US Dollar Fundamental Outlook: Careful Fed Approach a Let-Down for USD Bulls

The Fed leaned dovish and slightly disappointed USD bulls at their meeting Wednesday night. Many were expecting Chair Powell to reveal much more details on rate hikes and the plans for tightening, but that didn’t happen. Instead, he urged for “patience on rate hikes,” practically reiterating that rate lift-off won’t necessarily follow once tapering is completed in summer 2022. The dollar briefly declined on the Fed’s announcement, although it quickly recovered from the dip.

US data was nothing but solid last week. Friday’s Nonfarm Payrolls were better than expected overall, while ISM manufacturing and the ISM services PMIs were also strong and beat the forecasts. The jobs data confirms the positive US economic outlook, but also that the Fed should be in no rush to tighten policy. It seems USD bulls weren’t impressed with this either, much like with the Fed’s forward guidance two days earlier. Positioning, therefore, likely played a role in pushing the dollar on a retracement. Most importantly, however, the bullish USD dynamics remain completely unchanged following last week’s turbulent schedule of events. Thus, the uptrend should still be very much intact here, and sooner or later, a break to new USD cycle highs is likely.

The focus on this week’s US calendar is the Wednesday CPI report. Inflation remains the center of attention, and it will be no surprise if this is the event that unlocks further USD gains. As in recent months, if CPI prints higher than expected, it would increase pressure on the Fed to tighten more quickly and would therefore be bullish for the dollar. Ultimately, the USD uptrend should remain intact even if CPI is a slight miss to forecasts, while a beat could push the USD powerfully higher.

Euro Fundamental Outlook: The Economy is Slowing, the ECB Is Dovish, and Covid Cases Are Surging Again - Not Good for EUR

The euro is kicking off the new trading week near its lows, with the odds favoring a further decline against the likes of the greenback and the commodity dollars (AUD, CAD, NZD).

Eurozone economic data released last week was mostly weak. Notably, German industrial production and retail sales released Friday missed expectations, highlighting the weakness in the economy. Economists are expecting a further deceleration in the economy.

Covid cases are also surging across the continent and many countries are considering new lockdowns, even ones with very high vaccination rates. This is likely another big negative for the economy that can chop off more points off GDP growth and possibly even cause a technical recession in the Eurozone.

This calendar for the new week is relatively light, with only the German ZEW economic indicator and the European Commission’s quarterly economic forecasts. If the Commission’s outlook is also weak, it could inspire fresh EUR selling and push the currency on its next bear leg lower.

On balance, the low-yielding EUR with a steady dovish hand from the ECB can find few factors to draw support on. Therefore, it is likely to remain in the group of weak currencies among the Fx majors in the period ahead.

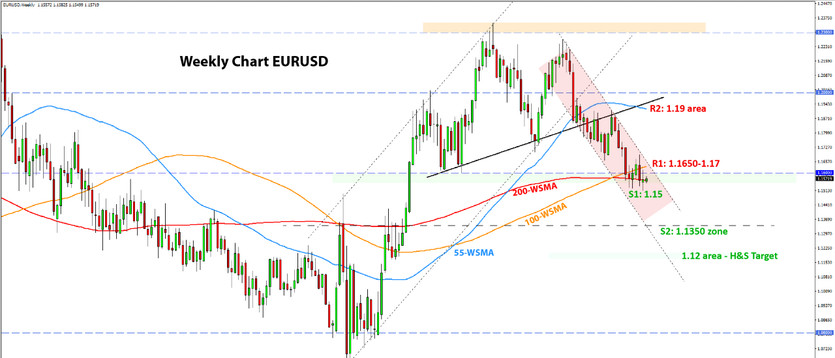

EURUSD Technical Analysis:

The technical picture mainly remains bearish here despite the bounce off fresh cycle lows on Friday. Last week’s price action looks like consolidation following the volatile moves we saw the week before.

The spinning top candle closed near 1.1560, leaving the door open for further attacks to the downside here. The first support is at the 1.1550 zone (1.1520 actual low). Below it, if the downtrend resumes, EURUSD could extend toward 1.14, which is a moderate support zone, and then 1.1350 is the more important support in the current context.

The head and shoulders pattern that was triggered by the break and confirmation of the neckline this summer remains alive and has its target projection in the 1.12 area.

The key resistance is at the 1.1650 - 1.17 area, which stopped the rally in late October. As long as it holds, the current bearish trend will stay intact. Above it, 1.19 is the next critical resistance zone on the higher timeframes.

British Pound Fundamental Outlook: The BOE Has Another Unreliable Boyfriend; GBP Dumped on BOE’s Shocking Decision to Hold Rates Steady

Many will rightly describe last week’s BOE decision as a fiasco. They’ve been propping rate hike expectations for weeks to the point where markets fully priced in a 0.15% rate hike for last Thursday. Governor Andrew Bailey even said, “we have to act on inflation” a few weeks ago. Talk about the unreliable boyfriend? That wasn’t all. The overall communication from the BOE was also very dovish, with the MPC voting 7-2 against a hike.

Hence, it is no wonder that GBP fell like a rock following such a big surprise and reversal of expectations. If you’ve been reading our weekly analysis and newsletter for a while, you were probably not as surprised as others because we were expecting GBP to fall anyway.

The GBP downtrend will likely extend, especially versus the currently stronger currencies like USD, AUD, CAD, and NZD. The UK economic calendar is quiet except on Thursday, when we will get the release of the new q/q GDP for the third quarter as well as UK manufacturing and industrial production. Negative surprises in economic data should only fuel potential GBP selling.

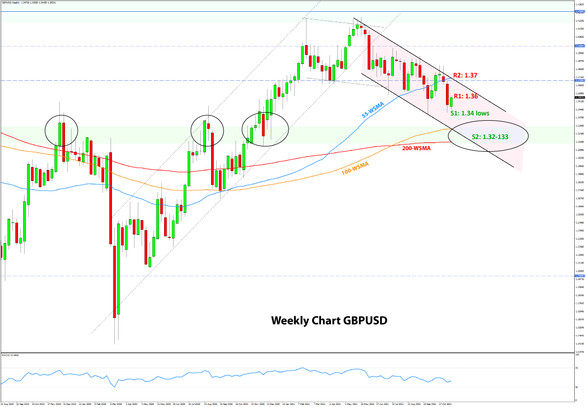

GBPUSD Technical Analysis:

Much as we anticipated, GBPUSD topped out in the 1.38 area, reversed down, and broke strongly below 1.36 last week on that BOE disappointment (discussed above). This 1.36 price zone is now the first important resistance. Cable should not move back above it this week if the downtrend is going to proceed smoothly.

The next resistance is the 1.37 zone, around the 55-day moving average (blue line) and the falling trendline. It is now the key resistance that should keep the downward channel intact.

The bearish weekly candle tells us that new cycle lows are on the cards here, at least toward the 1.33 - 1.32 support area. This is a confluence zone of the 100-week (orange) and 200-week (red) moving averages. The lower line of the current downtrend channel also comes in this same price area. Further below, the major 1.30 area will come into focus as the next support.

Japanese Yen Fundamental Outlook: JPY Recovers Some Lost Ground

The JPY was finally able to regain some lost ground after a prolonged period of weakness. In a busy calendar schedule, long-term US Treasury yields declined last week following a dovish Fed takeaway. The fall in yields pulled down USDJPY other JPY pairs (yen appreciating).

On balance, the JPY correction had more to do with external factors than domestic and JPY related ones. With this perspective in mind, the trends that recently drove JPY to 5-year lows have not been altered at all. The JPY remains at risk of further weakness, especially if 10-year US Treasuries start climbing again and if commodity prices resume the uptrends.

Conversely, if these trends reverse soon, or if risk sentiment worsens significantly and stocks start falling, the JPY will likely regain its shine and could test levels toward 112.00 against the dollar.

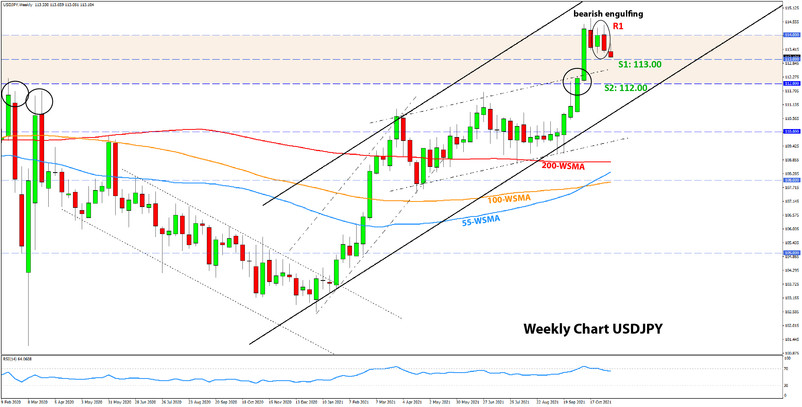

USDJPY Technical Analysis:

It is the first time since the strong September-October rally that we get a bearish weekly signal on USDJPY. The bearish signal is the small engulfing candle that formed last week. However, this is not a strong signal considering the size of the pattern relative to the previous tall green candle. The bulls are still very much in control here, but the bearish engulfing candle could prove an important sign that a deeper correction may be coming.

For confirmation of this, USDJPY will need to break the first support zone around last week’s low of 113.25, and then more thoroughly through the 113.00 zone. This will open further downside potential toward the 112.00 support zone, where the past major highs are located.

On the other hand, a bullish break above the 114.60 high will open room for USDJPY to climb to 116.00 and then toward the 2017 highs around 118.00. The major psychological area at 120.00 may come into focus next in such a scenario.