USD Fundamentals: Fed to Hike Another 75bp on Wednesday

The correction extended last week, and the greenback gave up more of the gains, with the DXY dollar index falling back toward the 106.50 area from a peak above 109.00. The correction last week was broad, with both risky (AUD, NZD, GBP) and safe haven (JPY, CHF) currencies gaining.

The broad corrective move last week indicates that it is largely due to technical and overbought conditions. Some moderate improvement in risk sentiment also contributed (stocks retraced higher). The dollar rose a lot in June versus all currencies, and some correction is natural to follow.

With that being said, the key fundamental picture has not changed and remains USD bullish. The Fed is still the most hawkish central bank, and the US economy is in better shape than most Western peers. The US’s energy independence is also a bullish factor in the current environment of scarce energy supplies.

The Fed meets on Wednesday and is widely expected to raise rates again by 75bp. While some even expected a 100bp hike following the upward CPI inflation surprise two weeks ago, it is now clear to everyone that 75bp is more than enough. In addition, the Fed is doing QT (quantitative tightening), which amplifies the effect of the rate hikes on money and credit contraction. Inflation has likely already peaked this summer, and the markets are realizing that. As a result, the focus is shifting to recession fears as the Fed’s and other central banks’ tightening will hurt economic growth and jobs. The general risk-averse mood among investors is likely to persist for the coming months as long as the Fed is on the tightening trajectory. Risk aversion is another bullish factor for the US dollar.

The calendar this week also features the GDP and PCE inflation reports. However, no big surprises are likely there that could alter the Fed’s hawkish course. Thus, any impact from the releases should be rather muted and short-lived, and is unlikely to affect the established USD uptrend.

EUR Fundamentals: Hawkish ECB Can’t Help EUR – Bearish Factors to Preserve

The euro traded mixed in the past week and was caught between three important events. Those were 1) the ECB meeting, 2) the resumption of Russian gas flows, and 3) Political turmoil in Italy.

Two of those events turned out favourable for the euro. First, the ECB hiked rates by a larger 50bp (vs 25bp forecasts), delivering a hawkish message. Second, Russian gas flows via the Nord Stream pipeline resumed last week following the scheduled maintenance. Flows are at the same level (40% of capacity) as before the maintenance. This is good news for Europe, at least temporarily, though the markets remain fearful that Putin could again cut the gas supplies in the future.

The third event, however – Italian politics – went in the wrong direction. Mario Draghi resigned after his Government collapsed, and Italy will hold a general election on September 25. Populist parties are leading in the polls, which is not good news for Europe and the EUR currency.

So, overall, the mixed performance of the euro last week makes sense as the currency was pulled between the three different factors. Still, as we’ve said many times before here, any ECB hawkishness can’t do anything to offset the negative impact of reduced Russian gas supplies or political instability in Italy. Thus, the path of least resistance for the euro remains down as long as these geopolitical factors don’t improve.

The Eurozone calendar also features some high-profile data this week. The German Ifo business climate was released this morning and missed expectations, confirming the economy is likely to weaken further. Then, flash GDP and CPI inflation reports will be in focus on Thursday and Friday. Weakness in these could be the turning point that will see the euro rolling over again, with perhaps EURUSD moving back toward the parity (1.00) zone.

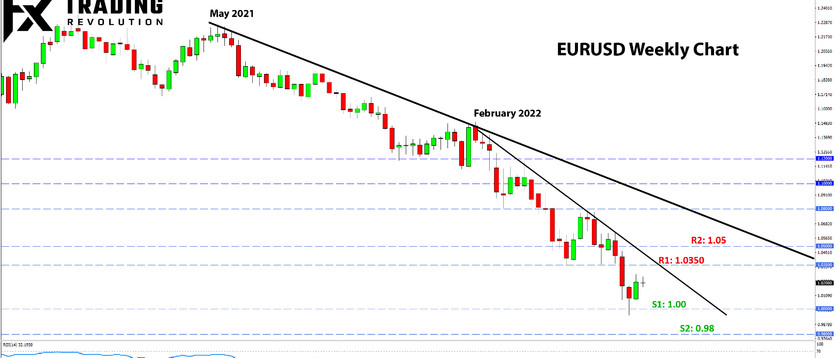

EURUSD Technical Analysis:

EURUSD retraced further higher after briefly trading below parity and is opening the new week above the 1.02 mark. Still, within the context of the dominant downtrend, the rebound last week is small. The trend is not even challenged here.

The first key resistance to the upside is 1.0350. It could be reached soon. A more serious challenge to the downtrend would pose a move toward the 1.05 area. But based on the weekly chart, the crucial resistance zones that keep the long-term bearish trend intact are 1.08 and 1.10.

To the downside, all focus is on 1.00 as support. Below it, 0.98 and 0.95 are the next support zones lower.

GBP Fundamentals: Politics Back in Focus - Rishi Sunak and Liz Truss in the Run for New Prime Minister

Following Boris Johnson’s resignation as leader of the Conservative party, the UK is also entering political instability. A new leader should be elected by September 5, with the race now reduced to two candidates, Rishi Sunak or Liz Truss.

The risk for GBP from the election run between Sunak and Truss comes from their contrasting policies, importantly on taxes and Government spending. The two have opposing views; Sunak is more orthodox, while Truss wants to increase spending and reduce taxes. This can have an impact on inflation and could make the job harder for the Bank of England. So expect the focus of Fx traders to remain specifically on tax and Government spending policies during the Sunak-Truss leadership race over the next month or so.

While the GBP calendar was busy last week, the data releases had little impact, and the currency traded more in line with broad risk sentiment and trends in the dollar. These factors are likely to remain dominant this week too, as the calendar is very quiet and markets will start to turn their attention to the August 4 Bank of England meeting.

GBPUSD Technical Analysis:

GBPUSD has managed to climb above the pivotal 1.20 level; however, the momentum is rather weak. The pair is encountering strong resistance here from the previous lows and the falling trendline that has kept the bearish trend intact since the winter.

This resistance zone starts from under the 1.21 level and stretches toward the 1.22 zone. As long as GBPUSD trades below this zone, the strong downtrend remains fully intact. To the upside, the next big resistance can be found at the 1.25 area.

The 1.20 zone is the obvious first support, ahead of the lows around 1.18. Next is 1.15, which is itself an important psychological and historical zone for GBPUSD.

JPY Fundamentals: Yen Jumps as Bond Yields Slide Further - This Trend Is Only Beginning

Ever since the start of the year, the decline of the yen was fueled by rising inflation expectations and consequently rising bond yields around the world, while the Bank of Japan kept Japanese yields at 0%. Over the last few weeks, that is changing as inflation expectations are falling rapidly, and so are bond yields.

With the ECB joining the rank of very hawkish central banks last week with a 50bp hike, inflation expectations plunged further. It is becoming clearer that central banks will likely be successful in bringing down inflation this year, and so bond markets are reacting by pushing yields down. Essentially, this can easily trigger a reversal in the bearish JPY trend, which was almost entirely driven by rising yields earlier this year.

Add to this the potential for further falls in stock markets and intensifying risk aversion, and a compelling case for JPY strength over the coming months can be built. This is a big risk and is increasingly becoming the likely scenario. Yields are testing some important support zones (e.g., 2.7% for US 10-year Treasury), and a downside break here can very much trigger a further break down in USDJPY and other JPY pairs too.

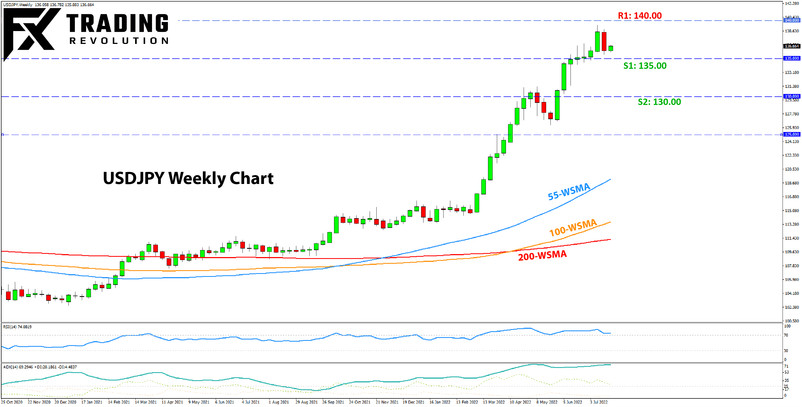

USDJPY Technical Analysis:

USDJPY failed to reach the 140.00 level itself, and following the big fall (weekly close around 250 pips lower), it may not reach 140.00 at all. While the bearish engulfing candle on the chart suggests the chances are now much higher we’ve seen the top, it is not a convincing signal to go short on its own.

USDJPY is now testing the 135.00 support zone. A break below it is likely to unlock greater potential for a steeper reversal and downside action. The 130.00 area is likely to be reached in such a scenario, and possibly even lower. Note that 125.00 is the 38.2% Fibonacci retracement of the entire rally from January 2021 until now. So, it will be an important support area if reached over the coming months.