USD Fundamentals: Friday’s Jobs Data Won’t Alter the Fed’s Hawkish Course

The US is off for the labor day holiday today, but already, a lot is going on the first day of the new week, and the DXY dollar index is pressing on the highs. While the Fx moves today are more related to developments in Europe (read below), the status of the US dollar as the cleanest dirty shirt in the Fx market (or the best of the worst) is still emphasized. With inflation at 8% - 10% in developed countries, paper currency has obviously lost purchasing power, but the US dollar is still doing well this year.

Friday’s Nonfarm payrolls report and other jobs data were good news for the Fed. The NFP component was good, while wage growth was slightly lower than the forecasts. The unemployment rate rose to 3.7%, but it was because more people returned to the labor market (seeking employment), obviously not because people lost jobs. On balance, the jobs data was close to the forecasts, which means the Fed’s hawkish trajectory remains unchanged. Another 75bp rate hike later this month remains probable, though not certain (around 60% currently priced).

The US calendar features many Fed speakers throughout the week, including Chair Powell (Thur). On the economic data side, the ISM Services PMI survey will be watched tomorrow (Tue). Traders will focus on the wording of Fed officials during their speeches this week, particularly about the possibility of a 75bp hike. Expect the USD gains to extend if market probabilities for a 75bp increase in the coming days leading to that September 21 Fed meeting.

EUR Fundamentals: Russia Stops Gas Flows; Focus on Thursday ECB Meeting (50bp or 75bp Hike?)

The euro is coming under pressure from the geopolitical front as Russia didn’t turn the Nord Stream gas pipeline on Saturday back on, as it said last week. The announcement from Gazprom late Friday that flows have been completely halted for an indefinite time shocked markets. European gas prices (TTF futures contract) are surging higher while the euro currency is under pressure on the open today. EURUSD made a fresh cycle low under 0.99.

The energy crisis will remain the key focus for Fx traders, and as long as it doesn’t improve or gets worse (like during the weekend), the euro will come under pressure. The ECB meeting on Thursday will be important to watch, with the main uncertainty being whether they hike rates by 50bp or a larger, 75bp hike.

Still, no matter how much the ECB hikes or how hawkish their message, the euro is unlikely to benefit much (not sustainably at least). Investors will continue to flee the euro area in anticipation of a deep recession triggered by the energy crisis. The downtrend in EURUSD is intact, and a move to 0.98 is now well within reach.

EURUSD Technical Analysis:

We are revisiting the same daily chart from last week, where we noted EURUSD trading in a range. Well, that range has already broken now, triggered by the news that Russia has wholly halted gas flows to the EU.

EURUSD is now under parity and attacking the 0.99 round number level. The 0.98 zone is the next support down, but the big focus is on 0.95 as a more important support zone.

To the upside, 1.00 is now the first resistance. The more important one remains at that falling trendline and 55-day moving average, currently located around 1.02. This 1.02 zone is now the key one that should keep holding, and as long as that is the case, the bearish trend momentum on EURUSD will remain strong.

GBP Fundamentals: Liz Truss Will Be the New Prime Minister; Fx Traders to Focus on Fiscal Policy

The UK Conservative party announced today that Liz Truss will be the new leader after winning the inner party contest. She will also become the new Prime Minister of the UK. The markets will now closely focus on her proposals for fiscal policies and then, once the new Government is formed, what is actually passed in Parliament.

Truss wants a big fiscal package to support the economy during the energy crisis. But that is not the best news for a country that is already heavily in debt and facing a recession due to high energy costs. More debt with no clear plan for paying it back will also increase the UK’s twin deficits, which is never good for a currency. Hence, the markets were selling GBP last week in anticipation of Truss becoming the new PM. There was no big reaction today on the actual announcement as it was already widely expected that Liz Truss had won the race.

The UK economic calendar is rather light this week, featuring only the testimony of Bank of England officials before Parliament. Like the ECB, there is little that the UK central bank can do to help the energy crisis or its currency in the current situation.

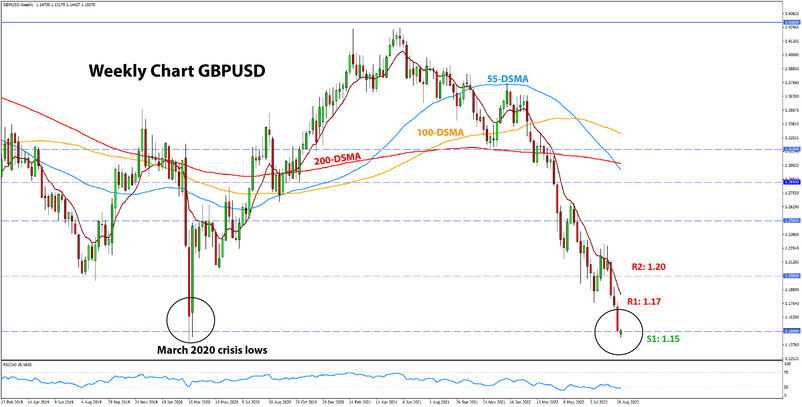

GBPUSD Technical Analysis:

GBPUSD reached the 1.15 level late Friday, and today is moderately rebounding here. This is a normal reaction after hitting such a significant technical zone, but so far, it is too early to tell what could happen next. The trend is still down, and traders will have that in mind. Chances are there won’t be many willing to pick a bottom here and go long.

That said, there are some technical reasons to consider the possibility for a larger bounce here. Namely, 1.15 represents the major crisis lows from 2020 when the Covid pandemic broke out. Some bullish pressures are sure to emerge here; the only question is will those be strong enough, and how much can GBPUSD bounce here?

Below 1.15, it is uncharted territory for cable. There is that 1.05 low from 1985, but other than that, there are no clear support zones under 1.15.

To the upside, 1.17 is the first resistance zone in line. The 1.20 area remains important, of course, but is too far away from current levels at the moment.

JPY Fundamentals: USDJPY Extends Rise in Tandem With Bond Yields

The JPY extended the decline last week, even against “weak” currencies such as the euro (EURJPY ended higher). Here, the story remains mainly tied to developments in bond markets. US bond yields extended their rise across the curve, with both short (1Y, 2Y) and long (10Y, 30Y) duration Treasury yields climbing. In the meantime, Japanese Government bonds remain fixed around 0% as the Bank of Japan firmly holds to its dovish policy stance.

While the 10Y and 30Y US Treasury yields haven’t climbed above the June highs, shorter-term rates like the 2Y have. Shorter-term bond yields are more directly affected by the Fed, and their hawkish stance is obviously pulling those yields higher now. And it seems it is shorter-term yields that are pulling USDJPY higher now too (as the rally has slowed compared to May-June but USDJPY is still able to reach a fresh high above 140.00).

Nonetheless, longer-term yields are likely to be more significant for the big picture in USDJPY. The most probable scenario remains that the 10-year Treasury yield peaked around 3.5% back in June as the Fed’s resolute hawkish stance should bring inflation down over the coming months. If that proves correct, then the peak in USDJPY should not be far either.

That being said, keep in mind that 140.00 is an important technical zone. So, a break higher could lead to some acceleration in the move purely based on market liquidity and technicals (there are fewer orders in uncharted territory here north of 140.00). In such a case, it will be no surprise if USDJPY reaches 145.00 in a quick fashion.

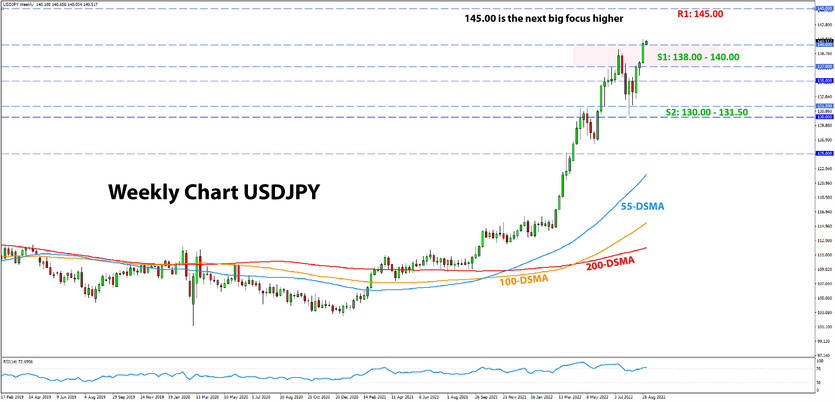

USDJPY Technical Analysis:

USDJPY is pushing above the 140.00 resistance today. It appears this could be the “big bullish breakout” many are hoping for, though the price action is gradual so far. Nonetheless, a further move higher could unlock greater gains and the pace could accelerate.

The next big focus higher on USDJPY is the 145.00 psychological zone. If this is a true breakout, 145.00 could be reached rather quickly.

To the downside, old resistance becomes support. Thus, 138.00 – 140.00 should now act as the first support.