US Dollar Fundamental Outlook: Fed & NFP to Send USD Higher?

The GDP miss and slightly slower than forecasted core PCE inflation did not inflict greater damage to the dollar. In fact, it still ended the week stronger versus all of the major currency pairs but AUD and NZD. This attests to the narrative that the US dollar remains well-positioned for further gains in the coming weeks.

The Fed meeting this Wednesday and then Nonfarm payrolls on Friday will be the central focus for traders this week and the first huge tests for the bullish USD case. Fed rhetoric since September has turned more hawkish, and the markets now expect them to formally announce QE tapering at this meeting and potentially give hints about the first interest rate increases in 2022. As we’ve said many times on prior occasions, the Fed is on path to being one of the most hawkish central banks among major Fx currencies, and this is the main theme that should drive the dollar stronger in the period ahead. Furthermore, a potential worsening of risk sentiment in the period ahead could provide an additional boost to the safe-haven dollar, while “risky” currencies such as NZD, CAD, and AUD may lag, even though their central banks are also hawkish.

A strong Nonfarm payrolls report on Friday will hugely help but is not a prerequisite for further USD gains. Anything close to the 400K NFP and 4.7% unemployment rate forecasts will be enough to keep the USD supported. If the actual figures are much better, the US dollar will likely rally that much morepowerfully. On balance, the probabilities asymmetrically seem to favor the US dollar this week as it would take huge misses in the economic data or a shockingly dovish Fed to reverse the current bullish dynamics.

Other important data on the US calendar are the ISM manufacturing and services PMI reports, which are leading indicators for the economy.

Euro Fundamental Outlook: Excessive EUR Reaction After ECB Rightly Reversed

The EUR jumped higher following the ECB press conference last week, but it was a rally with no solid foundation and hence was rightly fully reversed on the next day. President Lagarde was dovish overall, while the ECB statement contained almost no changes from the previous one from the September meeting. The ECB firmly stays on the view that rising inflation is temporary and will abate next year as these transitory factors subside.

Friday’s Eurozone data was better than expected, but that failed to inspire excitement among EUR traders who sold the currency in anticipation that the economy will weaken further over coming quarters. High commodity prices, especially gas, will undoubtedly hurt growth in Q4 and potentially in Q1 2022. With this bleak outlook, the ECB has very few reasons to think about tightening policy. Well, at least as long as inflation is “transitory,” right?

The EUR calendar for the week ahead is much sparser compared to last and features only 2nd tier data that won’t move the market. The euro will likely be driven by the larger long-term trend dynamics as well as developments with other currencies and the broader Fx market.

EURUSD Technical Analysis:

A bit of a roller-coaster ride last week, EURUSD firstly fell, rose, and then fell even harder to finish near 1.1550 at the close. Importantly, the 1.17 support zone around the 55-day moving average (blue line) held and was where EURUSD reversed before falling hard on Friday. This was the same area that we identified over the past 2-3 weeks as likely to hold off any bullish attempts. It has now become much more likely that EURUSD has seen the cycle high here.

To the downside, the first support remains at the lows at the 1.1550 zone (1.1520 actual low). Below it, if the downtrend resumes, EURUSD could extend toward 1.14, which is a moderate support zone on larger timeframes. The head and shoulders pattern that was triggered by the break and confirmation of the neckline this summer remains alive and has its target projection in the 1.12 area.

British Pound Fundamental Outlook: Bank of England Will Hike Rates by 15bp!?

A make or break event for GBP, albeit skewed more toward “break” than “make” in the current situation, the pivotal BOE meeting is finally upon us and will take place on Thursday. Little has changed for the GBP fundamentals since last Monday. The picture remains weak, and perhaps, the market realizing this may have been the culprit behind the late Friday sell-off (OK, and some USD strength lent a hand too).

The Bank of England is in a tough position of having to raise rates for “bad” reasons (inflation) without a positive outlook for growth. Despite this, the BOE will likely still hike the interest rate on Thursday by at least 15 bp. That is fully priced into the markets, so GBP is unlikely to react much to this outcome. Instead, traders will focus on the communication (forward guidance) and the MPC votes for the rate hike (the more votes against a hike, the more dovish the takeaway). An even more dovish scenario would be a closely split vote, coupled with an explicitly dovish statement such as that further hikes aren’t likely to come. This should be enough to send GBP tumbling lower.

A much more hawkish outcome seems highly improbable. But even if the BOE tries to go down that path (e.g., by hiking rates by more than 15bp and implying that more is to come), the market is unlikely to believe it. That is, while GBP may rally initially to a hawkish BOE scenario, such a rally is likely to be short-lived only. Thus, the path of least resistance for GBP remains down.

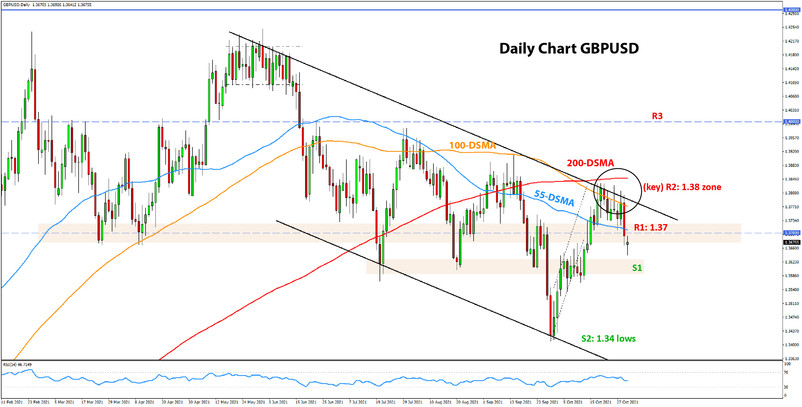

GBPUSD Technical Analysis:

Cable had another go at the 1.38 resistance but failed again, sold off sharply on Friday, and closed the week below 1.37. This is a more convincing sign that the top has been formed here, though with the likely high volatility this week, it wouldn’t be a surprise if the price gets near to this area again (see GBP fundamentals section above).

The first resistance from current levels is the 1.37 zone, around the 55-day moving average (blue line). If it holds, GBPUSD may extend losses toward 1.36 even earlier than expected. However, if the price moves above 1.37, then 1.38 may be tested next. This 1.38 zone remains the key resistance that should hold back any additional bullish attempts on any possible volatile swings this week.

To the downside, initial support is likely to be at that 1.36 zone that has been important so many times in recent history. Then the 1.34 September low is the next support lower ahead of the more important 1.33-1.32 zone.

Japanese Yen Fundamental Outlook: BOJ Not Budging About Inflation; JPY Remains Weak

The BOJ meeting last Thursday was a complete snooze. Much as expected, the Japanese central bank left policy and guidance unchanged. While other central banks are actively thinking about tightening policy or outright hiking interest rates already, the Bank of Japan is of a different breed and is not worried about rising commodity prices or accelerating inflation in other countries.

Indeed, inflation in Japan remains very low, much as it has for the past three decades. It is in stark contrast to much of the rest of the world and has created an environment that is dramatically widening the yield gap between other currencies and JPY. This is why we’ve seen JPY weaken massively, and as long as risk sentiment remains supported, the currency will remain a clear underperformer in Fx.

The rising commodity prices in the meanwhile will continue to exert additional downward pressures on JPY as Japan is a net commodity importer, and its trade balance has deteriorated as a result. The current situation seems like a perfect “bearish” storm for JPY. A reversal of these trends could potentially stop or slow the depreciation but looks very unlikely for the moment.

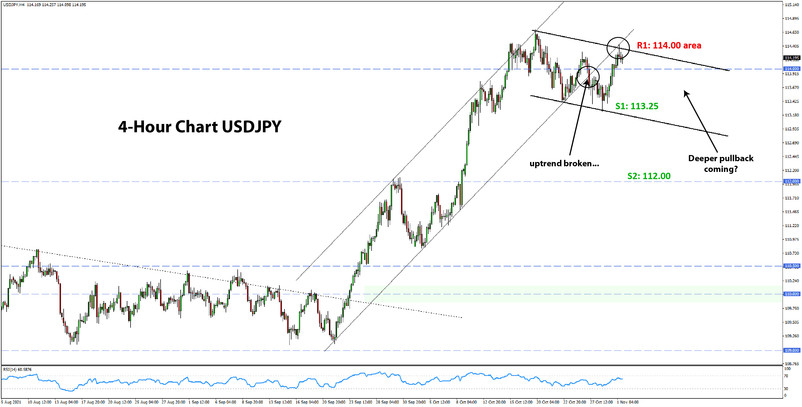

USDJPY Technical Analysis:

After the strong bull run, USDJPY has been consolidating for the past two weeks, right around the 114.00 level. The break of the rising channel on the shorter timeframes (daily and 4-hour), suggests that a top may have formed here, and a deeper correction to the downside is possible. For confirmation of this, USDJPY will need to break the first support zone around last week’s low of 113.25 (see chart below).This will open further downside potential toward the 112.00 support zone, where the past major highs are located.

But until that happens, the bulls remain firmly in control here, particularly on the longer-term timeframes. If the uptrend extends, USDJPY will have room to climb to 116.00 and then toward the 2017 highs around 118.00. The major psychological area at 120.00 may come into focus next in such a scenario.

On the higher timeframes (weekly, monthly), there is little technical resistance above 114.00 and especially above 115.00. So, a strong move above 115.00 will significantly increase the probabilities that the next levels USDJPY reaches will be toward 116.00 and 118.00.