USD Fundamentals: Massive Upside Surprise in CPI Inflation; Fed Still to Hike 75bp Next Week

The big news last week was the massive upside surprise in the US CPI inflation report, with the 9.1% actual print way above the 8.8% y/y estimates. The dollar was in an up-down flux, initially rising on the news but then giving up much of the gains by the end of the week.

Markets’ pricing of Fed rate hikes was behind much of the gyrations in USD pairs last week. Expectations for Fed hikes at the July 27 meeting spiked toward 100bp on the CPI report but then returned to 75bp after some Fed speakers (Bullard and Waller) said they are not in favor of a larger 100bp hike. Indeed a 75 bp is likely to be enough and is still a very hawkish move by itself. There are also many signs that inflation is peaking this summer (e.g., commodities are falling sharply, even oil fell), and the Fed is taking note of this.

Technical factors also contributed to the USD retracement last week, which is extending into this week too. The dollar already rose notably ahead of the CPI report, so some retracement is natural to occur after such a rally. Still, it is likely to be only a retracement, and the USD uptrend remains intact. The Fed is still the most hawkish central bank and, coupled with the lingering global risk-off environment, is to remain a very bullish cocktail for the dollar.

The US calendar is relatively light this week, with only 2nd tier data like housing and low-impact sentiment surveys. There are also no Fed speakers due to the blackout period (ahead of the July 27 Fed meeting), so it could be a quiet week for the dollar overall, which could see the consolidation prolong into next week.

EUR Fundamentals: EURUSD Finally Breaks Below Parity; Russian Gas Flows the Key Focus This Week

EURUSD traded below the parity level last Thursday for the first time in 20 years. Italian politics added to the negative sentiment in addition to the ongoing worries about Russian gas flows. Suddenly, the current Italian government led by Mario Draghi is facing challenges and is likely to fail soon. Early elections in a few months is the likely outcome, which means uncertainty will increase due to the very polarized political situation in Italy (both far left and far right parties enjoy popularity among voters). Political uncertainty in Italy is never good for the EUR currency, so traders need to watch this space. If things turn for the worse, the euro’s decline can get a catalyst from Italian politics.

That said, Russian gas flows remain the main concern and biggest bearish factor for the EUR. By the end of this week, flows via the Nord Stream pipeline should resume after the regular 10-day annual maintenance. If Russia doesn’t reopen the pipeline, expect bearish pressures on the EUR to intensify quickly as the markets will increasingly fear a nasty energy crisis in Europe for the coming winter.

The ECB is usually the main market-moving factor for the euro, but it is unlikely that to be the case for their meeting this Thursday, given the current environment of the EUR struggling with multiple geopolitical risks. The ECB will likely hike interest rates by only 25bp and signal a 50bp hike in September. A lot of focus will go to the announcement of a new policy tool that should help to keep Italian bond yields calm in times of uncertainty (yes, the latest political situation in Italy won’t help with their goal at all).

No matter what the ECB announces, it’s unlikely to help with the ongoing woes of the euro. Essentially, the trend is to remain bearish due to the geopolitical conflict with Russia, with gas flows being an immediate risk for the euro this week.

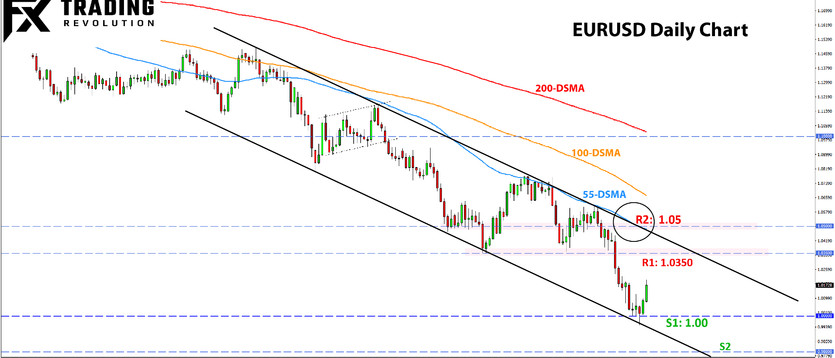

EURUSD Technical Analysis:

After briefly trading below the 1.00 level for a few hours, EURUSD is recovering this week and almost rose some 200 pips above parity. Still, within the context of the predominant bearish trend, this is still only a minor retracement.

The first resistance higher is at the now “distant” 1.0350 zone, with the next one at 1.05. EURUSD reaching either of these zones would still be well within the borders of the current downtrend. Only a break above the 1.05 zone would pose a more serious threat for the bears.

To the downside, all focus remains on the parity (1.0000) level and the zone around it. A renewed break below it is certainly possible, if not probable. The 0.99 and 0.98 round number levels would be support zones in such a scenario.

GBP Fundamentals: Busy Economic Calendar This Week

The pound sterling remained under pressure, crippled by the negative economic outlook for the UK economy and political uncertainty around the election of a new Prime Minister after Boris Johnson resigned last week. GBP faces a very busy calendar this week, with employment, CPI inflation and retail sales all in key focus for Fx traders.

CPI Inflation (due Wed) is expected to have accelerated above 9%, which suggests the Bank of England will hike by 50bp at the meeting on August 4. The jobs data will be released tomorrow and could be a bigger driver of GBP, particularly if it shows some surprising weakness. The retail sales are due on Friday and could cause some volatile swings in GBP pairs.

On balance, although the calendar is busy, the data this week is unlikely to alter the bearish fundamentals for GBP. The currency suffers mainly from global factors, and these are unlikely to change over the near term. Thus, the pound is likely to stay under downward pressures, though some short-term consolidation or recovery is possible, given the oversold conditions.

GBPUSD Technical Analysis:

Cable is also trying to recover above its own historically “crucial” level, which is 1.20. Still, like EURUSD, GBPUSD remains in a strong downtrend with powerful momentum.

The first notable resistance higher is all the way at the 1.23 zone, also near the 55-day moving average (blue line). And even a break above this level wouldn’t damage the established downtrend much. Instead, the 1.25 zone higher is the key that should hold the bearish trend in place, but given how far it currently is, a reversal is very far-fetched at these levels.

To the downside, 1.18 has been established as an important support zone, where GBPUSD rebounded last week. However, the key focus remains on the 1.15 psychological zone, and if the downtrend extends, it will likely be a reachable destination.

JPY Fundamentals: 140.00 in USDJPY Is Likely to Be a Big Hurdle

The trend of yen weakness is continuing, and USDJPY moved above the 137.00 high last week. The major 140.00 level is closely approached now and seems likely to be reached given how close the price currently is.

However, while the JPY trend is bearish, the dynamics and the main factors that were behind that trend have changed. Namely, global bond yields remain notably off the highs (e.g., 10-year US Treasury yields), and commodity prices have corrected sharply lower.

There is also an increased risk that equity markets will experience a further decline as central banks over-tighten monetary policy in order to reign in inflation. A risk-off episode in stocks is still likely to be bullish for the yen. Overall thus, the probabilities seem to be turning against playing the ongoing bearish JPY trend, and soon reversal opportunities may exist.

In the week ahead, Fx traders will watch the BOJ meeting on Thursday. With the pace of yen depreciation having slowed in recent weeks, they are unlikely to make major decisions or announce big changes to policy.

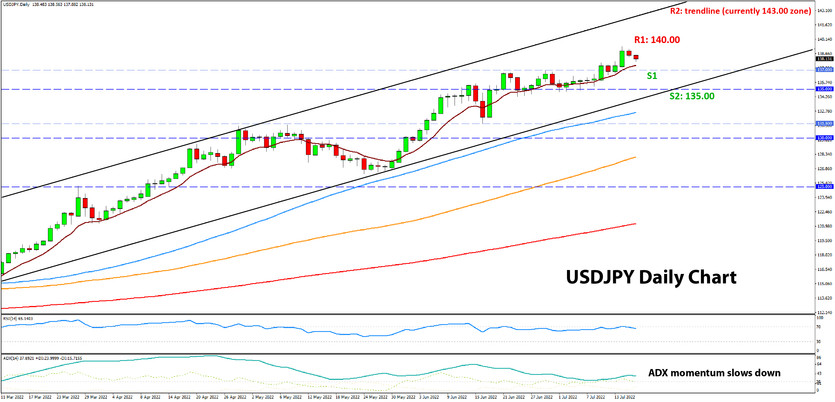

USDJPY Technical Analysis:

USDJPY is inching toward the 140.00 area, and as noted above, it seems very likely that it will be reached. As far as the technicals are concerned, there is nothing to suggest that the bullish trend is under threat at this point.

Momentum has slowed somewhat, as can be seen via the lower readings on the ADX indicator compared to June (see chart below). However, a clear bearish reversal signal will be needed for the technicals to suggest this trend might be close to a turning point. In this sense, and as noted above (in fundamentals section), a reversal in USDJPY at this point would be largely a factor of the global fundamental dynamics.

Support zones to the downside are 137.00 and 135.00, while to the upside, 140.00 is the first notable resistance. Above it, USDJPY may meet some resistance at the channel’s trendline around 143.00, but the big focus will be on the 145.00 psychological area.