USD Fundamentals: Watching the CPI Report

The dollar retraced moderately during the past week, although the moves were mainly caused by developments with currencies, not US-specific factors (Fx is a relative game, so the USD is always measured against other currencies, which can be weak or strong themselves at a given time). In particular, it was the recovery in the euro following the hawkish surprise by the ECB (more below) and the verbal intervention from the Bank of Japan that reversed some of the recent euro and yen losses against the dollar. Hence, this was the main factor behind the retracement in the DXY broad US dollar index.

Nonetheless, the Fed’s resolutely hawkish plans remain unchanged and should keep the USD firm in general. Another 75bp rate hike next week is now very likely to be delivered, which will put US interest rates at 3.25% already, far above other currencies. Any USD correction is still likely to be only a retracement within the trend.

The CPI inflation report due tomorrow (Tue) is the key focus on the US calendar this week. Inflation will stay high for sure, but what the markets will care about is whether it is starting to drop or will it still stay near the 40-year high. The y/y core CPI is forecasted at a still high 6.1%, while the headline figure is expected to stand at 8.1%. The m/m reports will also be closely watched. The USD reaction should be easy to assess - higher than forecasts CPI would be bullish (in anticipation of an even more hawkish Fed), while lower than forecasts actual numbers could prompt an extension of the USD correction.

EUR Fundamentals: Hawkish ECB Hikes 75bp

The ECB delivered a “hawkish” 75bp rate hike last Thursday, which took Euro area interest rates at 1.25%. This is still far below what is needed for the current inflationary environment, so the ECB announced more rate hikes are to come in the following months. In their economic projections, ECB staff members revised higher the forecast for interest rates and inflation while they lowered GDP growth. The stagflationary scenario is now the official expectation of policymakers.

Aside from the ECB, the European energy crisis with gas and electricity remains the key focus for the euro currency. A meeting between EU energy ministers to agree on a strategy for dealing with the energy crisis has so far failed to produce results. Gas prices, however, remain off the record highs last month, though still at very painfully high prices of around €200 MWh. The Eurozone economy is still in a very bad spot and going into a deep recession over the coming months. This inevitably will resume the bearish pressures on the euro sooner or later. The downtrend in EURUSD is unlikely over at this stage, and fresh lows under 0.98 look like the probable scenario.

The EUR calendar is rather light this week, with only the German ZEW economic sentiment index due tomorrow worth watching.

EURUSD Technical Analysis:

EURUSD is retracing further higher this week but is hitting strong resistance at the 1.02 zone that we noted here last Monday. Today’s attempt is already rejected quite strongly, and the exchange rate is back toward the 1.01 level.

If EURUSD moves toward 1.00 again, the resistance would be confirmed to be holding. Given how many times the trendline and 55-day moving average (blue line) were tested in this trend, 1.02 is a critical technical point on the chart. A break above it could trigger a short squeeze which could lead to a quick acceleration of the correction.

To the downside, 1.00 and then the prior lows around 0.99 remain the nearest support zones. Lower, 0.98 should also be notable support.

GBP Fundamentals: Busy Economic Calendar This Week

The news that the queen had died didn’t shake the pound much as markets usually care about economic policy, which is in the domain of the Government. Indeed, the UK also has a new Prime Minister (Liz Truss), and Fx traders will closely watch what her Government announces about fiscal policy.

The Bank of England’s monetary policy will also depend on how much the Government will spend. More stimulative monetary policy could bring about more hawkish policy from the BOE too. But it is a complicated interconnection between monetary and fiscal policies, and a lot depends on the details about how the two will impact the currency. For now, it is still too early, but over the coming weeks, announcements from the new Government could be the key driver for GBP.

The UK calendar is rather busy this week, starting with the GDP report (released this morning), followed by employment reports tomorrow, CPI inflation (Wed) and retail sales (Fri). The main attention will be on inflation, given the current environment, but big deviations from the forecasts are unlikely; hence it’s unlikely that we’ll get a big market reaction either.

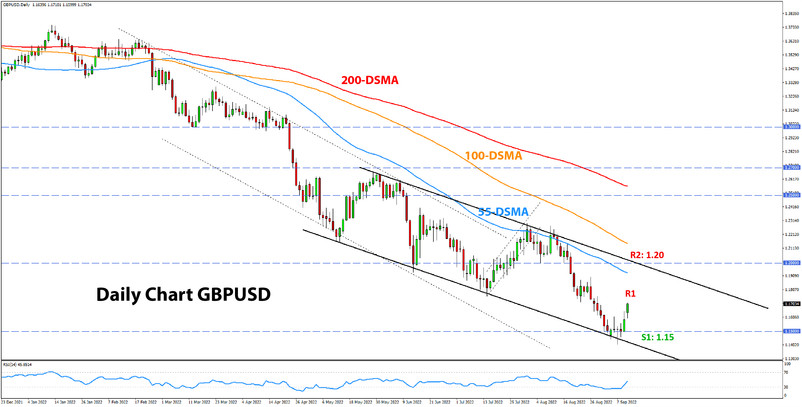

GBPUSD Technical Analysis:

Cable is rebounding from the 1.15 area after reaching a low of 1.1404 last Wednesday. As we discussed in the previous weekly Fx last Monday, some reaction at the 1.15 area was likely given its significance as a psychological and technical area.

GBPUSD is now approaching the 1.17 resistance zone. The bearish pressures should increase here. But in case of a break higher, the next resistance could be at 1.18. The most important resistance, however, remains located at the major 1.20 area. It is the key one that defines the current downtrend. As long as GBPUSD stays under 1.20, the technical bias and trend will remain bearish.

JPY Fundamentals: Will Japanese Officials Intervene Against Yen Weakness?

USDJPY broke above 140.00 last week and then quickly surged toward the 145.00 area, which prompted the first instance of verbal intervention from the BOJ after a while. Governor Kuroda, in an unscheduled speech, again reminded investors that fast depreciation of the yen is undesirable. USDJPY reached a high before his speech and corrected down to 142.00.

Nonetheless, the uptrend in USDJPY is powerful, and there are certainly very few brave traders (if any) who would want to fight this trend. Indeed, the fundamentals remain pointed bullish for USDJPY and most other JPY pairs, which means further upside action is the likely scenario unless the BOJ intervenes big time to rein in this trend. Intervention from Japanese authorities is now the main risk to holding long USDJPY positions.

This past Friday, we released a special update on the long-term outlook for USDJPY, which you can find here.

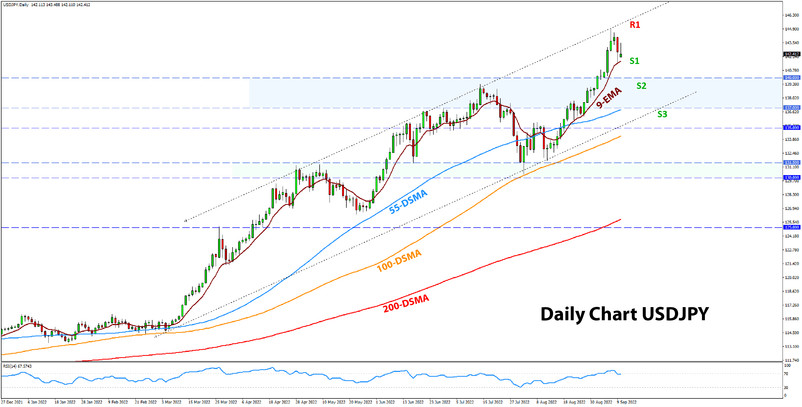

USDJPY Technical Analysis:

USDJPY made the long-awaited break above 140.00 last week, reached a high around 145.00 and is now retracing back toward the 9-day exponential moving average (line in crimson color). Bullish pressures could re-emerge here and help start a new bearish leg that could take USDJPY back to the 145.00 highs and potentially further higher.

Key support zones to the downside are 140.00, 137.00 and 135.00 (see chart). Any corrections to the downside should be stopped here in order for the strong bullish momentum to remain intact.

To the upside, we are in uncharted waters. Above 145.00, the 147.00 zone could be important as it’s the multi-decade high reached in 1998.