US Dollar Fundamental Outlook: Fed Hiking Cycle to Begin on Wednesday; USD Bull Trend Intact

Fx investors continue to prefer holding US dollars in the current environment of worrisome geopolitical relations between Russia and the West, aggravated by rising inflation and slowing economic growth globally. There is nothing on the horizon to suggest that these dynamics will change soon, and thus the USD should continue to perform well.

The main focus this week is on the Fed meeting Wednesday. They’ve already well telegraphed that a rate hike is coming, and most likely a 25bp one. Based on recent FOMC communication and market pricing, the Fed is likely to deliver 6-7 further rate hikes this year, bringing the interest rate at or around 2% (now 0.25%). The Fed’s hawkishness is fully justified by the strong recovery in the US economy and high inflation, now running at 7.9% y/y as last week’s CPI report showed.

There is potential for two-way volatility around Wednesday’s Fed meeting in the short-term, but ultimately, the direction for the dollar is likely to remain up. In this sense, the underperformance in European currencies against the USD should remain more pronounced than currencies that are geographically and economically more distant from the Russo-Ukrainian war.

On top of the hawkish Fed, risk aversion continues to be the dominant mood in markets given all the uncertainties at the moment (both geopolitical and inflation). That being the case, the US dollar stands to benefit from both factors. Risk aversion combined with a hawkish Fed creates a strongly bullish backdrop for the USD.

Traders will also keep an eye on other US data this week, like PPI inflation (Tue), retail sales (Wed), and Philly Fed manufacturing index (Thur).

Euro Fundamental Outlook: Even a Hawkish ECB Can’t Save EUR; EURUSD Can Fall Toward 1.05 & Beyond

The ECB surprised last week by outlining a more hawkish path for exiting QE this year than the markets expected. The EUR initially jumped on the announcement but fell steadily thereafter, erasing all the short-lived gains and beyond. EURUSD closed the past week significantly lower off the 1.1120 high reached on the ECB’s announcement, indicating traders’ attention has returned to the geopolitical and economic risks from the war in Ukraine and the hostile relations with Russia.

This is no surprise as the outlook for the Eurozone economy is now much grimmer than before the war. More expensive fossil fuels and commodities will hurt the global growth outlook, but much more Europe’s due to the high dependence on Russian energy (especially gas). The sanctions on Russia will likely keep gas prices high in Europe for a prolonged time, potentially leaving a lasting negative impact on the EU economy and thus permanently scar the EUR’s fundamental valuation. After all, paying for more expensive gas from now on means Europeans (i.e., businesses & consumers) will have less money to spend on everything else (lower GDP growth). Weaker GDP prospects imply that Europe will be a less attractive destination for investors than before (hence money flowing out of Europe). In Fx language, this means that the odds for EURUSD to fall to 1.05 and even to parity (1.0) have now increased several folds.

The EUR calendar is much quieter this week, featuring the ZEW economic sentiment surveys tomorrow (Tue) and a speech by ECB President Lagarde (Thu). The negative outlook for the EU economy should already be reflected in the leading ZEW surveys, which are set to plunge at much lower levels compared to February (released before the war in Ukraine). The ZEW reports may act as a catalyst for the next leg lower in EUR pairs.

News from Ukraine will continue to be closely watched by markets. Negotiations resulting in positive developments (like ceasefire) can provide a relief rally for EUR pairs, and perhaps this is the biggest risk in holding short EUR positions. Still, it’s unlikely that a ceasefire deal alone can provide lasting support, and thus any EUR rallies based on such news should still be short-lived.

EURUSD Technical Analysis:

EURUSD has been in a steady decline since mid-February, with the bearish move accelerating following the Russian attack in Ukraine on February 24. After briefly testing the water above 1.10 last week, the pair is now back below this psychologically important level. The 1.10 mark can also be used as a proxy for near-term sentiment, meaning that when EURUSD is below it, sentiment is bearish.

The March 7 lows near 1.08 are now back in focus and may be attacked as soon as this week. A break lower could see a move down to the next round number levels of 1.07, 1.06, and 1.05. The 1.05 zone is the most prominent one, which is also a critical technical support zone on weekly and monthly charts.

To the upside, sentiment can shift bullish if EURUSD moves above 1.10 again. But that alone won’t be enough to turn the trend around. For that, EURUSD will need to break and hold above the 1.1120 – 1.1150 resistance zone. The next resistance would come at the 1.13 zone in such a scenario.

British Pound Fundamental Outlook: Negative Impact of Ukraine War Overshadows BOE Rate Hike Plans

The pound sterling continues to underperform, weighed primarily by the war in Ukraine and the negative economic effects stemming from this crisis. The same factors pressing the euro are hitting GBP too due to the geographic proximity to Europe and close trade ties.

The UK economic calendar is quite busy this week. Tomorrow (Tue), the UK reports the latest jobs figures (claimant count, unemployment rate, wages), and the Bank of England meets to decide on interest rates on Thursday. A rate hike is almost a given after clear BOE communication that they plan to continue hiking and take the policy rate at least to 1% before thinking about pausing (currently 0.5%).

However, aside from GBP possibly receiving some short-term support around a volatile BOE meeting on Thursday, the outlook further out is not very supportive despite the hawkish BOE. Unlike the US, the UK economy is not as well-positioned to weather the shock of surging energy prices and negative impacts of sanctions on Russia. This could keep GBP an underperformer in tandem with the euro. In particular, this means that the newly found bearish trend in GBPUSD may have scope to extend further over the coming weeks.

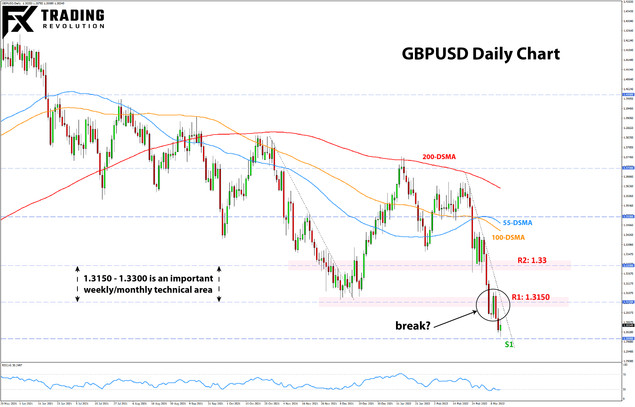

GBPUSD Technical Analysis:

GBPUSD is in a similar situation to EURUSD on the daily timeframe. The trend is unambiguously bearish here, and cable seems to be breaking below the critical 1.3150 – 1.33 weekly support. This could mean that the trend could accelerate further and take GBPUSD significantly lower in the coming days/weeks. Please see our weekly Fx analysis from March 7, where we discussed the weekly chart of GBPUSD (important in the current context).

The nearest support on the daily chart is the 1.30 psychological zone. A break below it can lead to the above-mentioned bearish acceleration. The next support zone lower is 1.2850, ahead of the much more significant 1.25 area on the weekly chart.

On the other hand, if GBPUSD bounces here or at 1.30, the first resistance could come around 1.3150. However, this would act like a retest of the previously big 1.3150 – 1.33 support zone. Hence, such price action may provide attractive opportunities to short GBPUSD. Above 1.3150, the next resistance is at 1.33

Japanese Yen Fundamental Outlook: JPY Weakens as Stocks Rebound & Bond Yields Rise; BOJ Meets on Friday

Major stock indices remained stable last week and even rebounded in Europe on some optimism about Ukraine and (perhaps) plain dip-buying after a steep decline. In the meantime, the more hawkish than expected ECB lifted European bond yields (German 10-year bund yield trading above pre-war levels), and US Treasury yields also rose steadily throughout the week. These dynamics combined with high energy and commodity prices left the JPY in the dust last week as the weakest currency of the majors.

With inflation still below 2% and having the most dovish central bank that is determined to keep interest rates near 0%, the yen cannot find support on the back of any of this. This is the name of the game for now, and as long as that is the case, the JPY will remain with a weakening bias. However, if/once those dynamics change, we could see a sharp JPY strengthening. In that regard, a sharp and large stock market correction remains the main risk that could kick-start a bullish yen move (JPY pairs sell-off).

On the calendar, the Bank of Japan meeting on Friday is the focus for JPY traders. No surprises are likely here, despite some speculation that the BOJ may make a hawkish shift like what the ECB did recently. As recently as last month BOJ Governor Kuroda confirmed their dedication to dovish policies, which was then also backed by action (BOJ QE continues).

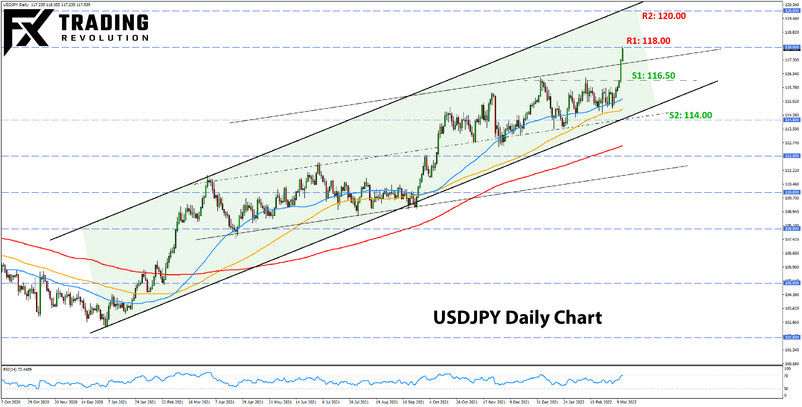

USDJPY Technical Analysis:

USDJPY is finally seeing more meaningful moves following months of relatively confined action between 114.00 and 116.50. USDJPY broke above this 116.50 resistance last week and is extending the move higher on the open this Monday, already reaching 118.00.

The long-term trend is bullish on the daily timeframe, as the channel shows on the chart below. With the break above 116.50, it seems the road toward 120.00 is clear. The current 118.00 technical and psychological zone is perhaps the last hurdle on the way up.

To the downside, 116.50 should now act as support. The 114.00 zone should be the next support lower.