated with USD pairs at the moment. Hence, much of the action on JPY crosses is affected and can be explained by movements in the dollar.

That said, some political uncertainties are also coming on the radar in Japan as Prime Minister Suga has announced his resignation. A new leader will likely be chosen by September 29, and while no big turmoils are expected, it will be worth it for Fx traders to keep an eye on Japanese political developments over the next few months. No impact on the JPY is likely in the near term as the new Prime Minister should still continue with the large fiscal and monetary stimulus. However, any indication that the new leader may deviate from this path could translate into a lot of wild moves on JPY crosses.

Japan’s economic calendar this week features the GDP report on Wednesday.

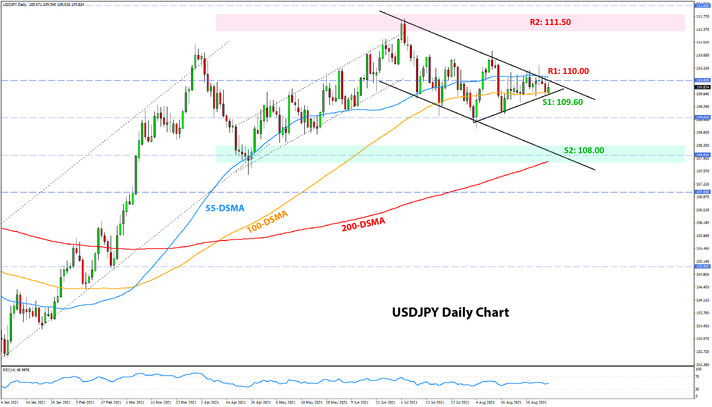

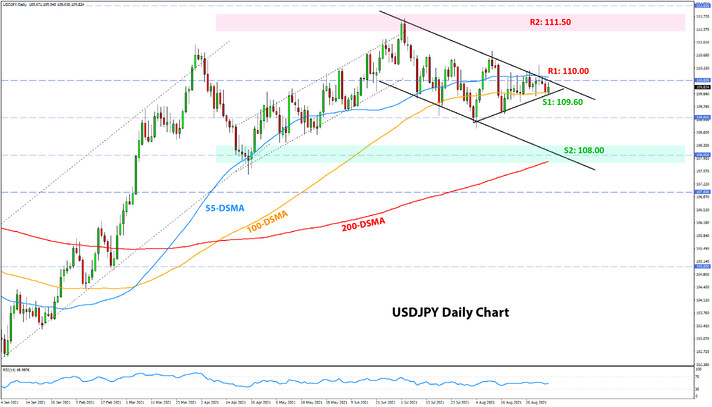

USDJPY Technical Analysis:

For the USDJPY pair, we are going to take a look at the daily chart we discussed three weeks ago, as the potential breakouts can be more easily seen here.

Namely, USDJPY has almost precisely to the pip stayed within the frame of the downward channel. Interestingly, the price action has compressed even further in the past 10-15 trading days, and is now tightly constrained between a support line at 109.60 and the channel’s resistance at 110.00 (see chart). This sets up the pair for a “nice” and potentially big breakout, either up or down.

A bearish breakout scenario could offer a 150 pips potential to the downside toward the 108.00 support zone. Similarly, a bullish breakout scenario could easily take USDJPY about 200 pips higher, closer to the 111.50 resistance near the past highs.