US Dollar Fundamental Outlook: A Busy Wednesday in a Light Thanksgiving Week - Watch GDP and PCE Inflation

The greenback extended its rise last week, with the DXY index strengthening another 1% in addition to the 0.87% rally from the week before. The string of positive data and hawkish comments from FOMC members fueled the already underway USD uptrend.

With the booming retail sales report, a falling unemployment rate, and inflation way above the Fed’s 2% target, FOMC policymakers have all the reasons to lean hawkish. As Chair Powell said during the last Fed press conference, the pace of tapering can be adjusted if needed, and the markets are now starting to price in a faster taper process. Moreover, Fed Fund futures show two rate hikes priced in for the second half of next year. With such bullish market dynamics, the USD rally is on solid footing and has a lot of room to extend.

The busiest day this week is Wednesday, when we’ll get the latest GDP and PCE inflation reports as well as the FOMC meeting minutes later in the day. The calendar is strangely packed on Wednesday, while other days are very light due to the Thanksgiving holiday Thursday followed by Black Friday. This means that the last two days of the week could be very quiet with little action in Fx. Reports like the unemployment claims, which are usually always released on Thursdays, will also be released on Wednesday.

Potential risks for USD bulls are possible misses in the data, which could be a reason for consolidation, especially given the strong USD appreciation recently. Still, any consolidation should be temporary and is unlikely to take a big bite out of the dollar uptrend.

Elsewhere, President Biden’s expected announcement for the next Fed Chairman remains another front to watch. Biden should make the call any day now (not a set date given, but he said last week he would do so around the Thanksgiving holiday). While Jerome Powell is still seen as the most likely candidate to get the reappointment (his 2nd term), if he does not, the Fx market could react by selling the dollar. Notably, Lael Brainard is the other favorite candidate, and she is seen as a more dovish central banker. So, if she gets the term, the dollar could suffer initially on the announcement, albeit this too should be short-lived as who leads the Fed is unlikely to make a huge difference.

Euro Fundamental Outlook: Slide Extends as More (Vaccinated) Countries Impose Harsh Lockdowns

More bad news out of mainland Europe hit the currency last week. The winter Covid wave continues to rage even in highly vaccinated countries. It is now the official cause for authorities to again lock down large parts of the EU with restrictions applying both to the vaccinated and unvaccinated alike.

Notably, not only EURUSD was moving lower, but EURCHF also broke below 1.05 on the negative newsflow (EURCHF hasn’t been this low since 2015). Even if you look very hard until your eyes hurt, you won’t find anything positive about the euro at the moment.

The services and manufacturing PMIs (preliminary releases) out of the Eurozone will show how much businesses are feeling the impact of this Covid wave. The reports will be out tomorrow (Tuesday), with expectations already way lower than in recent months. If the actual figures miss even those low expectations, the EUR will be virtually “free” to continue its slide downhill.

EURUSD Technical Analysis:

EURUSD plunged further in an extension of the downtrend and reached levels last seen in early July of 2020. A straight road down since the late October reversal at the 1.1650 - 1.17 resistance area, the bearish trend accelerated, and the pair closed the past week below the 1.13 level. This puts the 1.12 target of the head and shoulders pattern well within reach, with little to stop EURUSD from getting there in the near future. This is also the next support lower from current levels.

In our previous weekly, we said the 1.13 area is the first important support zone. Indeed, EURUSD stopped and even bounced here last Wednesday only to be pressed down again. While currently below 1.13, this support zone has not been totally broken yet, and there is still a possibility for a bounce to take the pair above it. Nonetheless, the bearish trend is strong and any rallies will hardly be durable in this situation.

To the upside, 1.14 is the first resistance in sight. However, it is not a significant technical area, so the nearest important resistance remains at the 1.15 zone ahead of the next one at 1.16.

British Pound Fundamental Outlook: GBP Traders Brace Yourselves, Brexit Is Back

The pound stayed resilient as UK data mostly beat expectations last week, keeping BOE rate hike prospects intact. And while the main focus is still on what the BOE will do, Brexit is also entering the main picture for GBP (again). Markets are nervous about the possibility of the UK triggering article 16 of the Brexit deal, which could mean that we are back to the so-called “hard Brexit” scenario.

Although huge volatility magnitudes like the ones seen in the 2016-2020 period are less likely this time around, a unilateral suspension of the UK-EU Brexit deal would still be a hard hit for GBP. Market pricing also shows there is only a modest amount of Brexit risks priced in to GBP at the moment. Most of the recent decline was due to the BOE’s rate hike disappointment and not Brexit. So, if the UK decides to trigger article 16, expect GBP to be hit hard on the news as the Fx market will have to adjust and re-price the new situation.

Furthermore, BOE rate hike odds are still running a bit high for next year, so there is plenty of scope for more disappointments, even without the Brexit gloom and doom. And if the UK decides to trigger article 16, then the Bank of England will have its hands tied and will have to stay dovish to support the economy. In this environment, there seem to be more negative risks to the GBP outlook than the potential for positive surprises. Hence, the currency should remain vulnerable in the period ahead. But, until the actual newsflow turns more negative, the pound can be supported for a while longer. If you are looking to short GBP, it would still be best to do it against the US dollar, which is generally strong at the moment.

GBPUSD Technical Analysis:

Cable consolidated above the 1.34 support zone but remained well-contained, far from posing any serious challenge to the downtrend here. Yes, it did rally as high as 1.35, but the attempt was sharply rejected there. Overall, the ongoing GBPUSD action still looks like a consolidation within the larger trend here which has been down.

The 1.35 zone remains the first important resistance to the upside. However, the weekly chart below shows that the bearish trend will be intact even if the bulls try to test levels as high as 1.37. This is the absolute upper border of the trend as the channel resistance line should stop any possible bullish attempts here if the bear trend is going to remain intact.

On the downside, the lower trendline of the same channel formation tells us support is currently located at the 1.3250 - 1.33 area. The 200-day (red) and 100-day (orange) moving average lines are at 1.3157 and 1.3288 each, which more concretely define the wider support area at this juncture.

Japanese Yen Fundamental Outlook: JPY Stays Firm as US Yields Fail to Break Higher & Oil Rally Retraces Further

The JPY was generally firm for another week and strengthened notably versus some weaker currencies like the euro. US Treasury yields were flat, with the 10-year yield falling to break above a key threshold around the 1.65% level. With yields contained, so was USDJPY as the two continue to be closely linked. Thus, a sustainable break higher in USDJPY (i.e., further JPY weakness) will likely require a bullish breakout in US Treasury yields as well.

In the meantime, oil prices declined further, which was the 4th down week in a row. Overall, the main factors that were behind the sharp JPY depreciation in September and October have receded in recent weeks; hence, JPY held its ground.

With inflation on the rise, the positive outlook for stocks and risk appetite is not as robust as earlier this year. Moreover, with Biden complaining about high oil prices and talking about fighting the market by releasing oil from the US Strategic Petroleum Reserves, the outlook for oil and commodities is not as robust as previously either. In such an environment, it will be harder for JPY to weaken further and may, in fact, start to regain some of the lost ground.

The focus on the Japanese economic calendar is on the y/y releases of the BOJ and Tokyo Core CPI reports out on Wednesday and Friday, respectively. It will be interesting to see what inflation is doing in Japan in the current global inflationary climate, but as usual, don’t expect any JPY reaction in the Fx market on this.

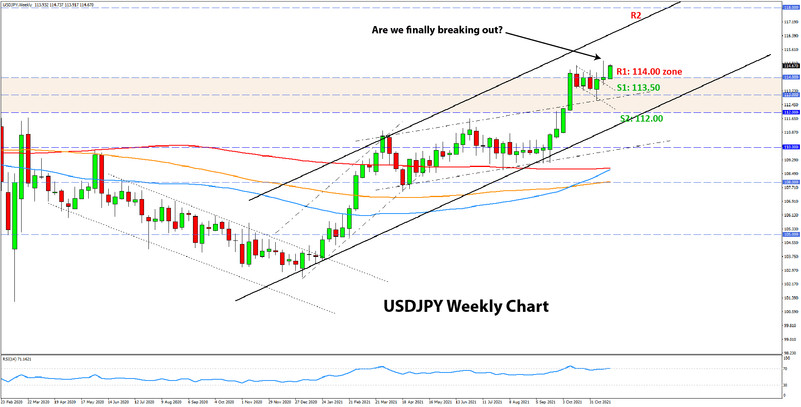

USDJPY Technical Analysis:

USDJPY has been playing with that resistance zone around the 114.00 level for some 5-6 weeks now and hasn’t been able to break it. Two attempts were already rejected, and it seems a third one is already underway today.

The trend is no doubt bullish here, so a move above last week’s high near 115.00 will be an extension of this trend. The trend channel formation shows us that its resistance line comes in at the 116.50 - 117.00 area as the first target and resistance zone. Of course, this is a trend channel, so it is a rising trendline, and it shows that the target will move up to around the 118.00 zone in mid-January. Remember that 118.00 is also the major technical area on the monthly chart, so some reaction is likely there if USDJPY climbs that high.

To the downside, expect support around the 114.00 zone and then at 113.50. A move below 113.50 would not be a good sign for the bulls, as it will likely mean that a deeper retracement is coming. Under such a scenario, 112.00 would be the next support that may be tested.