US Dollar Fundamental Outlook: Fed’s Hawkish Shift Intact - Powell Says Time To Retire “Transitory”

The big news last week was Fed chair Powell’s testimony before the Senate, where he officialized the Fed’s hawkish shift by saying that it is time to retire the word “transitory” when describing inflation. The dollar surged as he was saying the words (EURUSD down 120+ pips, USDJPY up 90+ pips), although these gains retraced in the following days as traders are still coming to terms with the appearance of Omicron.

In addition to the new uncertainties around the virus, some US data last week disappointed (Nonfarm Payrolls, consumer confidence) and there are more pivotal events this and next week scheduled (Fed meeting December 15). So, between all those uncertainties, it’s natural that traders don’t want to take new positions. Hence, the dollar consolidation seems likely to continue in the following days and into the all-important Fed meeting next Wednesday.

Nonetheless, the message from Powell was clear and reasserted the Fed’s seriousness in fighting inflation. Several FOMC members have already said they think the Fed should end QE sooner and probably start raising rates by mid-2022. This is much more hawkish relative to other major central banks, and this theme should eventually support the dollar in the period ahead (think into and during Q1 2022). And while Nonfarm Payrolls missed expectations, the unemployment rate fell substantially, making the overall takeaway from the jobs reports a neutral one. There was nothing in the data to discourage the Fed from proceeding with faster QE tapering next month.

It is a relatively light US calendar until Friday when the latest CPI inflation data will be released. Another hot report is expected by economists (y/y headline 6.7% and core 4.9%), with potential for upside surprises. Based on the actual CPI release, the USD could extend the uptrend (CPI beat) or extend the consolidation (on a CPI miss).

Euro Fundamental Outlook: Inflation Heats Up, but the ECB Won’t Budge One Bit - Here’s Why

Inflation was a hot topic in Europe last week. The latest CPI data showed y/y Eurozone inflation has risen to 4.9%, much higher than the 4.5% consensus forecast. The core CPI measure also beat expectations of 2.3% and rose 2.6%. Still, despite the upside surprises, the ECB doesn’t seem worried by inflation, or at least not as much as the Fed or BOE, for example. ECB Governing Council members, including President Lagarde, were out speaking last week, reiterating that rate hikes in 2022 are highly unlikely and inflation is only a passing “hump.”

Indeed, there are some well-known temporary inflation factors in the Eurozone, such as base effects from the German VAT increase, which will put downward pressure on headline CPI starting from next month (January 2022). Moreover, core inflation still remains way lower than other countries and way lower than what the ECB would like to see on an average basis. With these dynamics set to persist, the EUR should continue to struggle and remain downwardly pressured, particularly against currencies with hawkish central banks.

This week’s quiet calendar sees only the German ZEW economic sentiment reports. Activity has been declining since May and could even turn to negative (contractionary) territory in the coming months as lockdowns and vaccine mandates hit the Eurozone economy during this winter. Just another reason for the ECB to stay uber-dovish and the euro weak!

EURUSD Technical Analysis:

EURUSD has been in consolidation mode for the past couple of weeks. The range so far recorded a high around 1.1380 and a low around 1.1180. As we’ve noted in prior weekly editions, 1.12 – 1.13 is a solid support area, and the consolidation seems like a natural development at this stage.

The downtrend remains intact, and it will take a rally toward the 1.15 – 1.16 area to pose a serious challenge. This area is also the primary resistance zone higher from current levels. It can also be defined as the area around and between the 100-week (orange) and 200-week (red) moving averages, currently located at 1.1635 and 1.1540 each. In fact, similar technical factors are pointing to this same area as important resistance on the daily chart as well. So, we can safely say that the wider area of 1.1500 – 1.1650 is a critical resistance area in EURUSD. And as long as the price is below it, the trend remains down.

In terms of support levels to the downside, a potential break below the 1.12 – 1.13 support will bring the focus to the 1.10 psychological zone as the next important support.

British Pound Fundamental Outlook: BOE Rate Hike Bets Are Having a Wild Ride Again (and so Does GBP)

GBP had some rollercoaster moves during the week, though it generally closed lower on Friday. Perhaps the biggest negative was the speech Friday afternoon from BOE hawk Michael Saunders who said that the uncertainties around the Omicron variant might make him vote for no rate hike at the next meeting (December 16). This was a big surprise for the markets because Saunders was one of the only two MPC members who voted for a hike in November (7-2 vote to keep rates steady).

Could the Bank of England deliver another disappointment to GBP bulls? If so, the selling can certainly extend as we already saw last week on Saunders comments. The risk-off sentiment also prevailed for another week, which is not the best environment for sterling either. While not as sensitive to risk sentiment as other currencies, GBP still tends to weaken in periods of risk-aversion. So, this factor is no longer a tailwind for the pound.

The UK calendar is also light, with perhaps Friday only more interesting around the GDP release. Overall, GBP looks set to remain in broader ranges this week as traders gear up for the Bank of England meeting next Thursday.

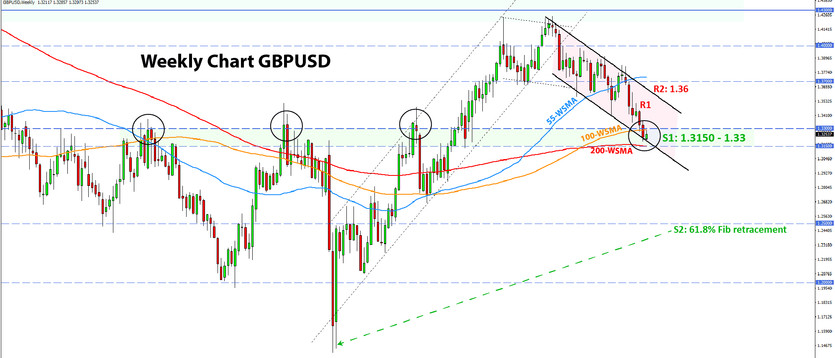

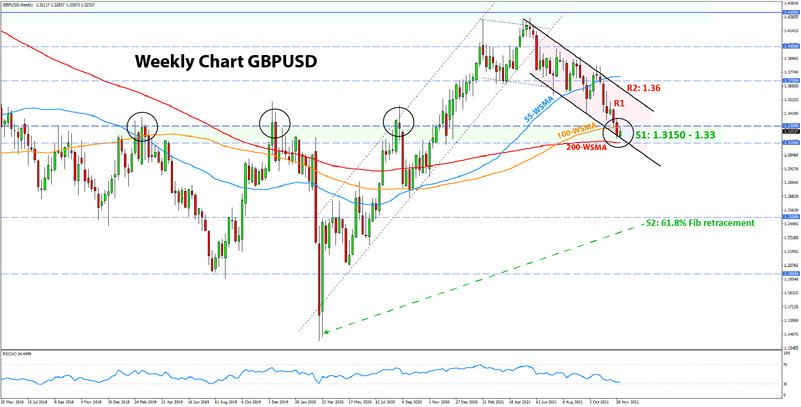

GBPUSD Technical Analysis:

Cable reached the 1.3150 – 1.33 big support area that we discussed last Monday. As can be seen from the weekly chart below, it is indeed a zone where GBPUSD has reversed multiple times over the past years. Moreover, the 100-week and 200-week moving averages are located in the same area.

Given the significant support barrier very near to current levels (in the context of the weekly chart), short positions do not look attractive as long as GBPUSD is above this 3150 – 1.33 support. However, a bearish breakout below the 1.3150 could lead to a significant sell-off, at least based on the technicals. There are no big support zones below 1.3150, except for the 1.30 psychological zone, but it’s questionable how much it could hold off such a sell-off on its own without additional technical indicators lining up near it. Thus, the next big support below 1.3150 is way down at the 1.25 – 1.26 area, which is the 61.8% Fibonacci retracement (from March 2020 low to May 2021 high).

Resistance zones up from current levels are located at 1.34 and 1.35 ahead of the more important one around 1.36.

Japanese Yen Fundamental Outlook: JPY Extends Gains as Positioning Unwind and Risk Aversion Continue

JPY had another strong performance in the prior week as the unwinding of risk-on trades continued and risk aversion persisted. JPY positioning is still overextended after that massive decline during September/October, and further reductions can continue to play a role in JPY strength for a while longer.

The Omicron variant and the Fed’s tapering plans are front and center when it comes to the risk mood across markets. The number of uncertainties has suddenly increased due to the new Covid strain because it could have different implications for the economy and inflation. Thus, it will likely remain the dominant driver of JPY this week as well.

However, more should be known about Omicron soon, perhaps even this week. And if the news is good (as in Omicron being less dangerous), risky assets could rally in relief. This scenario would likely see the JPY underperforming. If, on the other, scientists’ assessments of the new variant are worrisome, then the risk mood will sour again. JPY will be a winner in this scenario. The Covid worries have also depressed US Treasury yields, making it another factor that has now turned from a headwind to a tailwind for the yen.

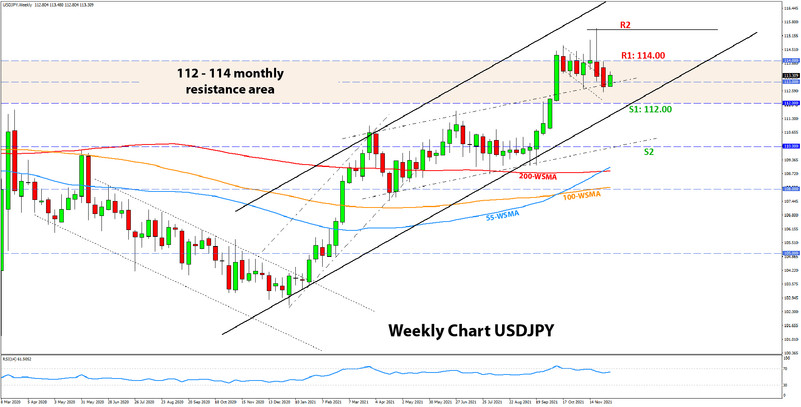

USDJPY Technical Analysis:

USDJPY is now fully back inside the 112.00 – 114.00 range that we identified back in September and October as a critical resistance area. It seems it has essentially held off the bullish attempt here, although the bulls are by no means done yet.

For now, USDJPY remains in no man’s land. A move above 114.00 would start to open up upside potential again. On the other hand, a break below 112.00 would technically end this uptrend that has been in force since the beginning of this year (January 6 is the actual low).

Thus, 112.00 and 114.00 are the two crucial technical zones for traders to watch. Until one breaks, USDJPY can continue to range-trade for a while between these two zones.