USD Fundamentals: Watching the ISM PMI surveys & Nonfarm Payrolls

The DXY index reached a new cycle high of 114.60 last Wednesday before it reversed from there to a low of 111.40. The trigger for the correction was an improvement in risk appetite (or rather an easing of risk aversion) on the news that the Bank of England had intervened to calm the distressed UK Government bond market. The BOE’s action triggered a rebound in risky assets and a decline in government bond yields, including US Treasuries. This pulled the dollar lower in the second half of last week.

The long-term fundamental picture remains unchanged, however. The US economy is still in the most favorable position, and the Fed is one of the most hawkish central banks. The slight risk aversion tone will also persist due to the geopolitical situation in Ukraine and Europe, thus should continue to provide a further boost to the USD from safe-haven flows. Overall, the current correction in the USD should also prove temporary.

The US economic calendar is quite packed this week. The focus is on the ISM manufacturing PMI (already out today at 50.9), the ISM services PMI (Wed) and the key releases of the Nonfarm payrolls and unemployment reports on Friday. More strength in this data should only reaffirm the case for more aggressive rate hikes by the Fed and, therefore, the bullish USD trend.

EUR Fundamentals: Higher Inflation Is Not Bullish for the Euro

Eurozone inflation Friday again came in higher than the forecasts, with the core CPI measure printing a new all-time high of 4.8%. Yet, this was not very bullish for the euro, and in fact, the currency fell after the report. That is because traders know the ECB can’t do much to help the euro and the inflation is driven by factors outside of their sphere of influence. Thus, no matter how much they hike interest rates, it will hardly translate into a bullish reaction in the EUR.

On the geopolitical front, things aren’t getting better either. Tensions in Ukraine are as high as ever amid Russia’s annexation of four more regions, and the blow-up of the Nord Stream gas pipelines. These latest developments pretty much ensure an anxious winter in Europe – both regarding gas supplies and a potential escalation of the war in Ukraine (let’s hope not).

The euro benefited and eased some of the losses against the dollar and other safe havens after risky assets recovered Wednesday in sympathy with UK bonds and the pound following the intervention from the BOE in the UK’s gilt bond market (more on that below). Nonetheless, the predominant EUR fundamental drivers remain bearish, which suggests the downtrend in euro pairs like EURUSD and EURCHF are likely to remain intact. Thus, any rallies in those pairs should prove good opportunities to build fresh short positions.

EURUSD Technical Analysis:

EURUSD reached a low of 0.9535 last Wednesday, after which it rebounded strongly to now trade above 0.98 already. The psychologically important 0.9500 was not traded last week as the market decided to retrace higher instead.

Still, the EURUSD bear trend remains in place and won’t be challenged until the parity (1.00) zone comes under attack. So, far that is still some 200 pips away, and it doesn’t look like EURUSD can keep going up in a straight line. Some topping out and a subsequent fresh move down looks like the more probable scenario.

In addition to 0.98, the 0.99 zone should also be resistance ahead of 1.00. To the downside, EURUSD can still trade to or below 0.95. That would not be a surprise if or once a new bearish leg starts. For now, EURUSD seems to be in “corrective” or consolidative mode.

GBP Fundamentals: BOE Intervention in Bond Markets Provides Short-Term Respite

The intervention by the BOE was the big news of the past week. The action triggered a range of moves across markets and helped to mitigate risk aversion. In the Fx market, the pound recovered substantially, now having erased all the losses triggered by the government’s fiscal plan announcement on September 23 (Friday).

While the BOE’s action helps to relieve some of the stress in bond markets, it’s questionable if it can ease bearish pressures on the pound in a sustainable manner. Indeed, the reason for the meltdown in bond markets and the plunge of GBP is the new proposed fiscal plan of the new government led by Liz Truss. And there is nothing the BOE can do about what the government decides or does.

So, in this sense, how GBP will trade from here will depend a lot more on what news comes from the political authorities in the UK, i.e., the government. However, political analysts believe a complete reversal (U-turn) of Liz Truss’s plans is highly unlikely. Sadly, only a complete U-turn can save the pound from further steep losses. But even in such a scenario, GBP remains vulnerable in the current environment as risk aversion dominates.

So, with GBPUSD having already retraced to the 1.12 zone, further upside action will be harder to come by. Instead, a return back toward 1.10 and 1.08 seems like the more probable scenario as sellers return in the market following last week’s washout of late shorts.

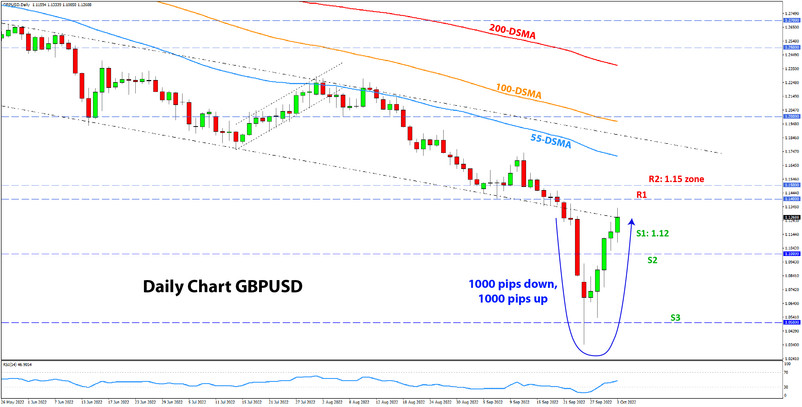

GBPUSD Technical Analysis:

A thousand pips down, then a thousand pips up. That’s the scale of the GBP rollercoaster ride in the past 6-7 trading days. GBPUSD is now back trading in the 1.12 – 1.13 zone, completely erasing the plunge from the Friday and Monday a week ago.

With the big move retraced, some stabilization in the price action seems likely. At least, that’s how most such volatile situations in the currency market play out (for instance, you can look at the short-term charts after the Brexit referendum in 2016). So, some downside action should inevitably follow after the current retracement leg is done.

To the downside, 1.12 and 1.10 are the first support zones. In a wider context, 1.05 would come into focus if GBPUSD goes that far again.

To the upside, the pair is already meeting resistance at 1.12 – 13. Stronger resistance should emerge above 1.14 and toward the 1.15 area.

JPY Fundamentals: Holding Up Firmer Following BOJ Intervention

Strangely enough, the yen was one of the calmer spots during the volatile past week in the Fx market. The calmness follows after the BOJ intervention on September 22 (Thur), where they used Fx reserves to prop up the falling yen in the currency market. USDJPY has held under 145.00 since then, though it continues to press on the highs here.

It was reported Friday that the Ministry of Finance used ¥2.84 trillion ($19.7 billion) for the intervention to stem further yen weakness. This is a record amount but still tiny relative to the size of Japan’s Fx reserves (around $1.4 trillion). So, the BOJ and MoF have plenty of ammunition to intervene again if needed.

That being said, it is unlikely that intervention alone can reverse the trend in USDJPY. Nor do Japanese authorities seem to pursue that. It seems they only want a more gradual, orderly decline in the yen instead of the rapid freefall that transpired for much of this year. So, USDJPY may eventually break above 145.00 in the end, but it may consolidate for a while first.

Based on this, it’s fair to assume that declines in USJDPY triggered by intervention shouldn’t be too deep. And any such dips can be used to establish fresh long positions, potentially targeting the 150.00 zone. Still, we should keep in mind that such long USDJPY trades will be a little like swimming against the river, given that the BOJ and MoF will resist further disorderly fast appreciation.

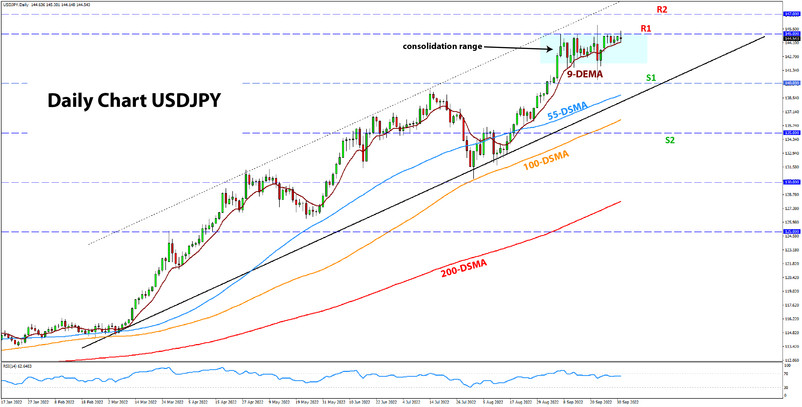

USDJPY Technical Analysis:

The sideways consolidation in USDJPY is extending for more than 20 days now as the price keeps flirting with the 9-period EMA (purple line). Not much has changed here, and perhaps the 9-period EMA remains key for the short-term picture. A break below it could open the way for a fast decline toward 140.00 which is the first support zone lower.

Under 140.00, the next support is the 137.00 zone, which may turn out to be very important if tested. Namely, a rising trendline is lining up in this area, in addition to previous highs and lows. The 135.00 zone is also not far; this whole 135.00 – 137.00 area may be tested as one wider support band. It won’t be a surprising scenario now, especially given the enormous volatility in USDJPY and also the Fx market in general.

To the upside, the 145.00 area should be resistance, but a break above it will again put USDJPY in uncharted territory. The 147.00 zone – a multi-decade high from 1998 – could be the next resistance higher. The next resistance would likely be the 150.00 area.