US Dollar Fundamental Outlook: Shock 6.2% Inflation Rattles Markets, USD Goes Up!

Inflation was front and center for the dollar last week, and the much hotter than expected CPI report Wednesday helped to push the USD index to fresh highs for the year. The initial reaction was mixed, with inflation hedges like gold and silver rising and the USD even falling briefly, but then the USD started to rise again and closed the day sharply higher.

Headline inflation was 6.2% vs. a 5.8% forecast, while the core CPI reading was also hot at 4.6% vs. 4.3% forecasted. The Fed’s confident “transitory” narrative is beginning to be seriously doubted, and there is a good chance that FOMC members will start to be more vocal in the period ahead. The risks for a hawkish tilt at the Fed have just increased massively, and with that, the odds for a further rise in the USD. Following the post-CPI rally, the dollar was a tad weaker Friday on the huge miss in the UoM consumer sentiment survey. While an important report that the Fed watches closely, the weak UoM consumer sentiment should not sway the Fed to remain ultra dovish in the face of continued surging inflation.

The US calendar is relatively light for the week ahead, featuring the retail sales report and 2nd tier data such as housing and the Philly Fed manufacturing index. More interesting will be the array of Fed speakers throughout the week. The market’s overall takeaway from those little speeches could very well end up being the main driver of the USD this week. With inflation already at 6.2% and no signs of it abating any time soon, many Fed speakers may lean on the hawkish side this week, which could provide another boost for the US dollar.

Another front to watch is President Biden’s expected announcement for the next Fed Chairman. He should make the call any day now, and while Jerome Powell is the most likely candidate to win the term (his 2nd), if he doesn’t, the Fx market could react by selling the dollar. Notably, Lael Brainard is the other favorite candidate, and she is seen as a more dovish central banker. So, if she gets the term, the dollar could suffer initially on the announcement, albeit this too should be short-lived as who leads the Fed may not make a huge difference when inflation is at 6.2%!

Euro Fundamental Outlook: EU Countries Are Imposing Covid Lockdowns Again, Despite High Vaccination Rates. Yikes!

Covid lockdowns are here again in Europe, and people are not happy. Rightly or not, some European countries with relatively high vaccination rates (think Netherlands, Norway, Denmark) are still looking to impose restrictions on their citizens to fight a new surge in Covid cases and hospitalizations. And we thought we would achieve herd immunity with vaccination rates of around 70% or higher. Disappointing!

The euro doesn’t like the news either. The currency is breaking to new lows within the downtrend and was one of the worst performers in Fx last week. In the meantime, the economy should already be feeling the impact of the new Covid wave. The EU Commission forecasts released last week had similar inflation projections like the ECB, i.e., much lower than in the US and elsewhere. Thus, from this perspective, the main bearish EURUSD narrative of inflation and yields divergence between the EU and US remains in place and should continue to push EURUSD lower this and in the coming weeks.

This week’s Eurozone economic calendar is also light, with only the preliminary (flash) GDP scheduled for release tomorrow (November 16). If anything, a miss in expectations could only add to the EUR’s woes and push it further lower.

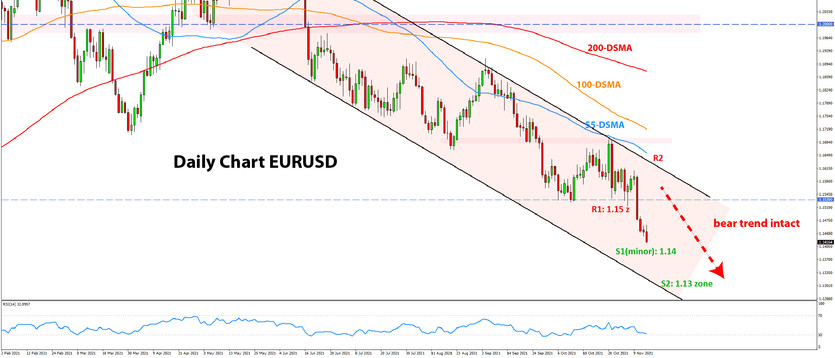

EURUSD Technical Analysis:

EURUSD finally cracked 1.15 and recorded a new swing low in the current bear trend. The price action is progressing pretty much as we anticipated in our recent analysis, with the 1.1650 - 1.17 resistance holding the retracement in late October and the bearish trend extending lower now.

The next support is around the 1.14 level. But it is not a significant technical zone, so the focus will be on the next support. It is the 1.13 area, which is the first important support zone down from current levels.

The head and shoulders pattern that was triggered by the break and confirmation of the neckline this summer remains alive and has its target projection in the 1.12 area.

To the upside, 1.15 is the first resistance zone now that should fight off any attempts by the bulls to reconquer the trend.

British Pound Fundamental Outlook: Jobs & Inflation in Focus on the Calendar

Sterling extended the fall in the first part of the past week but then consolidated and even managed to end the week higher versus some currencies. Some repricing of BOE hike expectations likely played a role in the GBP’s apparent resilience. While the BOE disappointed earlier this month, they are still set to provide that rate hike in December. One month doesn’t make a huge difference, and the market knows that the BOE is still one of the more hawkish central banks in Fx. Hence, the downward path for GBP may not be as straightforward as in other currencies. Still, the trajectory is likely to be down, especially against currently strengthening currencies like the dollar, as the UK’s economy underperformance should limit any BOE hawkishness.

Brexit concerns are also lurking in the background again as the UK is allegedly considering triggering article 16 of the Brexit deal over the Northern Ireland border dispute with the EU. So far, the impact on GBP is minimal as markets are not expecting things to deteriorate, but if this escalates, the currency will plunge hard. Watch this space as it could provide significant GBP bearish momentum if EU-UK frictions escalate again.

It is another eventful calendar for GBP this week, with the focus on Tuesday’s employment data and Wednesday’s CPI inflation. Retail sales will be published on Friday also. Strong data, especially on inflation, will refuel BOE hike expectations and could give GBP a boost. Weak data, on the other hand, will probably result in an extension of the GBP downtrend.

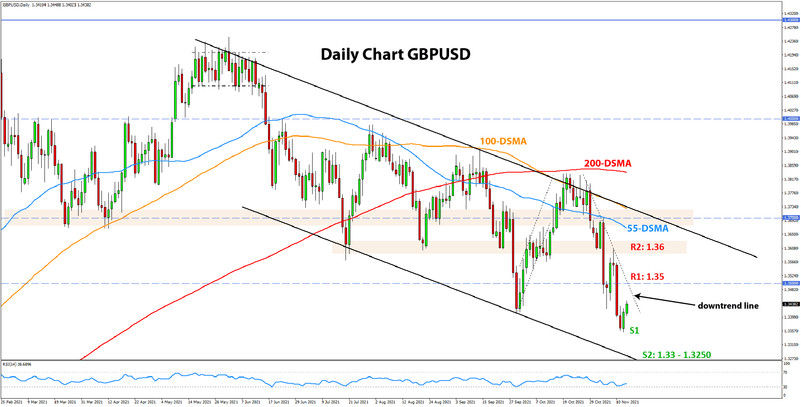

GBPUSD Technical Analysis:

GBPUSD found some support around the 1.34 zone again and started to recover modestly from here last week. However, the bounce doesn’t inspire much confidence for bulls thus far, and it looks more like a retracement within the bearish trend than something serious that can pose a threat to the downtrend.

The first important resistance is the 1.35 zone. It should stop potential bullish attempts and keep the downtrend intact. 1.36 is the next important resistance higher.

On the downside, all eyes are on last week’s low around 1.3350, and its potential break that can push GBPUSD to reach the lower trendline of the channel formation. Currently, it is located in the 1.3250 - 1.33 area, which is likely the target zone for many GBPUSD bears.

Japanese Yen Fundamental Outlook: JPY Holds Its Ground for Another Week

The yen remained resilient and finished down only against the US dollar last week. Still, when looked at in the larger context, JPY is 3% down vs. USD in Q3 and remains the currency with one of the weakest fundamentals currently. Risks of further weakness are very much alive as long as risk sentiment remains strong and commodity prices remain elevated. If US Treasuries start climbing again, it should add fuel to the USDJPY uptrend.

In the opposite scenario, an episode of risk aversion will likely bring back some flows to the yen and help it to recover from recent losses. With inflation on the rise, the positive outlook for stocks is not as robust as earlier this year.

Japanese GDP already released earlier today missed expectations. The other key data piece this week is the national core CPI on Friday, which is expected to show 0.1% y/y, way lower than the inflation seen in western economies.

USDJPY Technical Analysis:

USDJPY tested the 113.00 support zone last week and rebounded strongly off it on some USD strength. The bulls seem to be still in control here, but the potential for a lower correction will remain as long as the current consolidation formation (bull flag appearance) is not broken to the upside.

On the other hand, a bullish break above the 114.00 high of the consolidation formation and then above the 114.60 high of the bull leg will open room for USDJPY to climb toward 116.00. Above it, the next target area will be toward the 2017 highs around 118.00. The major psychological area at 120.00 may come into focus next under this bullish scenario.

To the downside, below the 112.80-113.00 zone, the next support would likely come in around the 112.00 level.