US Dollar Fundamental Outlook: Watching GDP and PCE Inflation Ahead of November 3 Fed Meeting

Consolidation is still the name of the game for the greenback, ahead of what are likely to be busy two weeks in the Fx market. While the November 3 Fed meeting remains the central focus for Fx traders, this week’s GDP growth data (Thursday) and PCE inflation (Friday) will also shape the Fed’s thinking and actions in two weeks’ time. So, it’s all connected, of course.

Remember, the PCE report is the Fed’s preferred measure of inflation, so this report will be more significant for Fed policy than the CPI released two weeks ago. The core PCE measure is expected at 3.7%, and a higher or lower number than this will likely have an impact on the dollar. The best case scenario for the US dollar would be if both GDP and PCE inflation beat the estimates. Strong GDP vs. slower inflation should also be a bullish scenario. But, if it’s the opposite (lower GDP and higher PCE), stagflation worries will increase even more, and while the dollar will probably still rally in this case, it won’t be a healthy rally going forward (the British Pound is in this situation, see section below).

Finally, if both GDP and PCE miss estimates, then the USD correction can probably extend a little deeper lower. Still, it would likely take a huge miss in US data in the coming period to completely reverse the USD bull trend, so all USD dips should still remain part of the larger consolidation.

Other data worth watching on the US calendar this week is CB consumer confidence, durable goods orders, the Chicago PMI, and the revised UoM consumer sentiment survey.

Euro Fundamental Outlook: ECB Meeting in Focus - Still Singing the Transitory Tune

The EUR calendar is even busier than the US, with the ECB meeting taking place on Thursday followed by Eurozone GDP and inflation data on Friday. It could be a make-or-break week (though more likely a break) for the currency. Either this rally (that so far looks corrective) ends, or it turns more serious and challenges the established downtrend.

The main attention will undoubtedly go toward the ECB meeting, where investors will closely watch the inflation discussions within the ECB’s Governing Council. President Lagarde and the majority in the team are still viewing the inflation spike as a transitory phenomenon, but there are already some dissenting voices. Thus, while the overall tone from the meeting will be dovish, there could be a slight hawkish surprise if more Governing Council members are worried about inflation (dissent within the ECB).

The flash (preliminary) GDP and CPI inflation releases on Friday will be as important for the EUR currency as the ECB meeting. “Stagflation” is a word we are hearing everywhere these days, and Friday will give us a view on where the Eurozone stands on this issue. Compared to other economies, Europe is still behind, particularly in meeting its inflation goal. Eurozone growth (GDP) and inflation are both slower than in the US. Hence it is clear why EURUSD is falling and why it’s likely to continue falling further. Barring major surprises in economic data or else in the period going forward, the euro should remain an underperformer among the major Fx currencies.

EURUSD Technical Analysis:

EURUSD extended higher after the rebound at the 1.1550 support zone in the first half of October. But the rally still lacks serious momentum, and in fact, the price is already falling this Monday after failing to move above the 1.1665 resistance. So, the overall technical situation suggests that this EURUSD rally is only part of a correction within the larger bear trend (see chart).

The 1.17 and 1.1750 are the key resistance zones to the upside and should hold any further bullish attempts. The 1.1750 resistance zone remains like the key threshold that, if broken, can seriously challenge the current downtrend and would at least mean that a move to 1.19 or 1.20 is becoming more probable.

To the downside, the first support remains at the lows at the 1.1550 zone (1.1520 actual low). Below it, if the downtrend resumes, EURUSD could extend toward 1.14 and lower as part of the gradual bearish trend here. Also worth noting is the head and shoulders pattern that was triggered by the break and confirmation of the neckline this summer remains alive and has its target projection in the 1.12 area.

British Pound Fundamental Outlook: CPI Miss Curbs GBP Rally

It is a quiet UK calendar for the week ahead, but this may not mean that GBP volatility will calm down. Instead, the currency will likely continue to get plenty of attention as that November 4 Bank of England meeting draws nearer and rate hike bets continue to be hotly contested.

The bulls are still in the driving seat for now as several key BOE officials, including head Governor Bailey, have recently called for rate hikes using strong language (Bailey said, “we have to act”). The markets now expect a 0.15% rate hike at the November 4 meeting, and this narrative is behind much of the recent GBP rally. But, as we noted in previous pieces, the risks are high for a “buy the rumor sell the fact” price action when the BOE actually hikes interest rates next Thursday.

Last week’s slower than expected CPI inflation print was a relief and cooled off the GBP rally. But it is still far from killed at this point. Overall, the outlook for GBP remains fragile, with greater risks of a large sell-off in case economic data disappoints going forward, compared to the potential for an extension of this uptrend.

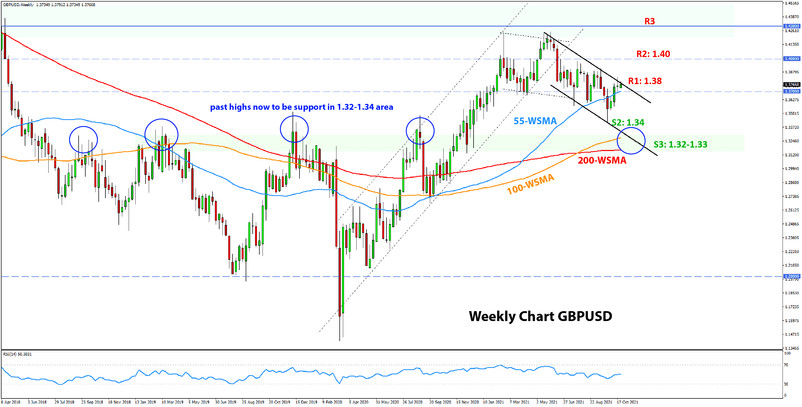

GBPUSD Technical Analysis:

The rally was rejected right at our designated 1.38 resistance zone, and GBPUSD closed the past week with a (weekly) doji candle. This is the first notable sign that the recent bull move is running out of steam.

The 1.38 area remains the key resistance that should hold back the bullish attempt. A break above will open serious upside potential and will most likely result in the price reaching at least the 1.40 area.

If, however, GBPUSD turns down here, then the initial support is likely to be at that 1.36 zone that has been important so many times in recent history. Then the 1.34 September low is the next support lower ahead of the more important 1.33-1.32 zone, which is a confluence area of the 100-week (orange line) and 200-week (red line) moving averages.

Japanese Yen Fundamental Outlook: BOJ to Affirm Ultra-Dovish Policy

While other central banks are actively thinking about tightening policy or already outright hiking interest rates, the BOJ is of a different breed. High inflation hasn’t been a problem in Japan for decades, and the Japanese central bank is not worried about rising commodity prices nor accelerating inflation in other countries.

Instead, the main worry for the Bank of Japan remains deflation, which Japan has been fighting since the mid-1990s. Thus, at the meeting on Thursday, they will reaffirm the ultra-dovish policy stimulus that they are already perusing. This is in stark contrast to much of the rest of the world that is in tightening mode. Hence it’s not a surprise that we are now seeing JPY weaken so massively.

High oil and gas prices rising stock markets and Treasury yields are another blow for the yen that are fueling the uptrends on JPY pairs. All in all, the current environment is like a perfect storm for a weaker JPY. A reversal of these trends could potentially stop the JPY’s depreciation, but such a scenario looks highly unlikely at the moment.

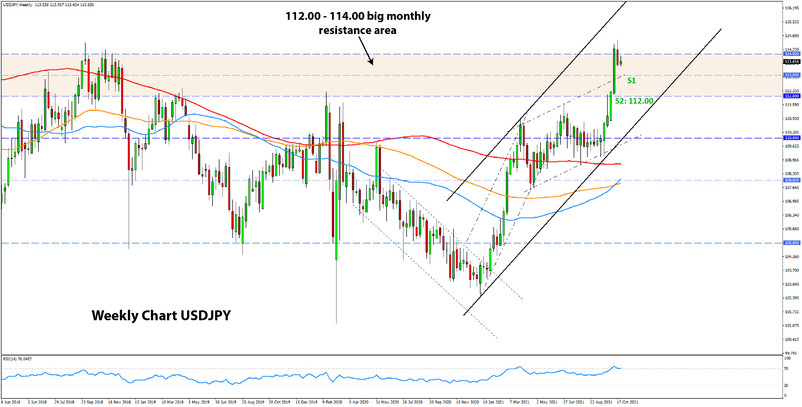

USDJPY Technical Analysis:

The recent moves in the USDJPY pair are beginning to unambiguously look like a decisive bullish breakout of that 114.00 resistance area. Last week, the price retraced moderately lower and is now below the 114.00 level, but the bulls remain in control here, and the uptrend is intact. Support levels to the downside are located around 113.00 (midpoint of the tall bull candle) and then at 112.00, where the past major highs are located.

More upside potential is opening up toward the 2017 highs around 118.00 and then the important psychological 120.00 area. There is little technical resistance above 114.00 and especially above 115.00 on the weekly chart. So, a strong move above 115.00 will significantly increase the probabilities that the next area that USDJPY reaches will be 118.00.