US Dollar Fundamental Outlook: Volatility Skyrockets as Russia Attacks Ukraine; USD to Stay Firm Amid Risk-Averse Mood

Markets start the new week in risk-off mode as the Russia-Ukraine war escalates further, following Russia’s attack on Thursday morning. Moreover, the massive and far-reaching sanctions the west has now imposed on Russia are more impactful to markets than the war itself. There is not just a war in Ukraine, but also an economic war between the West and Russia. The Russian ruble is in free fall today because of the additional sanctions imposed over the weekend.

Despite this week’s calendar being a very busy one, expect economic reports and other events to take secondary importance to the events in Ukraine and the war there. This includes the Nonfarm payrolls and ISM manufacturing and services reports, which would typically be the main focus for Fx traders. Most of the US data this week is expected to print solid numbers and perhaps beat expectations. However, given the speed with which events in Ukraine are unfolding, any economic report may soon become obsolete, hence markets care less about data.

This leaves Fed Chair Jerome Powell’s testimony before Congress on Thursday as potentially the most important event on the calendar (of those that are scheduled). He will certainly be asked about the impact of the war and the economic sanctions on Russia, and the potential Fed’s response, should one be needed. In particular, markets are now on edge for possible USD liquidity issues, given that massive amounts of Russian USD assets are now frozen and have basically disappeared from global markets overnight. Given the global reserve status of the US dollar, the risk in this scenario is an abrupt and steep strengthening of the USD. If USD liquidity stress starts to appear, the Fed may need to ramp up the supply of dollars, similarly as it did during the March 2020 Covid outbreak when markets scrambled for dollars.

As for trading the market, Fx traders are now supposed to turn into geopolitical and war analysts. This is not an environment where one can comfortably expect to have an edge based on traditional trading strategies and methods. The markets will likely remain volatile, potentially with episodes of sharp bi-directional price gyrations (we already saw this last Thursday). Thus, it’s rather better to keep trading light and reduce risk by keeping position sizing smaller than in normal times.

Euro Fundamental Outlook: Exposure to Russia-Ukraine to Keep Bearish Pressures on EUR Currency

The EUR is the most hit major currency from the war in Ukraine due to the close links with the region and with Russia, particularly for oil and gas imports. EURUSD opened almost 150 pips lower than the Friday close, although the market is now moving to close that gap. However, the retracement is not driven by any good news or improvement in the situation on the ground in Ukraine. So, this move could be just a technical correction that is short-lived. On this note, the EURCHF pair opened down 100 pips from Friday and is now trading even lower.

The EUR’s weakness is likely to persist this week as the market digests the impact of the sanctions, which will be harmful for the Eurozone’s economic growth. Moreover, both Russia and the EU consider targeting Europe’s gas imports. So far, the gas from Russia to Europe is flowing as usual, which is why we are not seeing huge moves in these energy commodities yet. However, the EU could decide to reduce or completely stop importing oil and gas from Russia. By the same token, Russia could itself decide to cut the flow of gas (although it would be very hurtful for the domestic economy) in retaliation to the economic sanctions.

In any case, even higher oil and gas prices would add to the pain for the already slowing EU economy. It will be hard to find a positive that can offer support to the EUR currency this week, except maybe for a “miracle solution” that would bring a quick ceasefire in Ukraine. Let’s hope one can be found and that peace will come to Ukraine soon.

The calendar features the preliminary (flash) CPI inflation report on Wednesday, but it’s unlikely to matter much in the current environment.

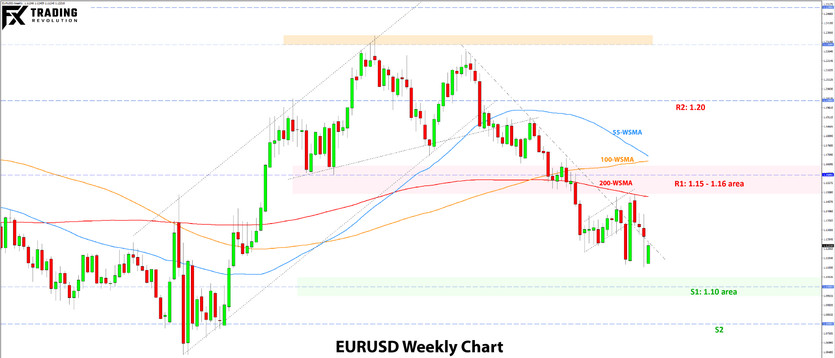

EURUSD Technical Analysis:

EURUSD is down back toward the 1.11 level today, following a gap lower on the open. The pair has recovered much of the 150 pips gap, but the overall technical bias remains bearish, particularly given the erasement of that tall green candle (which was the result of the ECB meeting at the beginning of February).

That said, the support at the wider 1.10 area in EURUSD is strong. As discussed in our yearly analysis here, 1.10 represents a multi-year support area on the monthly chart. Long-term buying pressures may eventually succeed in lifting the pair higher from this area over the coming months. However, we may see lots of volatility around this 1.10 support area over the short term. Such price reactions are not unusual when the market encounters an important technical zone.

To the upside, resistance is toward the 200-week moving average (red) in the 1.15 zone.

British Pound Fundamental Outlook: Not Much to Support GBP in Risk Aversion Trading

The pound also suffered in risk-off trading following the outbreak of the Russia-Ukraine war on Thursday. GBP was down even more than the euro, as the currency’s higher correlation to risky assets came to the forefront again. The UK’s decision to ban Russian banks from the SWIFT system and freeze Russian assets likely added to the negative GBP sentiment.

The UK financial system is also exposed to Russia and will feel the impact of the sanctions and the “disappearance” of Russian money in UK markets. Though the overall impact in the long term is likely to be small, the markets will remain uneasy due to all the uncertainties over the short term. This is likely to keep GBP under pressure, at least until relations between Russia and the West start to turn in a more positive direction.

In the meantime, expectations for the Bank of England to hike rates 6-7 times this year remain intact as the risks for higher inflation have increased further due to higher oil prices. This could provide some support for GBP or at least insulate it from larger losses in case risk aversion intensifies further over the coming days.

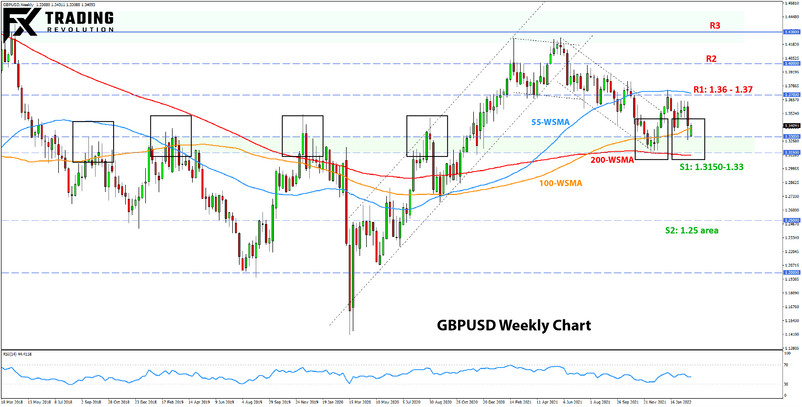

GBPUSD Technical Analysis:

GBPUSD tested the 1.33 support zone during the volatile session last Thursday. This is a robust support area, which will likely require powerful bearish momentum to be broken. Keep in mind that this support is defined as the wider area between 1.3150 and 1.33. So, the price can test it all the way down to 1.3150, or even lower (perhaps to 1.30) on an intra-day and intra-week basis, and the support may still not be broken.

To the upside, the first weekly resistance is seen at the 1.36 zone. Above it, the more important resistance zone is 1.37-1.3750 near the previous highs and the 55-week moving average.

Japanese Yen Fundamental Outlook: Safe-Haven JPY Gains Modestly

The safe-haven yen is firmer today, as would be expected, and opened the overnight session stronger than Friday’s close. This follows after western nations escalated the “economic war” with Russia and imposed a range of sanctions during the weekend.

Stock markets are under pressure and US Treasury yields have also fallen since Russia’s attack on Thursday as markets price in risks of lower economic growth due to higher energy prices. The fall in yields and the weakness in stocks are supportive factors for the yen, though the moves so far are largely contained. The risk aversion mood will likely need to intensify significantly before we see more notable JPY outperformance.

In the meantime, JPY may continue to trade range-bound, particularly as long as the sell-off in global stock indices remain contained. The S&P 500 and NASDAQ are off Thursday’s lows, likely preventing a further decline in JPY pairs. Key support zones in USDJPY (see more below) should also be watched closely as potential triggers for a bigger sell-off.

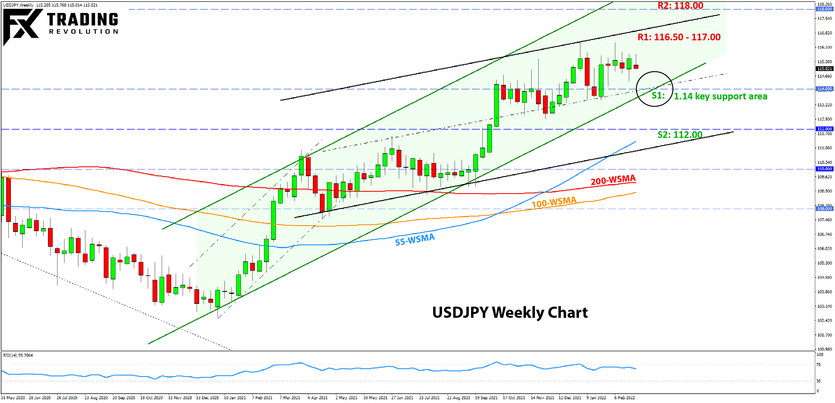

USDJPY Technical Analysis:

Despite all the volatility in the market last week, the weekly technical picture on USDJPY remains little changed. The key support and resistance zones remain the same, and USDJPY is still trading inside the established ranges and channel formations (see chart below).

The key support zone is firmly established at the 114.00 area. A break to the downside will likely clear the road for steeper losses, with 112.00 being the next important support and likely next destination lower.

To the upside, the 116.50-117.00 zone is the first resistance. The next resistance is toward the 118.00 area, which was a major inflection point for USDJPY in the past years.

Finally, the potential for a bearish head and shoulders remains, with the right shoulder possibly forming at the moment. That 114.00 support zone would be crucial for this potential H&S pattern too.