US Dollar Fundamental Outlook: Uptrend Intact, NFP Should Confirm the Bullish Outlook

USD bulls didn’t wait for the NFP this Friday to confirm the positive outlook in order to take the USD higher. They bought dollars, and the US currency broke some technical levels last week, which were previously rejecting breakout attempts for several months.

However, with the Nonfarm Payrolls now just days away, we can expect some USD consolidation and perhaps retracements into Friday’s release. The NFP is crucial for the dollar rally at this point. It needs to confirm the positive outlook for the US economy and, with that, the USD uptrend. Look for the NFP to show around 500-600K job gains (as consensus expects) for a moderately positive dollar reaction, while a print of 800K or higher will likely send the greenback surging higher on another powerful rally.

On the other hand, if the NFP prints anything below 300K again, then the USD will likely give back a large part of its gains and may even sell off hard. Still, the uptrend shouldn’t reverse completely even if the NFP disappoints, but the rally will surely be at least postponed, in this case.

The US calendar is relatively quiet until Friday, except for the ISM Services PMI tomorrow (Tuesday), which is expected to modestly decelerate to 60.0 this month. The ADP Non-Farm employment change (out Wednesday) and the unemployment claims (out Thursday) shouldn’t evoke a big USD reaction as all focus should firmly remain on Friday’s NFP release.

Euro Fundamental Outlook: Soaring European Gas Prices are Another Negative for the EUR

Without many bullish factors to support it, the euro is left to keep drifting lower. Aside from some technical corrections and potentially flows on episodes of risk aversion, the euro will hardly find something to draw support from in the current environment.

The Covid situation during the autumn season and potential new big outbreaks and lockdowns in the region are the obvious risks to the economy in the period ahead.Moreover, the recent energy crunch and soaring natural gas prices will hit the EU economy the hardest. The ECB has so far firmly stayed on the view that inflation is transitory, but if gas prices don’t stabilize and start cooling off in the coming weeks, these will feed through into inflation rates. It will be interesting to see if the ECB will then continue to view inflation as “only transitory.”

We’ll already get a glimpse into the ECB’s thinking this Thursday when the minutes from their latest meeting will be released. Traders will look for any voices within the ECB that are concerned about inflation and think the PEPP QE should end sooner. Such hawkish comments could boost the euro this week, though only temporary as it is unlikely this will be enough to reverse the entire bearish narrative that is pressuring the currency.

The EUR calendar features only 2nd tier data this week. The Markit PMIs will show the final readings, but those famously have a very muted impact on the Fx market compared to the flash (preliminary) reports which are published two weeks earlier. So instead, the focus on this week’s Eurozone data will be on the retail sales report and on the German factory orders and industrial production releases.

EURUSD Technical Analysis:

After falling steadily for four days, EURUSD reacted with the 1.16 support area on Friday. The small bounce is extending into the new week, though it remains modest so far.

The weekly technicals remain bearish, so this bounce should be a retracement within the trend. The bearish trend won’t be under threat until the 1.19 high is challenged. And that’s a long way from current levels.

With that said, the first resistance zones in line to the upside are located in the 1.1680 – 1.17 area (see chart), where the prior lows and the 38.2% Fibonacci retracement meet. If the price pushes through this zone, then the next resistance will come at 1.1770 – 1.18.

To the downside, 1.16 remains the key support. Below it, the focus will turn to the 1.15 area.

British Pound Fundamental Outlook: GBP Finally Pulled Lower by Positioning

The mix of risk aversion and surging power and gas prices is a bad one for the pound. For some time, we’ve been saying that many optimistic scenarios are well priced into GBP’s Fx rates and that the currency is at greater risk of a sell-off. That seems to have metalized already last week as sterling broke some key technical levels both versus the USD and the EUR. Gravity is finally pulling GBP down as the stretched long positioning is reduced.

It’s a light economic calendar for GBP this week. Hence, traders will closely watch risk sentiment and if the risk-off tone will continue. This can further hit GBP, probably the most against safe-haven currencies.

Overall, like the EUR, there isn’t much to support GBP at the moment, and if economic indicators turn for the worst in the period ahead, then sterling will probably extend the slide.

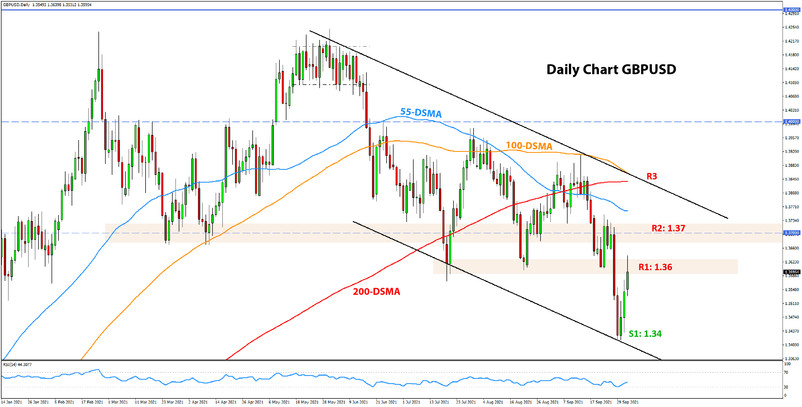

GBPUSD Technical Analysis:

Instead of extending the rebound higher last week, GBPUSD fell through the 1.36 support. The selling then accelerated, and the pair fell as low as 1.3410 before rebounding on Thursday and Friday.

Today, the rally is taking GBPUSD back to the (now former support) 1.36 resistance zone. If it pushes through, then the next resistance is at the 1.37 zone, which also connects back to previous important lows. Finally, the 3rd resistance is at the falling trendline (see chart), which currently stands around the 1.3850 level. The 100-day and 200-day moving averages are also in proximity to this falling trendline, so perhaps this will be a very important resistance area if cable reaches it.

The low just above 1.34 now represents the first support zone to the downside.

Japanese Yen Fundamental Outlook: JPY Firmer as Stocks Fall in Worst Correction since March 2020

While JPY correlation with episodes of risk aversion appears to have certainly weakened in recent years, last week shows that it is still alive nonetheless. But the yen also has a strong correlation with US Treasury yields, which declined in the second half of the week. So it was more a case of both factors driving JPY trading than risk sentiment alone.

So, a bullish JPY scenario can be imagined if stocks continue the sell-off this week and US Treasury yields slide. However, if stocks rebound and yields rise, then the JPY will slide hard, with USDJPY potentially breaking above 112.00.

On the domestic front, Fumio Kishida was elected to serve as the new LDP leader. His views are most similar to Abenomics policies, so markets except few if any major changes from him. Hence, the muted JPY reaction to the announcement.

USDJPY Technical Analysis:

USDJPY continued to march higher last week and reached the 111.50 resistance zone, and then extended to touch the 112.00 level as well before coming down 100 pips lower for the weekly close near 111.00.

Traders who look to re-enter long have their eyes on support levels to the downside. The nearest support zone is at 110.50, where the prior highs are located. The 110.00 psychologically important area is the next support lower. Based on a newly-formed ascending channel formation, its support line is rising and will come close to the 110.00 area in a few weeks.

To the upside, the 112.00 zone is in focus now as that’s where the most recent swing high stands. Above it, USDJPY could rise toward the upper end of the channel, near 113.00.