USD Fundamentals: King dollar returns with a vengeance as Fed leads CBs in the fight against inflation

The dollar’s performance in 2021 surprised many analysts. Contrary to forecasts, it ended the year much stronger instead of weaker. The USD reached its yearly low during the Capitol Hill riots on January 6, 2021, and aside from the weakness in April and May, it has been a steady ride higher for the greenback.

Now, at the start of 2022, things look very different from a year ago. Larger than expected inflation increases and a subsequent shift in Fed’s policy expectations in a hawkish direction during 2021 have turned the market bullish on USD. This change in dynamics has now reversed almost the entire bear trend from 2020.

US Dollar strength likely to extend into H1 2022 with less clarity afterward

While inflation is rising nearly everywhere, it stands much higher in the US compared to Europe or other places. This divergence translated into central bank policy divergence, resulting in a much more hawkish Fed compared to, e.g., the ECB or BOJ. This was the main factor that supported the dollar last year and should continue to support it during the new 2022 as the Fed looks set to turn even more hawkish in an effort to combat rising prices and anchor inflation expectations. Indeed, as long as the Fed stays hawkish, the USD will likely stay strong too.

The Fed’s hawkish stance is mainly illustrated by the consensus forecasts predicting three rate hikes by the end of 2022, possibly also accompanied by quantitative tightening (QT - opposite of QE).

Two possible scenarios centered around those market expectations could lead to either a stronger or weaker dollar this year:

· Bullish USD scenario (most likely) – the Fed delivers on those hawkish expectations or turns even more hawkish (e.g., also starts QT and delivers more than three rate hikes). – outcome: USD stays firm for most of 2022

· Bearish USD scenario – the Fed delivers less than the three rate hikes or none. – outcome: would likely lead to a reversal of dollar strength. Possible reasons for this to happen could be inflation starting to cool off by the summer, and the Fed actually has to shift dovish again just to avoid over-tightening or causing a recession.

Of course, the exact outcomes for the Fx market in both of these scenarios will greatly depend on the broader context too, such as what other central banks do. For example, if the Fed fails to deliver the three hikes, but other central banks are embarking on even stronger monetary easing, then that would neutralize the Fed’s dovish shift. After all, Forex is all but a relative game between two countries, and this is all that matters in the end.

Conclusion on USD:

On balance, 2022 looks set to be a good year for the greenback, though the prospects get cloudier after summer as many things could change by then. Hence, USD strength seems likely to persist in H1 2022. Then there is potential for either a further upside extension or a consolidation/reversal lower during H2.

On the radar: Covid, the Mid-Term Elections, geopolitics could bring new uncertainties around the outlook

As always, unexpected things can strike suddenly and surprise the market (e.g., as Covid did in early 2020). In this sense, some long-term developments we need to watch that may be the sources of shocks are:

· The Covid pandemic, of course, continues to be the first thing to keep on your radar. Omicron is now dominant in the headlines, but who knows what could happen down the road?! Most experts are still predicting a more benign path for the pandemic in 2022, but as we saw thus far, the virus has its ways of surprising us. Thus, traders and investors will need to continue to practice vigilance on this front.

· The US mid-term elections are another potential source of uncertainly, though there is no recent precedent for a big crisis arising around a US election (i.e., if you don’t count the Capitol riots as one).

· Geopolitics – China’s actions toward Taiwan and Hong Kong and Russia’s toward Ukraine could bring about a response from the US and western allies. This is another front that the market will closely watch for possible escalations, which would result in Forex volatility spiking accordingly.

EUR Fundamentals: Sluggish EU economic recovery feeds into a weaker currency

Perhaps similarly to 2018, high expectations turned into consecutive disappointments for EUR bulls during 2021. Instead of a vigorous recovery, the Eurozone economy started decelerating in H2 2021, even before EU nations started imposing the autumn lockdowns.

As a result, the EU economy has still not reached its pre-Covid levels, significantly lagging behind the US, Canada, Australia, and New Zealand who have already achieved this growth milestone. This economic underperformance then fed into EUR currency weakness versus the currencies of those countries (CAD, NZD, AUD, USD, and even GBP).

Uber-Dovish ECB to keep EUR under pressure in 2022

The ECB is firmly set to remain one of the most dovish central banks in the world, with very low probabilities of either ending QE or raising interest rates this year. The ECB’s dovishness should continue to exert downward pressure on the EUR currency broadly and versus strong currencies in particular. While other central banks have already raised interest rates or are close to doing it, the ECB clearly communicated rate hikes are off the table and that they will continue to do 20 billion euros of QE per month at least until December.

Three possible outcomes could lead to a higher or lower euro this year:

· Bearish EUR - if the current weak growth and inflation dynamics continue in the next months, then EURUSD can extend its gradual and steady downward path. Moreover, the EUR could also start to face some greater declines in broader terms if Eurozone CPI inflation (as expected) starts falling dramatically later in 2022.

· Neutral EUR - ECB stays dovish, but the Fed and other central banks (especially the currently hawkish ones) have to shift dovish again for some reason. This would create bullish EUR pressures from abroad without the ECB having to do much. In fact, this is quite common, and many past instances of EUR strength have been due to such “overseas factors.”

· Bullish EUR (an unlikely scenario) – The Eurozone economy starts to outperform, CPI inflation gets even hotter, and the ECB has to shift in the hawkish direction to cool things off (e.g., ends QE and starts talking about rate hikes). While this scenario should always be kept as a possibility, it appears extremely unlikely from today’s perspective.

Aside from Covid, the focus is on gas prices and the French election

· Aside from Covid, the French Presidential election in April is a key focus for EUR traders. While the same degree of uncertainty as in 2017 seems unlikely, one can never be sure about politics. So far, election polls put sitting President Emmanuel Macron in front and as the likely winner in both the first and second rounds. Fx traders and the market will continue to closely monitor the polls for any changes to the predictions. If, for example, some other candidate starts to be perceived as the likely winner, or simply comes close to Macron’s chances, it could quickly turn into increased volatility on EUR pairs (bearish).

· The energy crisis, especially skyrocketing gas and electricity prices, is currently grabbing the main attention across Europe. This is another hit to the economy, but so far is not expected to affect overall CPI inflation to a large degree. However, this front will remain an important focus for EUR traders, as the solving or not solving of this energy crisis could impact inflation and the economy, which would affect the EUR currency later down the road.

EURUSD Technicals: Entering 2022 at crucial support

Before you turn too bearish on EURUSD, you need to take a look at the chart below. This year we are looking at an even longer-term perspective, going back on the chart to around the euro’s inception in 1999.

Even at first glance, the below chart provides a compelling bullish case for EURUSD. The rising trendline going back to 2000 held off four bearish attempts in the past 20 years. It is obviously a major support area. Will there be a fifth rejection in 2022?

The above is the main question that we need to answer ourselves this year because based on that outcome, there can be two very opposition scenarios in play for EURUSD.

EURUSD chart scenarios:

· 1st bullish scenario – where the support in the 1.10 area holds, and EURUSD potentially climbs above 1.15 or toward 1.20 this year. This seems like the more likely outcome to actually materialize. Helping to strengthen the support area here is the broken channel line (broke in summer 2020), which is now being tested from the other side.

· 2nd bearish scenario – the major support around 1.10 doesn’t hold. In this case, EURUSD could be facing a major bearish breakout and a huge sell-off. Under this scenario, not only EURUSD at parity (1.00) would come into view, but possibly even levels below it! This is because, as can be seen from the chart, once this big 20-year rising trendline is broken, there will be virtually nothing (from a technicals perspective) to hold the pair from falling further. While as unlikely as it appears, this scenario is the big risk for EURUSD in 2022.

With that all being said, it could be a long road before we get a resolution in either direction. After all, this is a monthly chart, and it could take some time for things to play out! It would likely be best to avoid taking any long-term positions before a clear bullish or bearish signal confirms the direction around the crucial support here.

GBP Fundamentals: UK’s fast vaccine rollout supported sterling in 2021; What’s in store for 2022?

The UK’s speedy vaccination program was one of the primary factors supporting GBP in 2021, especially during the first half from January to June. It allowed the UK to reopen the economy ahead of others and subsequently to impose fewer and softer restrictions in future waves compared to places like Asia or EU countries. In the meantime, massive Government spending and fiscal packages such as the furlough scheme helped save jobs and preserve people’s livelihoods.

With the jobs market in good condition, the Bank of England has turned its attention to rising inflation. In fact, they’ve already ended QE purchases and delivered a surprise 0.15% rate hike in December, bringing the policy rate up to 0.25% from the all-time low of 0.10%. The BOE’s moves indicate that they are unwilling to tolerate inflation running above their 2% target for too long.

Can you trust an unreliable BOE to deliver the expected tightening?

Consensus forecasts see the Bank of England delivering four ¼ rate hikes in 2022. While those hawkish expectations are justified, they seem a bit aggressive. This means that the risks going forward are tilted for a dovish disappointment, i.e., the BOE delivering less tightening than what is currently priced in to markets.

With that said, it’s unlikely that GBP can be a broad outperformer in Fx this year if the BOE underdelivers on expectations. However, GBP still has good prospects to remain firm versus the low-yielding, zero-rates currencies such as the euro, yen, and Swiss Franc, while it could face headwinds versus the USD and the antipodeans (AUD & NZD).

Thus, there seem to be three relatively realistic scenarios for GBP’s direction in 2022:

· Bullish GBP scenario - BOE continues to surprise in a hawkish way and delivers the four rate increases or more. Reasons for such moves could be if the UK economy surprises to the upside and higher inflation is stickier than initially anticipated.

· Neutral GBP (most likely scenario) - BOE generally remains hawkish and hikes rates, but not as much as currently priced in. This would likely translate into GBP weakness versus select currencies while it should stay well supported against others (e.g., the low-yielders EUR, JPY, etc.)

· Bearish GBP scenario - BOE rate hike last December turns out to be a policy mistake and ends up doing more damage than good. Under this scenario, they would have to reverse course sharply, which would likely see GBP falling steeply as a result.

Covid and Brexit stay on the radar for GBP traders

The UK’s management of the Covid pandemic will continue to be watched by Fx traders. So far, the unusual, different approaches used by the Boris Johnson Government have provided an advantage, which consequently helped GBP to appreciate during 2021. Traders will keep watching if that continues to be the case, or other countries close the gap with the UK in terms of lessening restrictions and opening up their economies.

Brexit - Unfortunately, 2021 was not without Brexit headlines in the news, despite all the deals and agreements made and signed in previous years. Brexit frictions could linger as a potential source of uncertainty, with Northern Ireland remaining a key issue over which neither the UK nor the EU seem willing to get over.

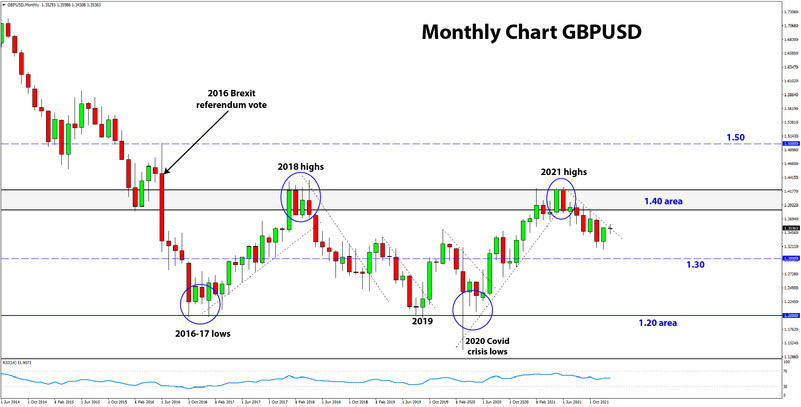

GBPUSD Technicals: Still inside the post-Brexit 1.20-1.40 range

Much as we anticipated, GBPUSD spent the whole of 2021 in its already established post-Brexit range between the 1.20 area as support and 1.40 as resistance. As predicted in our previous yearly Forex analysis, GBPUSD rose to reach and thoroughly test the 1.40-1.42 area and then retraced down from there in the second part of 2021. Now at the start of 2022, there is little to suggest that the technical picture on GBPUSD should change this year either. The range is firmly set after five long years of keeping the GBPUSD price action contained. Thus, it would likely take another major event (à la Brexit in 2016 or Covid in 2020) to break out of this range. But as we saw, even the outbreak of the Covid crisis in March 2020 wasn’t able to take GBPUSD past the 1.20 support area. All this indicates that 1.20 is a crucial line in the sand that simply won’t break easily without a significant fundamental catalyst to fuel such a breakout.

The third important technical area for the long-term GBPUSD charts is the mid-point between 1.20 and 1.40, the 1.30 zone. As can be seen on the chart below, 1.30 also acts as a critical inflection point for the pair; GBPUSD recorded multiple highs and lows in this zone over the past 5 years. The chances are that this 1.30 zone will continue to be a key technical zone this year too, with breakouts indicating important shifts in bullish or bearish sentiment for cable.

In this regard, we can also use the 1.30 zone as a proxy for gauging technical sentiment on cable. If GBPUSD is trading above 1.30, then the long-term sentiment from traders is likely bullish. On the other hand, if GBPUSD breaks below 1.30 and stays there, it would indicate that sentiment has shifted bearish, which would mean GBPUSD would have a harder time establishing and maintaining uptrends.

JPY Fundamentals: Better yields elsewhere keep bearish yen narrative intact

A year ago, the rollout of vaccines and optimism about how they will bring the pandemic to an end dominated the news headlines. Similar stories continued to circulate throughout the year and even to this day.

These hopeful Covid predictions, alongside continued CB monetary stimulus, formed one of the main narratives that kept risk sentiment supported and the yen generally weak in 2021. This was especially true in the first half of 2021, when vaccine optimism was at its highest. The delta variant emerging around summer then clouded the prospects for the success of existing coronavirus jabs. However, medical authorities are still confident that the vaccines will eventually bring the virus under control.

A perfect bearish storm sent JPY tumbling in the last months of 2021

The second half of the past year was further characterized by the energy crisis in Europe and Asia, combined with rising US Treasury yields across the curve (both long and short durations). This mix of a positive risk sentiment backdrop coupled with rising commodity prices (Japan is a major commodity importer) and higher Treasury yields resulted in a perfect storm for JPY weakness in September and October 2021. This same narrative continues to drive much of the current JPY weakness we are seeing today.

On the domestic front, no one expected any changes to policy from the Bank of Japan, of course. This “stability” in policy means that the BOJ has been in the backseat as a driver for JPY exchange rates, though their firmly dovish stance is indeed exerting perpetual bearish pressures on the currency.

The BOJ should keep its uber-dovish stance unchanged throughout this year as well, hence why the JPY is in the group of the most unwanted, low-yielding currencies for 2022.

Three possible scenarios for JPY in 2022:

With the Bank of Japan likely to again play only a trivial role in where the yen trades, below we outline three scenarios centered around risk sentiment and US yields as the main JPY drivers:

· Bearish JPY scenario: The perfect bearish storm for the yen largely remains intact. That is, US yields continue to rise broadly without hurting the stock market too much, while commodity prices remain elevated. – outcome: USDJPY could head toward 120.00.

· Neutral JPY scenario (probably most likely): Some of the bearish factors start to diminish (e.g., commodity prices decline, stocks stop rising, or US yields reverse the uptrend). - outcome: USDJPY largely contained in a range

· Bullish JPY scenario: Fed tightening causes a deep stock market sell-off, possibly a recession too. They then have to completely reverse course in the dovish direction. – outcome: This scenario would likely lead to a reversal of the entire USDJPY rise.

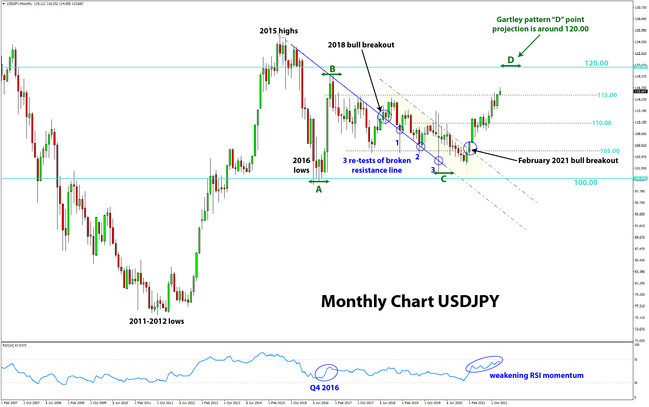

USDJPY Technicals:

After exactly four years of going nowhere in tight ranges, USDJPY finally attempted to stage a bullish breakout last year. The price broke the falling resistance trendline around the 105.00 area in February 2021, signaling more gains ahead. Indeed, aside from the consolidation between April and September, 2021 was a very bullish year for the USDJPY pair (ended 1200 pips higher).

We enter 2022 with most traders expecting more bullish action here. After taking out the psychologically important 115.00 level in late December, many momentum players are turning bullish on USDJPY. However, this long-term monthly chart below shows us that despite the nice visuals, lots of resistance still awaits at nearby levels to the upside.

One resistance zone to pay attention to as the most prominent one is a harmonic Fibonacci area around the 120.00 level. As you may have guessed, 120.00 is a key zone in USDJPY with or without the Fibonacci resistance. But with it, the resistance only gets stronger. The Fibonacci zone is formed by a harmonic Gartley pattern, shown on the chart as A, B, C, and D. Harmonic patterns most often indicate a very important technical zone, and when they appear on a long-term chart such as this one, the signals can be even more significant.

The harmonic Gartley converging with the 120.00 psychological area tells us that if - or when - this zone is reached, it will take a lot of heavy lifting (read strong buying momentum) to break the resistance here. In fact, it is much more likely that we’ll get a strong reaction and at least some correction to the downside first, even if USDJPY breaks higher in the end.

In the meantime, USDJPY is currently sitting above 115.00, with lots of free room without resistance to the upside. This means that USDJPY can indeed continue to rise in the foreseeable future before it hits a wall at some technical zone. The first notable resistance higher is the 118.00 area, just 200 pips under the major 120.00 zone discussed above.