Note: This is the last Fx weekly for this year. We’ll resume with our regular weekly updates every Monday from January 10. In the meantime, stay tuned for our yearly 2022 Fx analysis that we will publish in the first week of the new year (January 3-7, 2022).

US Dollar Fundamental Outlook: Fed Delivers on Hawkish Expectations; PCE Inflation in Focus This Week

The Fed largely delivered on the hawkish market expectations for the meeting last Wednesday. They doubled the pace of tapering to 30B per month, meaning that QE will end completely in March 2022. Many view this as the Fed opening the door to an earlier rate hike, potentially even in March.

They also significantly upgraded their inflation forecasts, now expecting it to finish this year at 5.3% and next year at 2.6%. All this was hawkish, yet the dollar ended the day lower and fell further the following day. Indeed, almost everything the Fed did was fully priced into the Fx market. Profit-taking and position squaring ahead of the holidays were likely a factor behind the post-Fed USD correction.

However, the case for further modest USD strength largely remains intact. Perhaps that was most evident on Friday when the dollar returned toward its weekly high. After the initial Fed reaction was digested, traders were back to buying dollars as it remains the “cleanest dirty shirt” among major Fx currencies. Investors know in the back of their minds that the Fed is the most hawkish major central bank currently, and few would want to stand in the way of this USD uptrend.

The focus this week is on the PCE inflation report, due on Thursday. A hotter number than the consensus forecasts (or the Fed’s 5.3%) can easily inspire fresh USD buying and potentially take it to new local highs. Keep in mind, however, the illiquid holiday period will start toward the end of this week (Christmas is on Saturday) and will last into the new year. This could mean that any reaction to the PCE inflation data may be muted as the market prepares to settle in a holiday range.

Other than the PCE inflation report, the calendar is very light this week and next but will get busier in the first week of January. Following the New Year break, the main focus for Fx traders will be on Nonfarm Payrolls that Friday (January 7). The ISM manufacturing and services PMIs will also be released that week.

Euro Fundamental Outlook: ECB Stays Dovish, Reiterates no Rate Hikes in 2022

The EUR got a lift post the ECB meeting, which was likely also an extension of the corrective USD reaction to the Fed meeting from the day before. Aside from the sheer volatility of a very busy week, other potential reasons that caused the euro’s bullish reaction are the slight hawkish adjustments the ECB made, such as the sizable upward revision of their inflation projections. Most forecasters didn’t expect such a sharp increase, especially for 2022 which was upgraded to 3.2% vs the previous forecast of 1.7% made in September.

Still, the overall takeaway from the ECB meeting was neutral and more dovish than hawkish in any case. The ECB firmly remains one of the most dovish central banks on a relative basis. While everyone else is tapering QE and preparing to hike rates, the ECB just told us last week that they will keep doing QE purchases at least until the end of 2022 and possibly beyond. The ECB also reiterated that rate hikes are highly unlikely to come next year. All of this is pure dovishness that will hardly inspire any flows into the EUR currency for the time being.

The EUR calendar is also very quiet over the final two weeks of 2021 and gets somewhat busier on the first week of the new year, with the key focus on flash CPI inflation (January 7). In the meantime, the already established trends and ranges are likely to dominate EUR price action, or the market may simply spend the entire holiday period in compressed horizontal consolidation.

EURUSD Technical Analysis:

EURUSD continues to trade in its consolidation range that is thus far capped around the 1.1380 high to the upside, and the 1.12 zone to the downside. Based on the channel that defined the downtrend since June and the RSI’s reading close to 30, the consolidation can continue for a few more weeks.

This means that EURUSD can potentially make another upside attempt toward the top side of the range at 1.1380 and above. In this regard, the key resistance to hold the downtrend intact is the 1.15 zone, around the channel’s falling trendline. But it’s important to keep in mind that this trendline is moving down, so it currently stands near 1.1450 but will converge further lower toward 1.14 over the coming weeks.

Support seems firmly pinned around the 1.12 zone. A break below the November low here would suggest that the road toward the 1.10 area is clearing.

British Pound Fundamental Outlook: BOE Surprises Again (This Time With a Hike) But GBP falters Anyway

The Bank of England has done it again! This time, they surprised the market with a rate hike (remember, in November they surprised by keeping rates unchanged). We saw a strong bullish GBP reaction in the first moments after the announcement, but the surprise hawkish decision failed to inspire lasting GBP strength, and the entire move faded by the Friday close.

Omicron and the worsening Covid outlook in the UK are probably to blame for GBPs bleak performance in the face of a more hawkish BOE. The UK is seeing record numbers of infections, and the government is imposing new restrictions to alleviate the increasingly overwhelmed National Health Service. Even a hawkish Bank of England can’t help the currency much in these circumstances, where the lockdowns will undoubtedly hit the economy and take a bite from GDP growth.

In this regard, the bigger scope for the pound to weaken would be versus the USD, while it may remain more resilient against the low-yielders and underperformers such as the EUR and JPY. GBP traders should also watch broader risk sentient as it can significantly change this narrative, and the pound can be sensitive to a worsening risk appetite (e.g., if stocks dump, GBP could sell-off too).

Following the super-busy schedule last week, the GBP calendar has nothing to offer in the three weeks ahead that can excite Fx traders. Thus the pound sterling will continue to trade based on sentiment, the developments with the omicron variant and potentially Brexit also with the issues over the disputed Northern Ireland protocol still lingering.

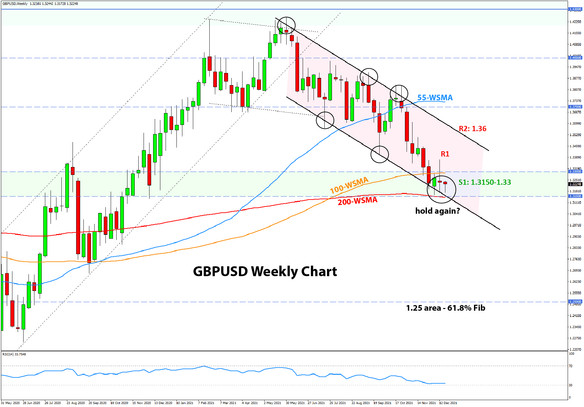

GBPUSD Technical Analysis:

Cable reached the 1.3150 – 1.33 big support area in late November and has started to consolidate here since then. This was very much expected and what we already discussed here last month when the pair was trading above 1.34.

The 1.3150 – 1.33 zone is a crucial support area in the current context. It is where GBPUSD has reversed multiple times over the past years and where the 100-week and 200-week moving averages are also currently located (see chart).

Given the significant support barrier very near to current levels (in the context of the weekly chart), short positions do not look attractive as long as GBPUSD is above this 3150 – 1.33 support. However, a bearish breakout below the 1.3150 could lead to a significant sell-off, at least based on the technicals. There are no big support zones below 1.3150, except for the 1.30 psychological zone, but it’s questionable how much it could hold off such a sell-off on its own without additional technical indicators lining up near it. Thus, the next big support below 1.3150 is way down at the 1.25 – 1.26 area, which is the 61.8% Fibonacci retracement (from March 2020 low to May 2021 high).

To the upside from current levels, resistance zones are located at 1.34 and 1.35 ahead of the more important one around 1.36.

Japanese Yen Fundamental Outlook: The Bearish JPY Factors Have Moderated Recently

Traders reduced short JPY exposure in recent weeks as the omicron variant hit the newswires and rattled markets. While stocks returned to all-time highs, traders have not re-added to short yen positions, holding down JPY pairs. US Treasury yields are also lower than they were before Omicron hit, which is another factor that’s keeping USDJPY and other JPY pairs subdued.

Risk sentiment, usually the key factor that drives the yen, will likely play a major role again going forward. A potential positive scenario for risk sentiment (e.g., Omicron confirmed as a less severe variant and restrictions eased) could see yen pairs rising again (JPY weaker). On the other hand, if risk-off worsens further for some reason (e.g., it becomes evident that Omicron is, in fact, as deadly as delta), then stocks may tumble, considering that Omicron is much more infectious and easily spread than delta or other Covid variants we’ve known so far. Such a scenario can send US yields and yen pairs down (JPY stronger).

All in all, it seems the bearish JPY factors of rising commodity prices, strong stock markets, and higher US Treasury yields that kept JPY weak throughout this year have moderated with the appearance of Omicron. How things develop with this variant will probably, to a great extent, affect where JPY trades during the holidays and in the next few weeks.

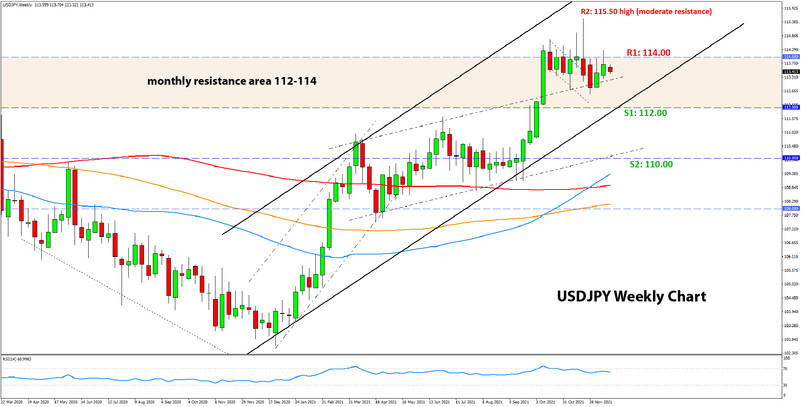

USDJPY Technical Analysis:

USDJPY continues to trade inside the 112.00 – 114.00 range that previously we identified as a critical resistance area. Thus, this weekly/monthly resistance area is so far holding and seems to have stopped the bullish attempt in October.

For now, though, USDJPY remains in no man’s land. A move above 114.00 would start to open up upside potential again. Such a scenario could see USDJPY rising above 115.00 and toward 118.00, which is the next significant resistance zone. On the other hand, a break below 112.00 would technically end this uptrend (channel) that has been in force since the beginning of this year (January 6 is the actual low). In this case, it shouldn’t take long before USDJPY reaches 110.00 again.

Thus, 112.00 and 114.00 are the two crucial technical zones for traders to watch. Until one breaks, USDJPY can continue to range-trade for a while between these two zones.